Global Markets Investor

@GlobalMktObserv

Investment, Equity (for Wall Street), Macro Research background. ~10 years experience in markets, supporting investors in succeeding. Join 600+ FREE subscribers

ID:1679591758332657665

https://globalmarketsinvestor.substack.com 13-07-2023 20:41:03

8,0K Tweets

6,0K Followers

70 Following

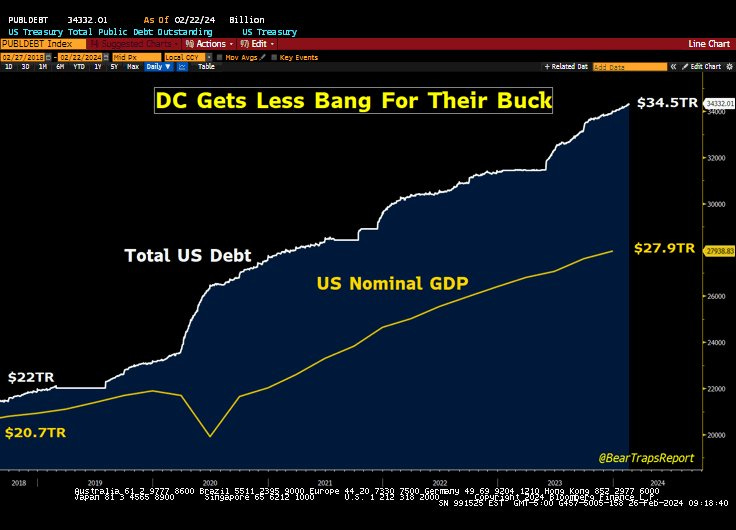

The Kobeissi Letter Since February 2019, the US national debt has increased by $12.5 trillion and the US GDP by $7.2 trillion.

Therefore, in the last 5 years for 1 unit of GDP, the US government has created 1.7 units of debt.

The US economy is becoming less productive every year.