Variant Perception

@VrntPerception

Operating at the intersection of market history & data science, we believe man + machine beats man or machine alone.

ID:42688847

http://www.variantperception.com 26-05-2009 18:46:03

3,0K Tweets

23,9K Followers

475 Following

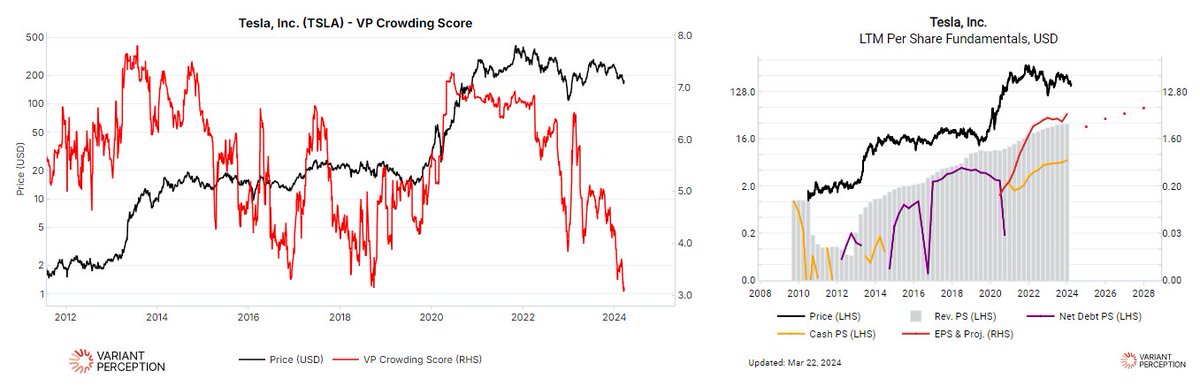

Otavio (Tavi) Costa Capex trends are incorporated in our calculation of Capital Cycle scores, which remain high for commodities and energy globally.

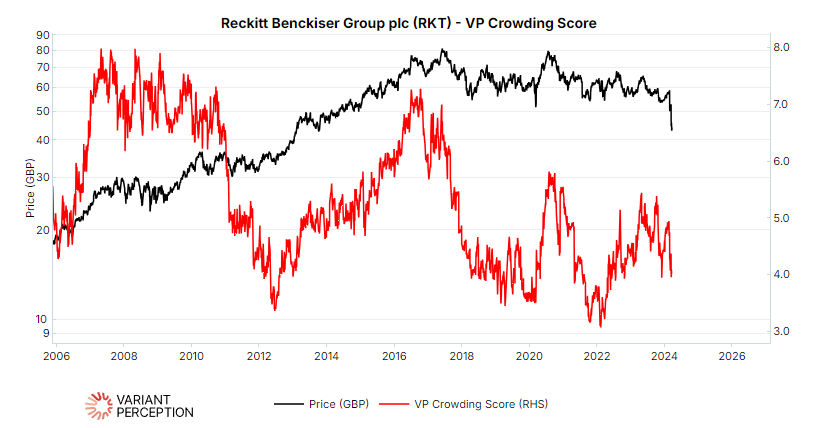

Great write-up on Reckitt Benckiser by Steve Clapham, Analyst Author Podcaster Substacker. $RKT.L's Crowding Score has been low for a while.

Britain’s Broken Compounder, open.substack.com/pub/behindtheb…