Boudewijn Chalmers

@BouChalmers

#WealthManagement - #CX - #WealthTech - #Digital - #EY - Co-author @WealthTECH_Book - All tweets are my own!

ID:114882876

https://www.linkedin.com/in/bchvp/ 16-02-2010 22:40:34

6,7K Tweets

1,3K Followers

960 Following

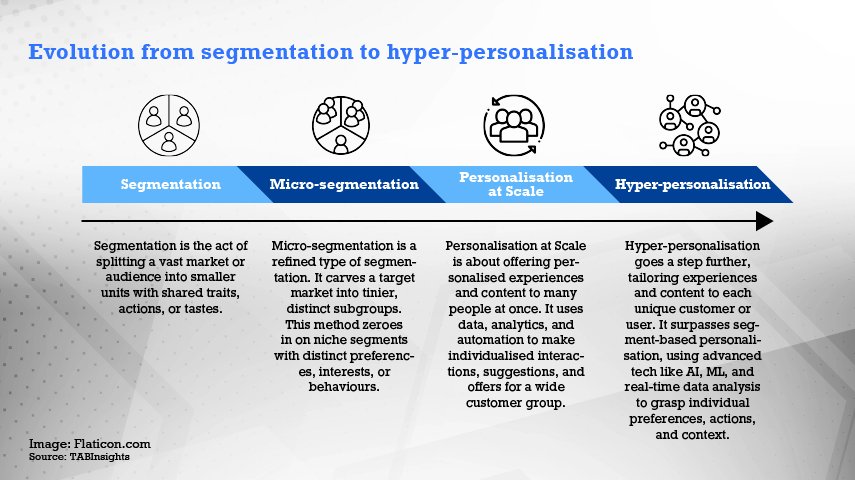

Nearly all wealth managers plan to adopt new technologies in 2024 driven by high ROI:

Financial planning, portfolio management, customer relationship management (CRM), and client communication tools have consistently been perceived as delivering the best ROI.

FINTECH GLOBAL.

How #AI dominated the #wealthtech conversation in 2023:

While the ability for AI to reshape #WealthManagement is still a 'what if' for some, many advisors are already putting the technology to work in practical ways.

Financial Planning.

financial-planning.com/list/10-storie…

🇦🇺Poor financial literacy in #Australia :

#FinancialLiteracy weakened in recent times, with a number of reports highlighting the challenges managing rising household costs, retirement and general ‘financial wellness’.

@BankingDay: bankingday.com/poor-financial… #WealthManagement

🛫 April Rudin 🌏 Theodora (Theo) Lau - 劉䂀曼 🌻 Dr Efi Pylarinou Spiros Margaris Craig Iskowitz Boudewijn Chalmers Rich Finance💡 Andreas Staub Oscar Neira 🤟🎸 Chris Gledhill Spot on, April! Wealth services will be highly automated and AI-assisted to a large extent. Those investors who prefer human advice and guidance will be served better than today. Independent from product distribution which is still dominating today.

Roboadvisor #Wealthfront announces $50 Billion assets milestone:

UBS-owned Wealthfront serves >700,000 clients, largely young professionals across the United States.

Fintech Switzerland. #WealthTech #investing

fintechnews.ch/roboadvisor_on…

Are #RoboAdvisors still the answer to costly advice or a dying breed?

By removing the human advisor component, robos promised to revolutionise the industry by making long-term #investing and financial planning cheaper and more accessible to the masses. Now, there are signs the

