Clement Brenot

@ClementBrenot

Economist - Interested in development and emerging markets, macro, finance and cities - Trying to understand things (it's not easy)

ID:1593578425

14-07-2013 14:47:56

35 Tweets

129 Followers

483 Following

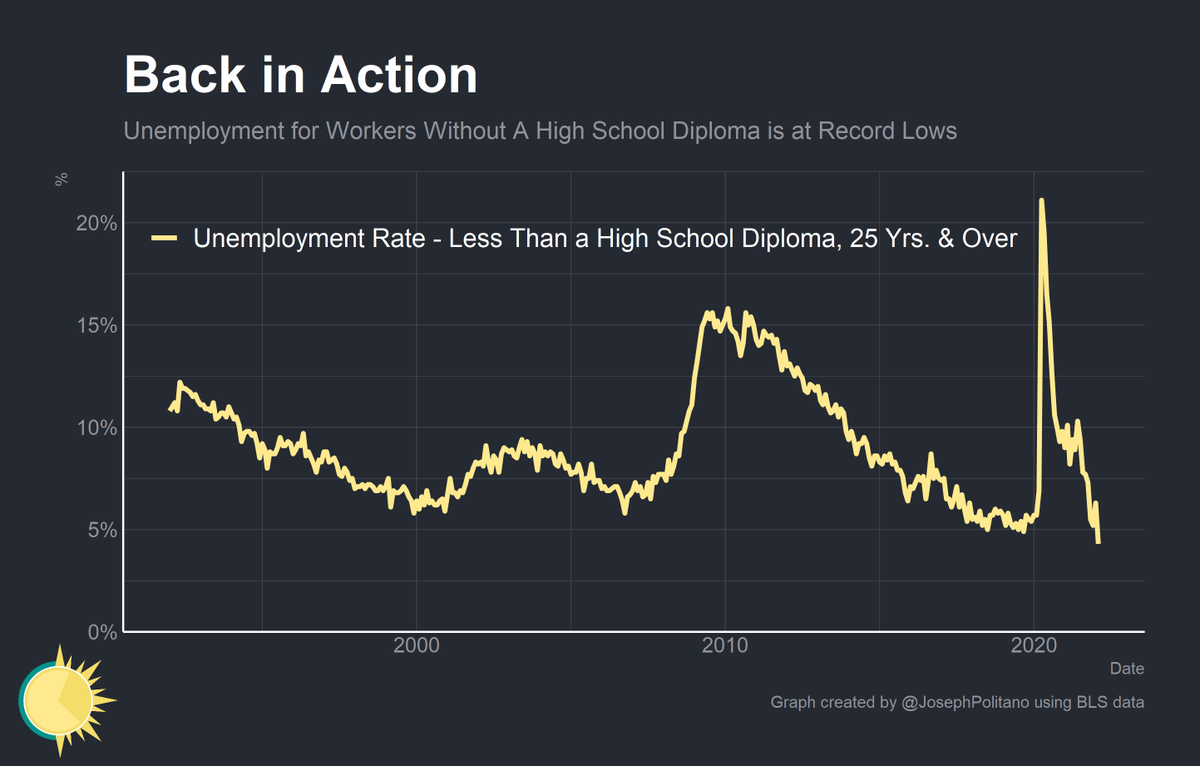

The US unemployment rate for adults without a high school diploma just hit its lowest level in history.

via Joey Politano 🏳️🌈

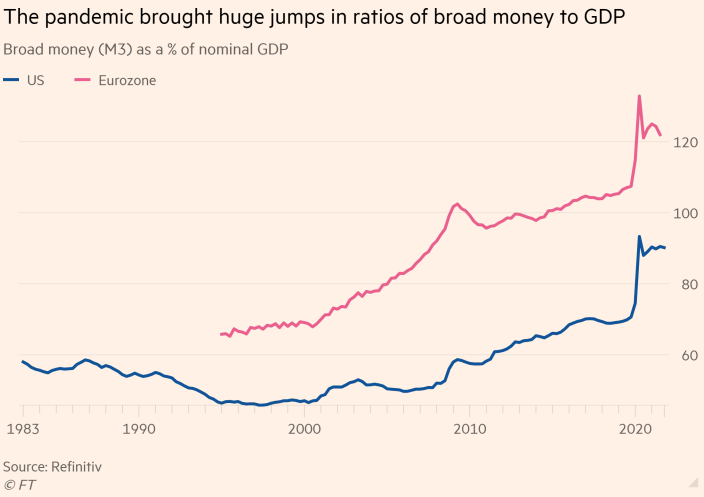

Nice exercise in modesty for economists by Martin Wolf, taking stock of old and new ideas (including by Alex Domash and Lawrence H. Summers

