Ameya

@Finstor85

Cover Tech & Retail businesses + Trade Nifty + everything that's tradable. Tweets are my personal views.

ID:1148479381003628545

09-07-2019 06:29:56

11,5K Tweets

35,2K Followers

193 Following

Oriana Power celebrates a monumental achievement as India's first solar-powered bullet train terminal is unveiled at Sabarmati.

#solarpower #bullettrain #sustainable #greentransportation #transportation #nhsrcl #train #terminal #sabarmati #orianapower #truere

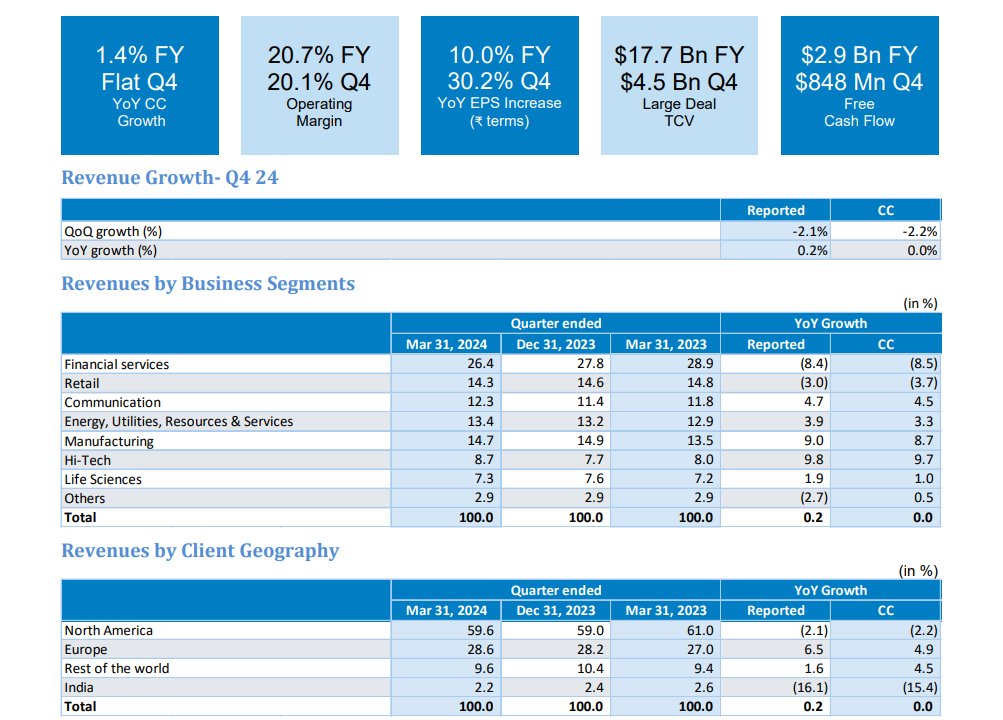

#TechMahindra nailed it here on one single slide. A couple of reasons for such rally because there's nothing in the result worth this up-move:

1. Street always wanted a change, Mohit Joshi is made a face of change here. While he has a mountain to climb, industry insiders would…

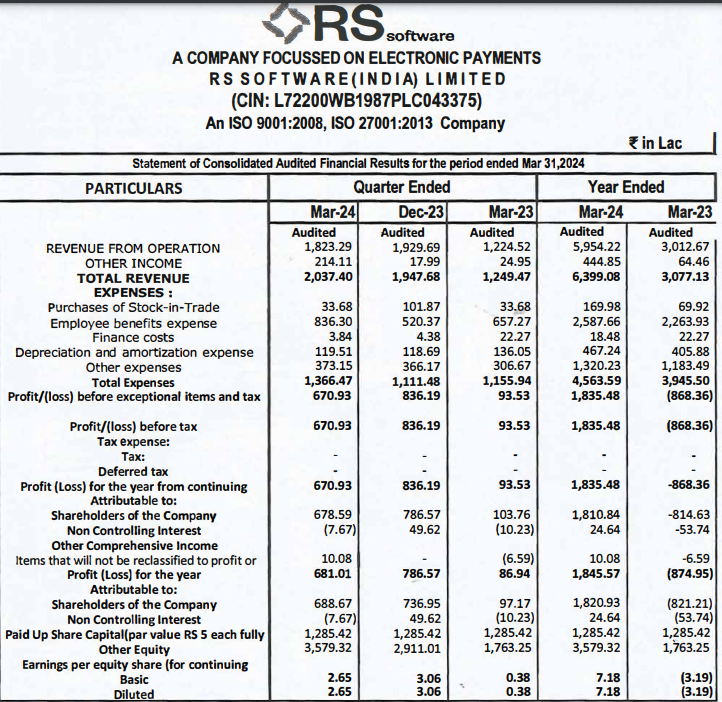

Normalizing the other income, revenue declined approx. 15-16% QoQ but that should be OK. What stands out is YoY turnaround in cashflows. But very unlikely to repeat Dec'23 performance. #rssoftware