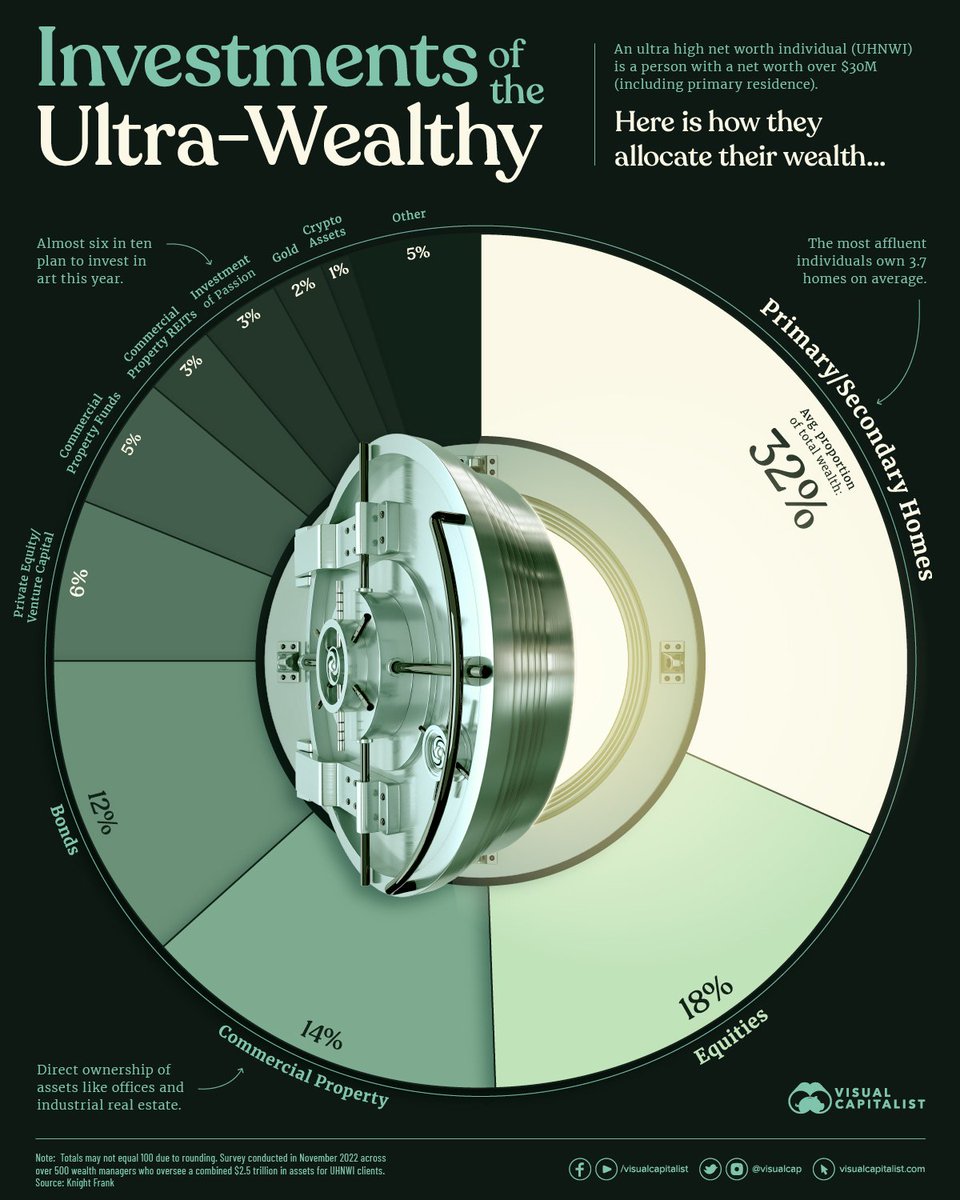

How the ultra- #wealth y invest:

Where UHNWIs invest their fortunes, based on a global survey of over 500 #wealth managers, family offices, and private bankers that oversee a combined $2.5 trillion in assets.

@KnightFrank via Visual Capitalist: visualcapitalist.com/visualizing-th… #WealthManagement

How can #FamilyOffices leverage #ArtificialIntelligence ?

AI wealth management models can be trained on historical financial #data , market trends, other relevant factors and applied to the following tasks:

1. Investment analysis;

2. Portfolio allocation optimisation;

3. Risk

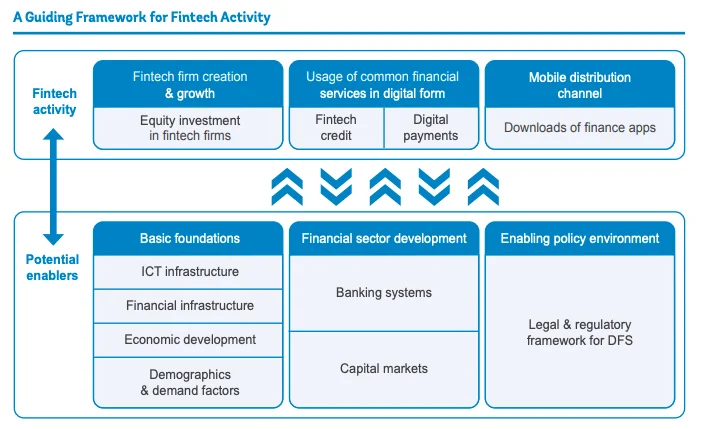

Key factors enabling fintech growth:

#Fintech activity is closely related to a country’s economic and institutional development.

