Heather Smallpack

@PRockbottom

Oxford University. Investment Banker. London/NYC/HK

ID:751785885033693184

09-07-2016 14:31:37

4,4K Tweets

111 Followers

581 Following

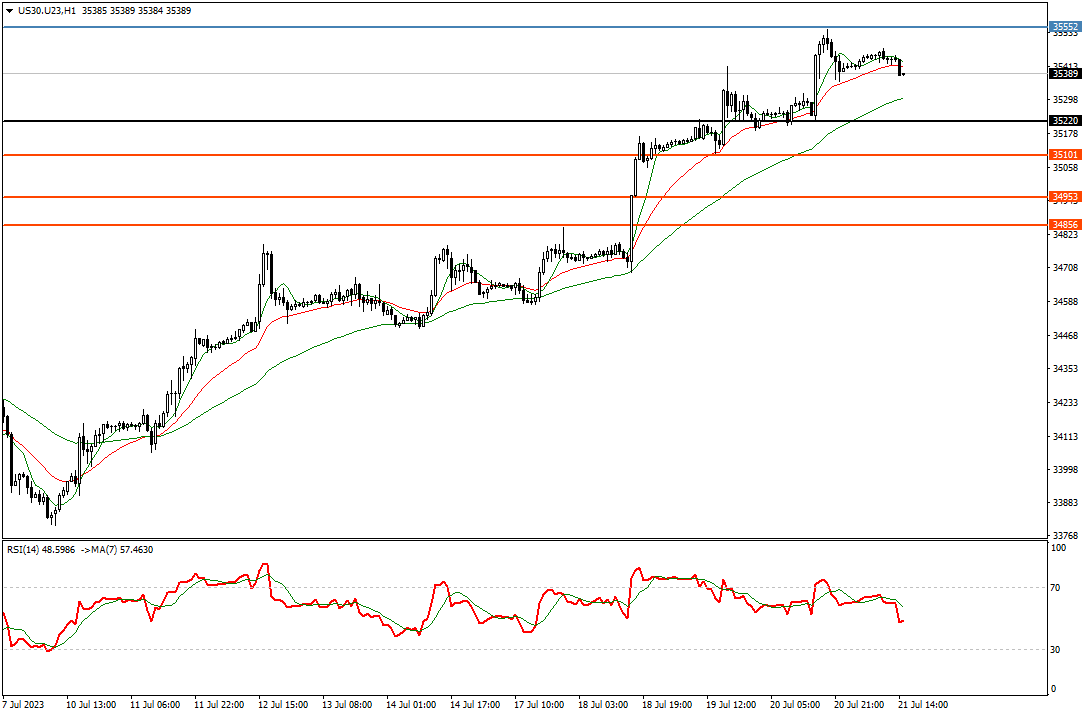

Dow Jones prints fresh session low at 75.68. #forex #dow jones #index #pricemoves #news #forex market #technicalanalsis #windsorbrokers

Robert Peston Oh jeez Robert Peston please stop.

Germany also has its highest borrowing cost since 2009.

It is lower than the UK because the Eurozone has a chronic deflationary problem due to its large unemployed population and they all bring each other down.

Also, Germany has lower debt-GDP.

