My Wealth Guide

@MWGIndia

Simplifying Money. Making Your Money Work as Hard as You Do. Founder @quirkylogic . SEBI Registered. India's Top 100 Women in Finance

BECOME FINANCIALLY FREE ⬇️

ID:1163664716121513985

https://linktr.ee/mywealthguide 20-08-2019 04:11:13

1,0K Tweets

871 Followers

26 Following

🥻Noodle straps.

That's the first thing that comes to mind when I think of mandira bedi

🏏It was incredibly inspiring to hear her tale of perseverance and tenacity, carving her niche in a field overwhelmingly dominated by men.

✨Mandira's journey served as a reminder that…

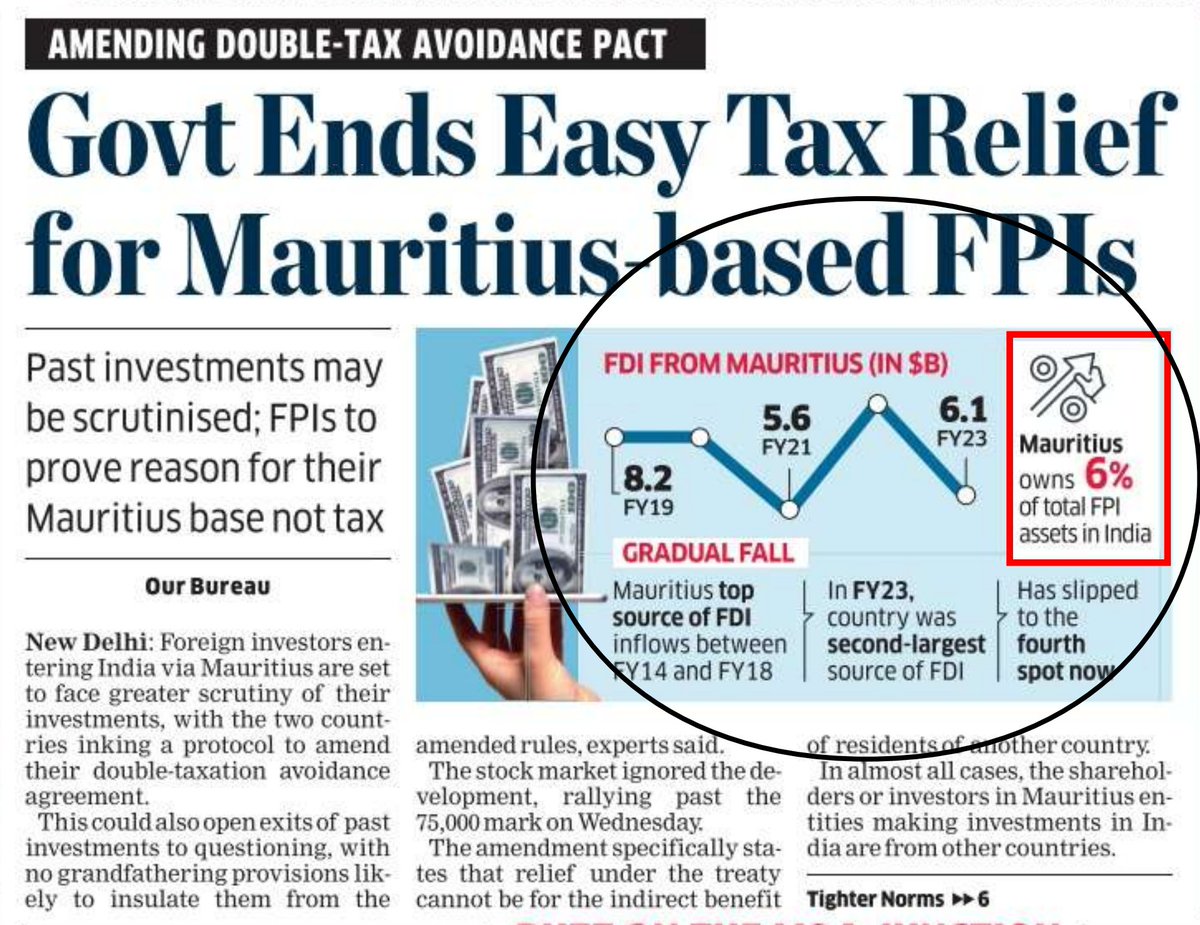

Are you ready for the new financial year ?

Moneycontrol has put out a great calendar to help you plan it.