Jeffrey P. Snider

@JeffSnider_EDU

Host Eurodollar University channel. Monetary science reborn. Putting central banks where they belong.

ID:2511153668

https://linktr.ee/eurodollaruniversity 20-05-2014 18:49:09

11,9K Tweets

119,8K Followers

927 Following

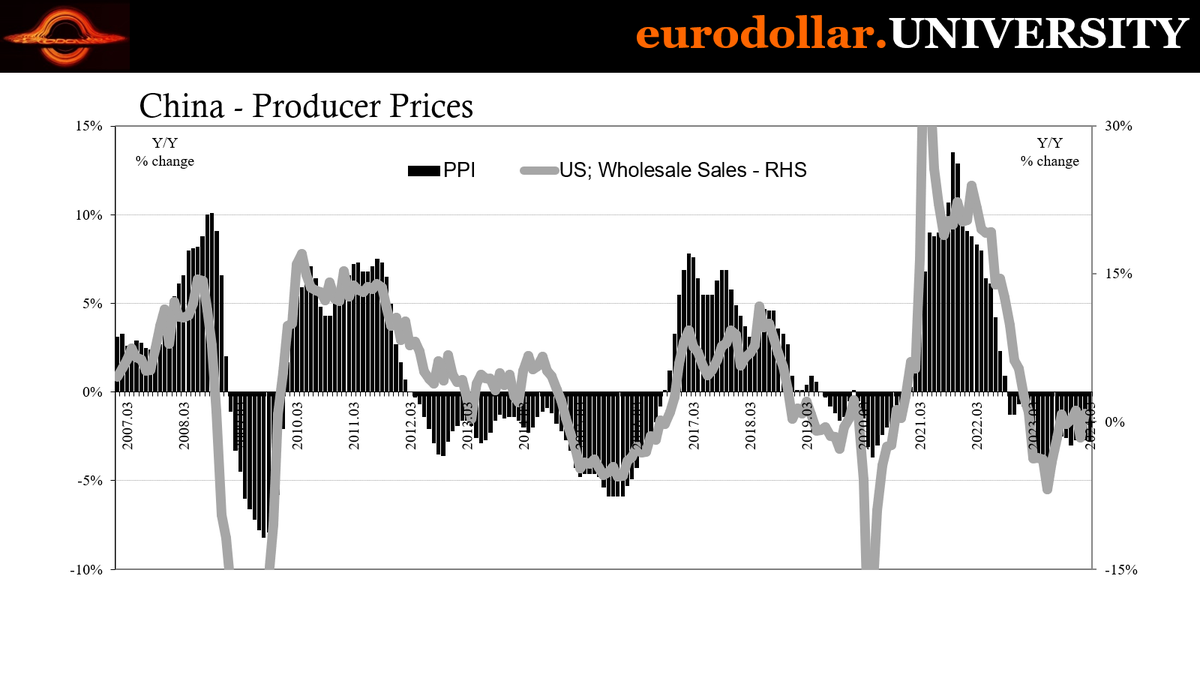

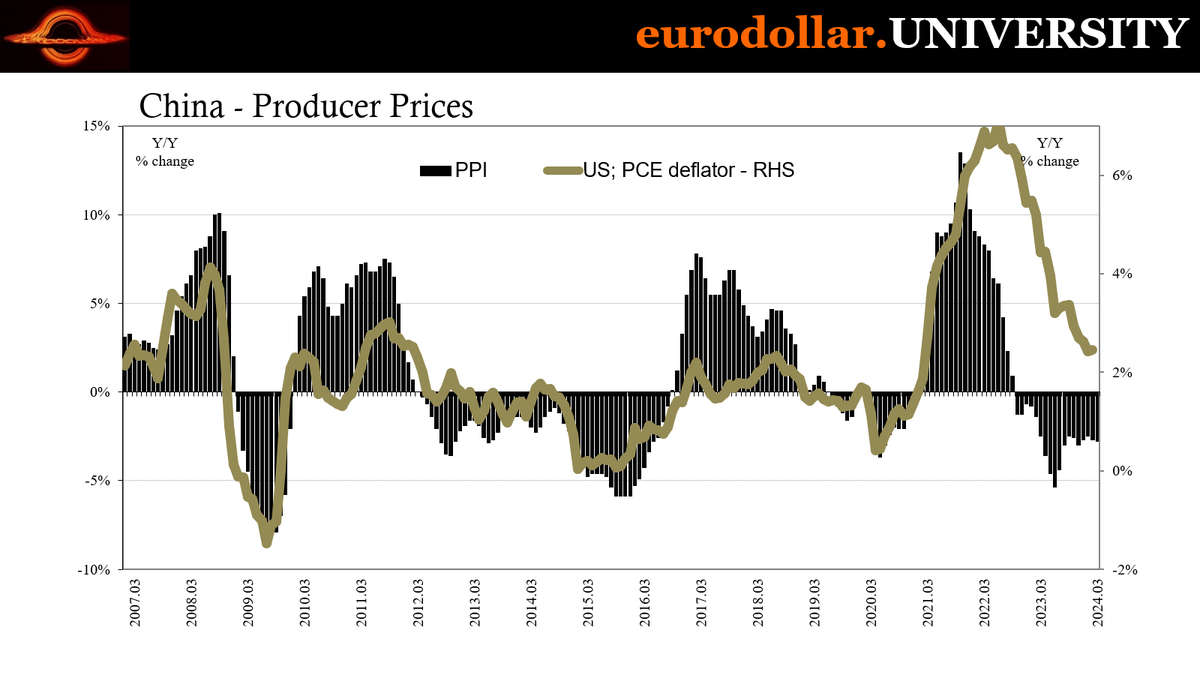

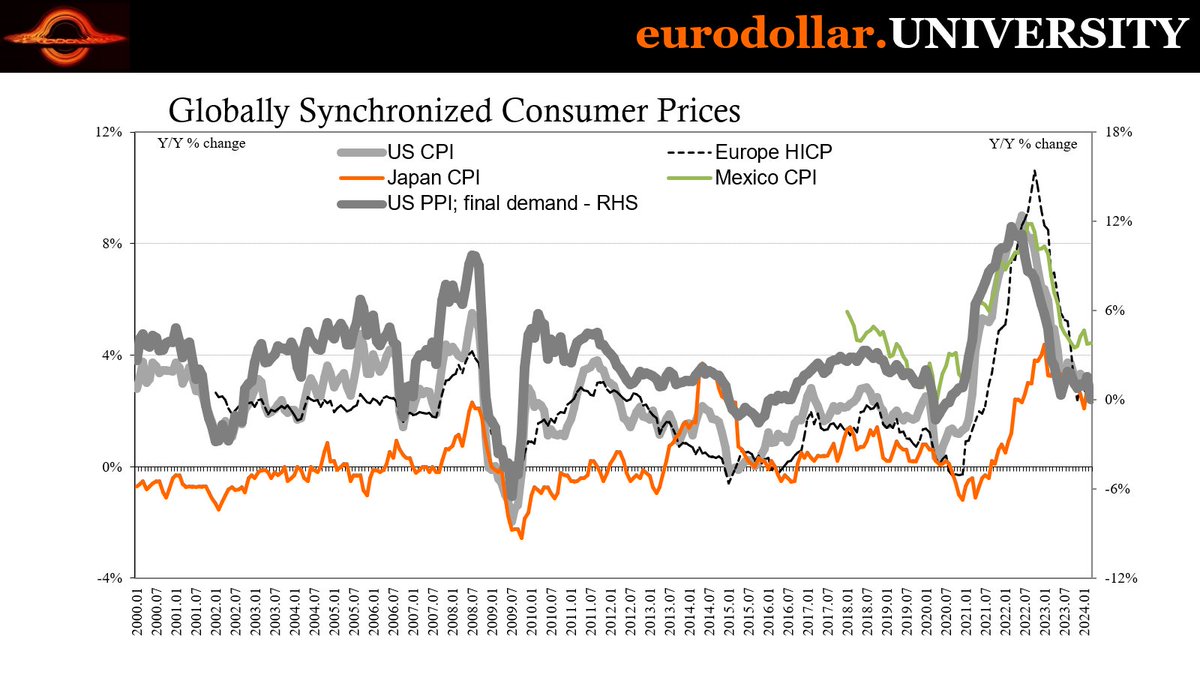

Most people's response to the downturn in China is, who cares? Sorry for them, but it doesn't seem to have any impact on everyone else.

#greatmigration

youtu.be/05T2LwiblyI