Taxation Updates (Mayur J Sondagar)

@TaxationUpdates

CA | Tweets are personal | Retweet ≠ endorsement 🇮🇳🇮🇳🇮🇳

ID:1151530035192328192

https://whatsapp.com/channel/0029Va52NFa1SWt3oyF1Hk1g 17-07-2019 16:32:09

6,7K Tweets

75,1K Followers

269 Following

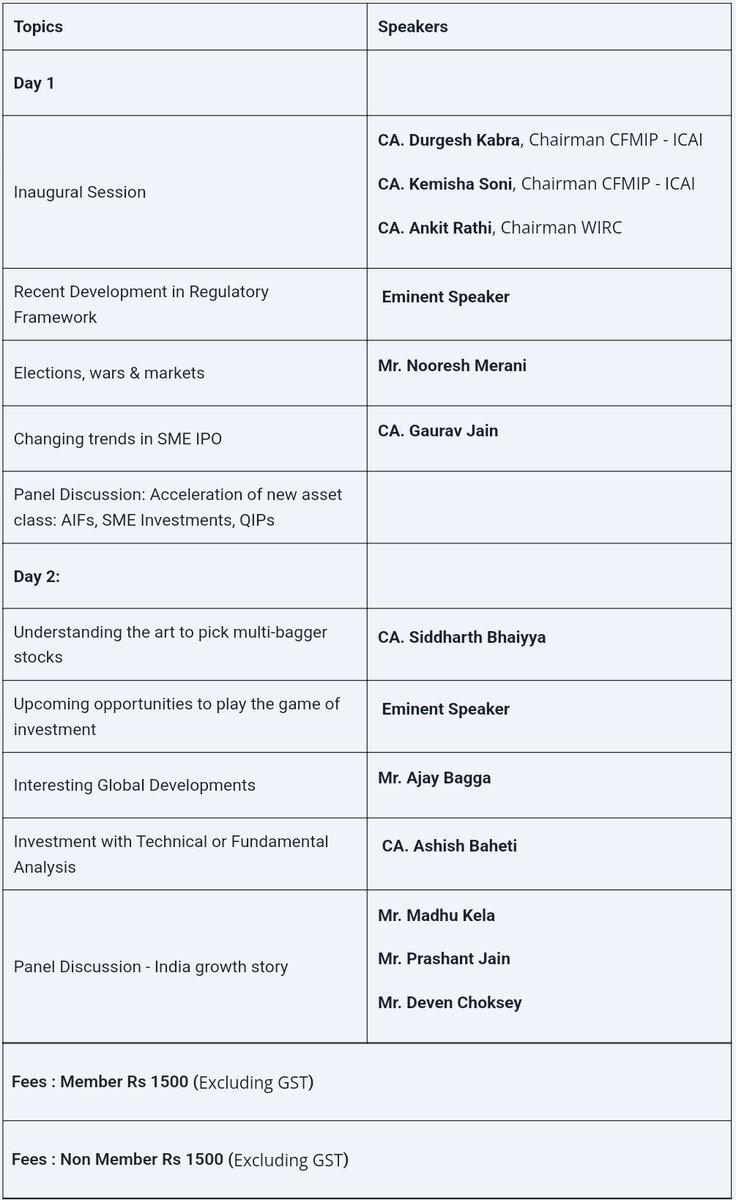

National Conference on Capital Market by WIRC of ICAI

May 3rd - May 4th, 2024

10.00 AM - 6.00 PM

Terapanth Bhavan, Thakur Complex, Kandivali East

Registration Link and More Details

wirc-icai.org/members/member…

Institute of Chartered Accountants of India - ICAI CA Ranjeet K Agarwal🇮🇳

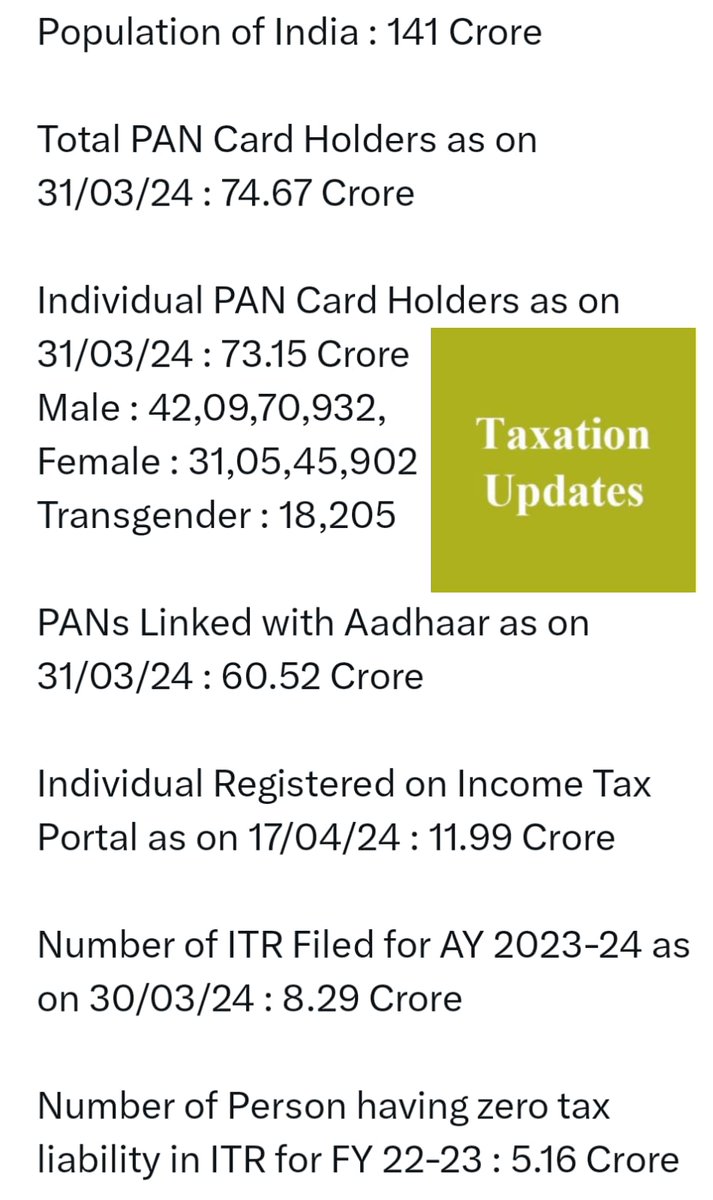

PAN Allotment Statistics up to 31.03.2024

👉Total PAN Card holders as on 31/03/2024 : 74,67,20,403

👉Individuals holds 97.97% PAN Card out of Total PAN Cards

👉Up to 31.03.2024 total 60,51,91,436 PANs have been linked with the Aadhaar.

Source Income Tax India

![Aditya Sinhal (@sinhaladitya) on Twitter photo 2024-04-21 12:54:11 Tracing footprints 🐾of @cbic_india updates on 🌟E- Invoicing🌟 since inception. *GSTN/NIC advisory* were equally important to follow. [for information about R1 auto-population, HSN code requirements, Exemption Declaration, Time-limits to generate, Enablement dates, etc] Tracing footprints 🐾of @cbic_india updates on 🌟E- Invoicing🌟 since inception. *GSTN/NIC advisory* were equally important to follow. [for information about R1 auto-population, HSN code requirements, Exemption Declaration, Time-limits to generate, Enablement dates, etc]](https://pbs.twimg.com/media/GLsKGgPbkAAupUb.png)