🆕Paper by World Bank via Fintech Singapore:

fintechnews.sg/77947/fintech/… #DigitalBanking #banking #WealthTech #regulation

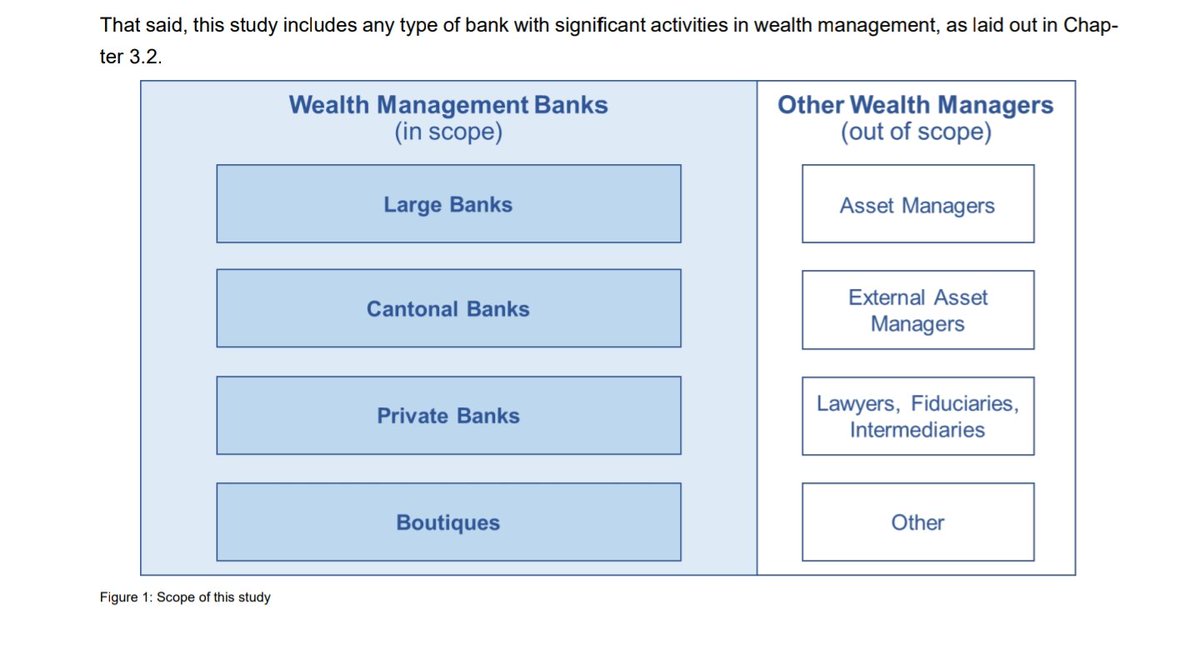

The $100trn battle for the world’s wealthiest people:

The two financial giants #MorganStanley and #UBS look likely to crush the competition. In differing ways, both are seeking even greater scale.