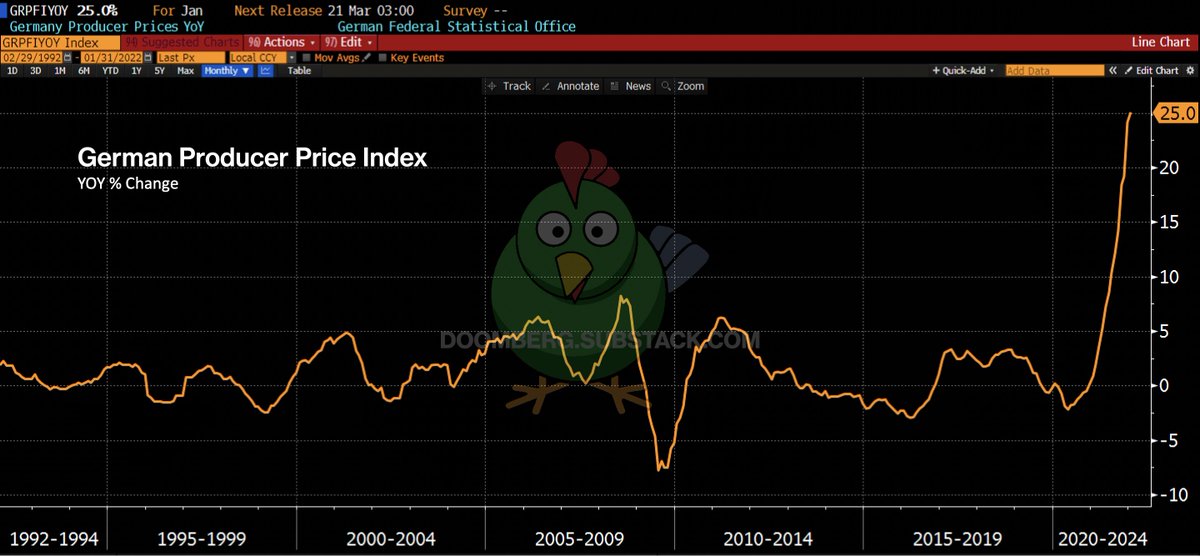

And it's so surprising to see inflation...

on.ft.com/3s8pAXL

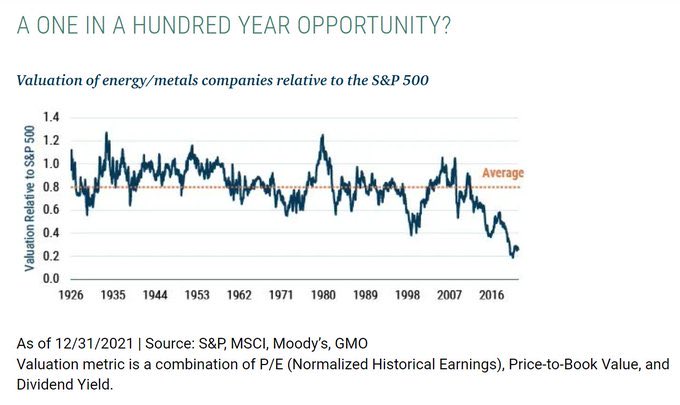

7. Irrational hatred of commodity stocks has created an opportunity unseen in centuries.

(albeit, n.b. this chart from Dec, these stocks gone up about 10-15% since then...)

h/t Plan Maestro $XLE $DBB $SPX

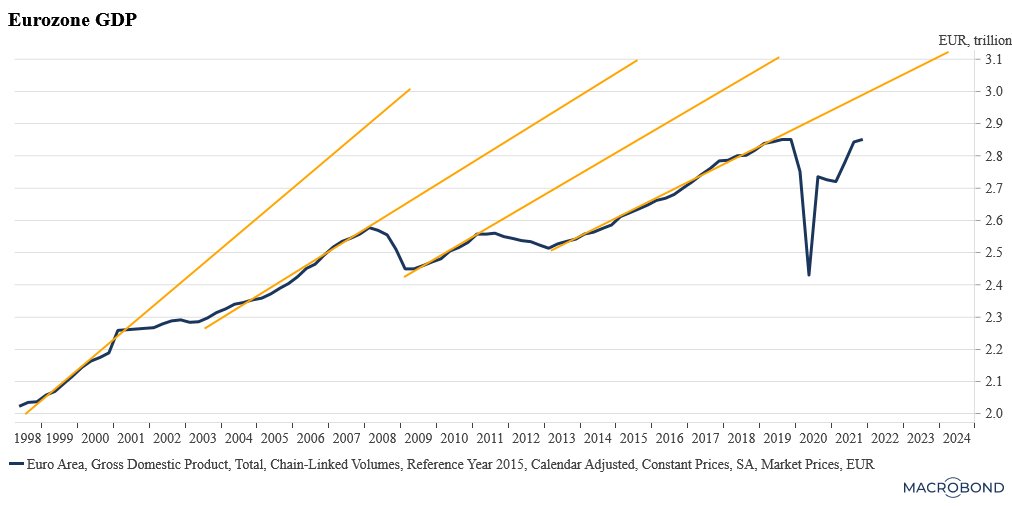

Real GDP in the €zone; every crisis seems to have a permanent impact - hello hysteresis, something wrong with econ policy?

chart via Riccardo Trezzi