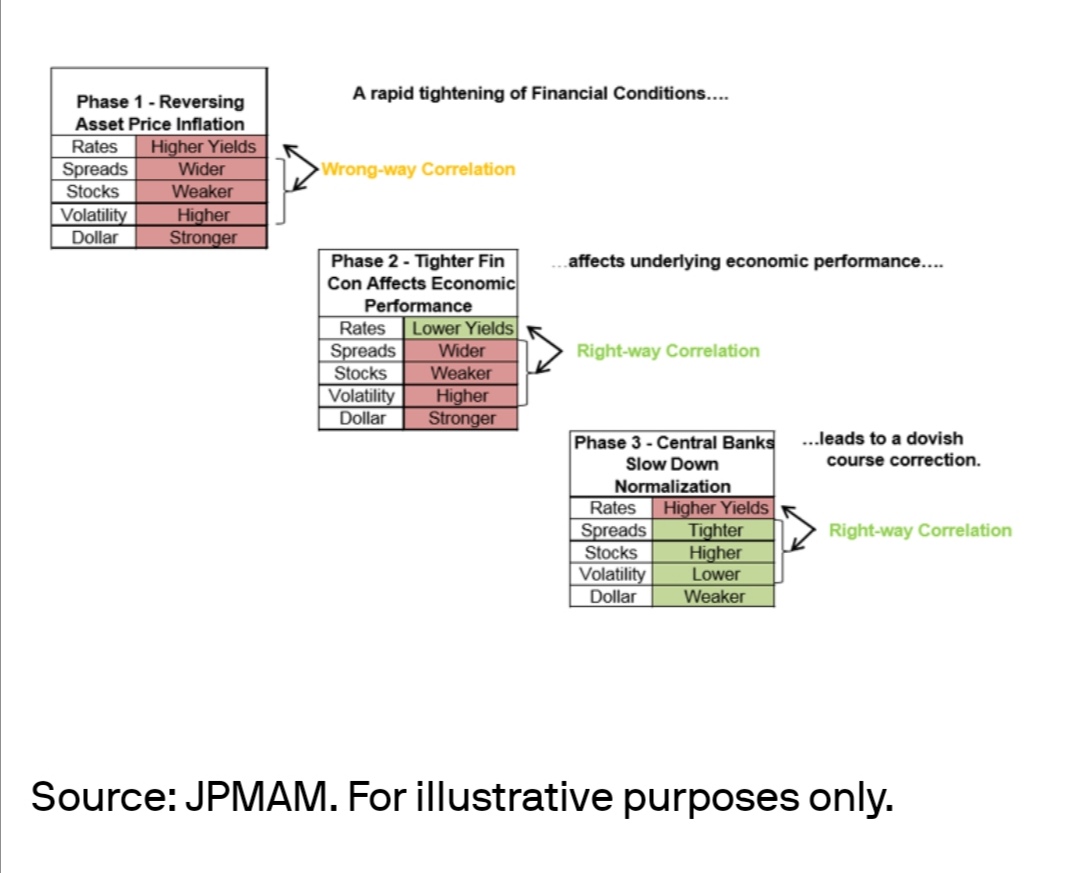

QT vs asset prices J.P. Morgan

'QE by its nature is a giant swap, inserting cash (reserves) into the econ system, and removing non-cash assets (govt bonds, mortgages, and sometimes even corp bonds and ETFs)...'

1/3

am.jpmorgan.com/us/en/asset-ma…

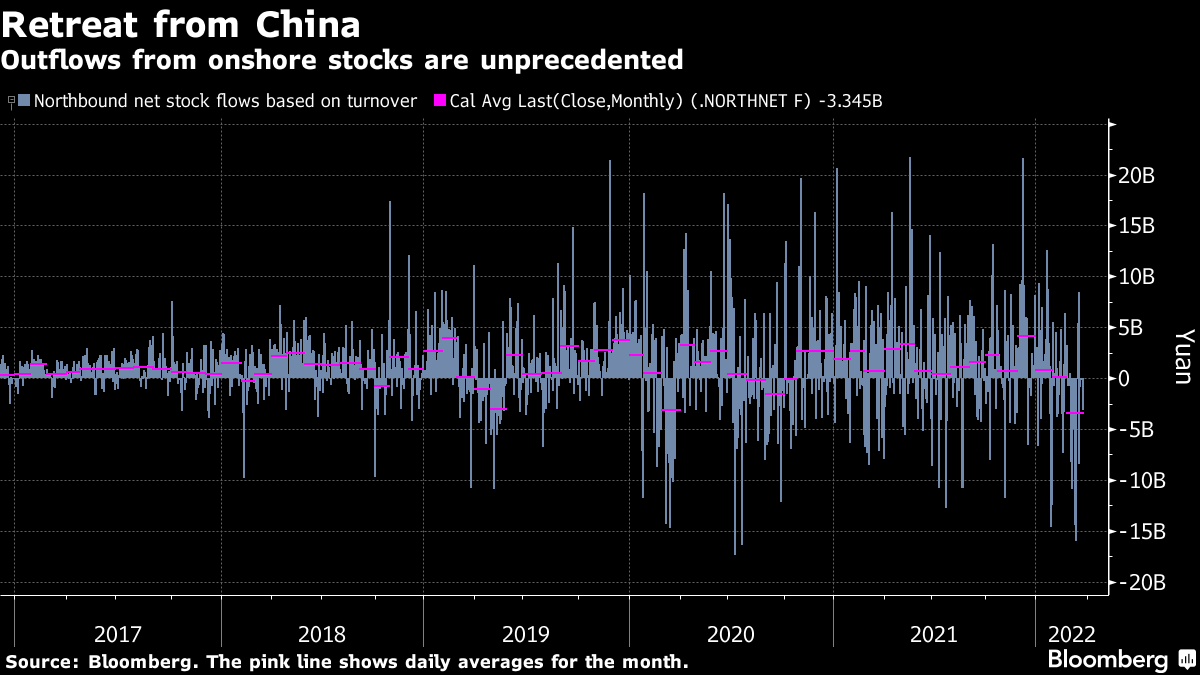

Sofia Horta e Costa Onshore funds could have also added to this by reallocating their exposure from onshore A shares to offshore China listings in HK, especially during the dip.

MSCI China A at ~2x P/B vs offshore $HSI at ~1x.

Transfer on death and payable on death designations are a simple way to pass accounts to your heirs. Learn about their advantages and disadvantages. #WealthPlanning