The Economist: economist.com/finance-and-ec… #wealth #WealthManagement

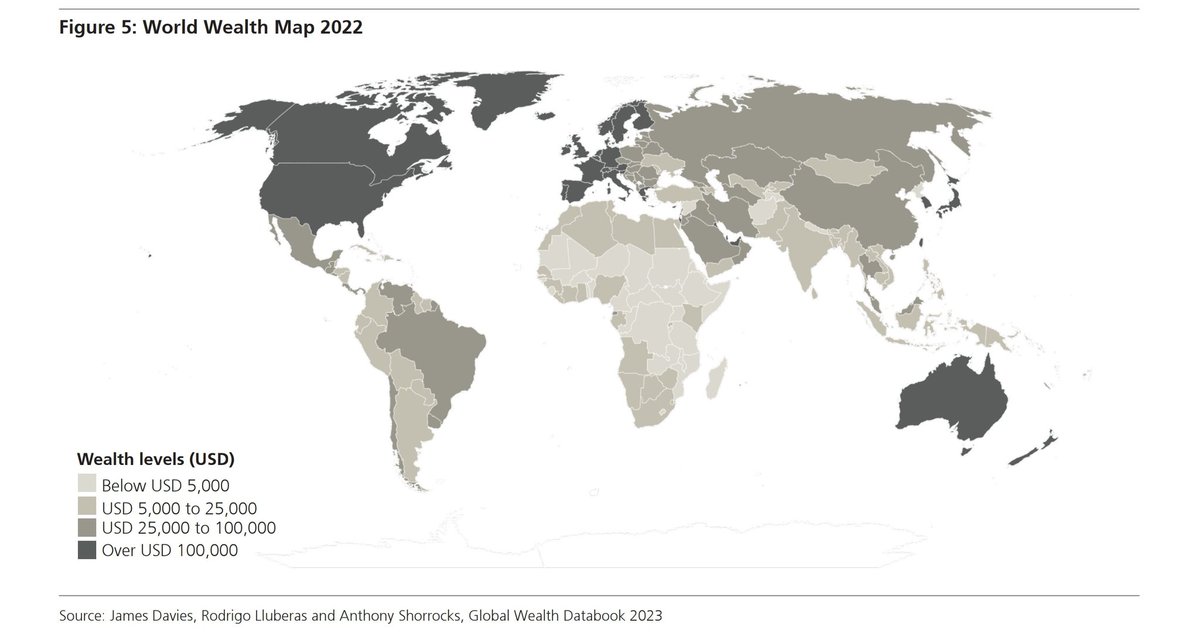

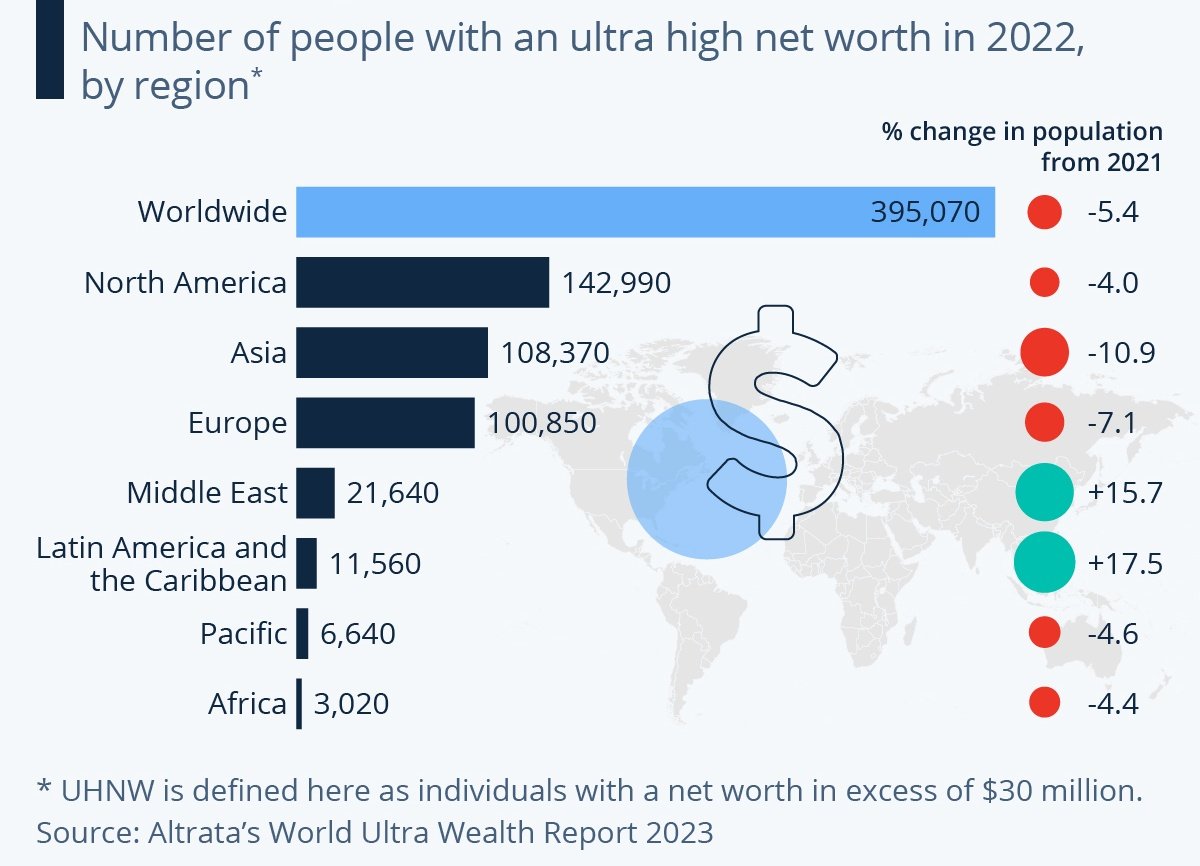

Global #wealth declines for first time since global financial crisis of 2008 –

Wealth increases recorded for Russia, Mexico, India and Brazil.

🆕Global Wealth Report 2023 by UBS (& Credit Suisse): ubs.com/global/en/fami… #WealthManagement #PrivateBanking