yames

@YamesAlexander

ID:3430998357

19-08-2015 05:55:10

3,3K Tweets

170 Followers

268 Following

Excellent paper from Kevin Erdmann on the link, or actually not, between (US) central bank policy rate moves and longer term government bond yields. open.substack.com/pub/kevinerdma…

We see “rule takers” is becoming a common bleat again 🙄

Here’s Stephen Kinnock showing how reality is rather more complex 👇

Busting The ‘Rule Takers’ Myth - Stephen Kinnock - Labour MP for Aberavon stephenkinnock.co.uk/busting-the-ru…

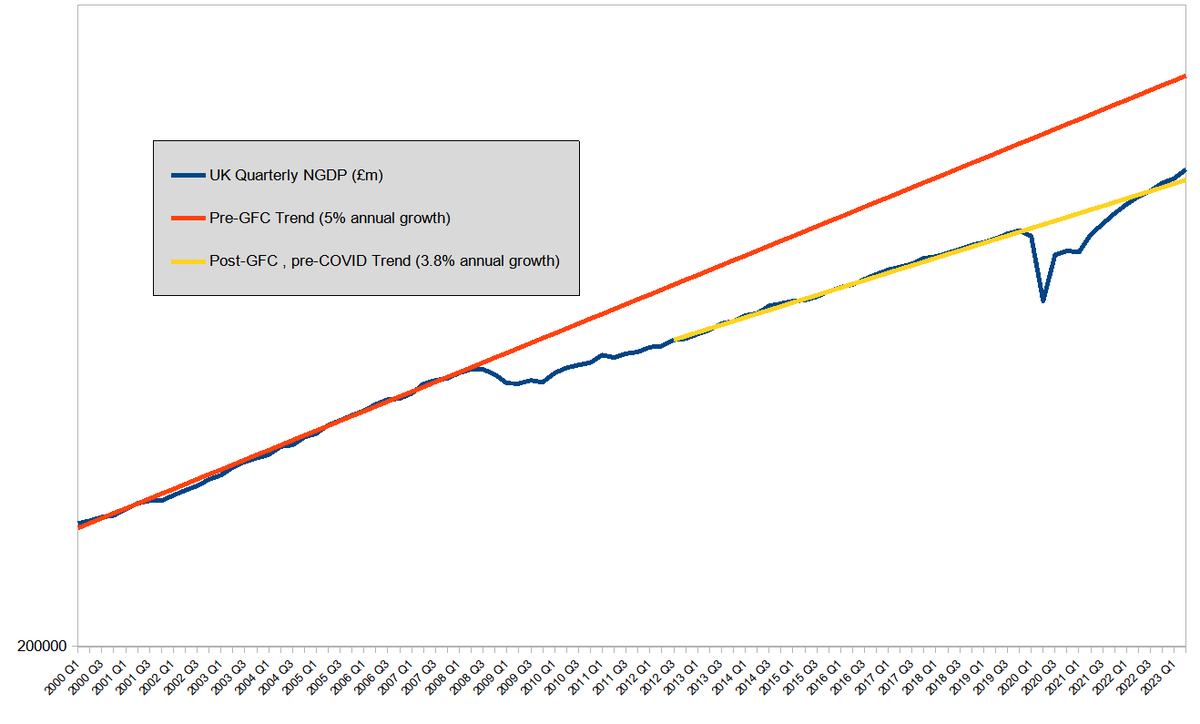

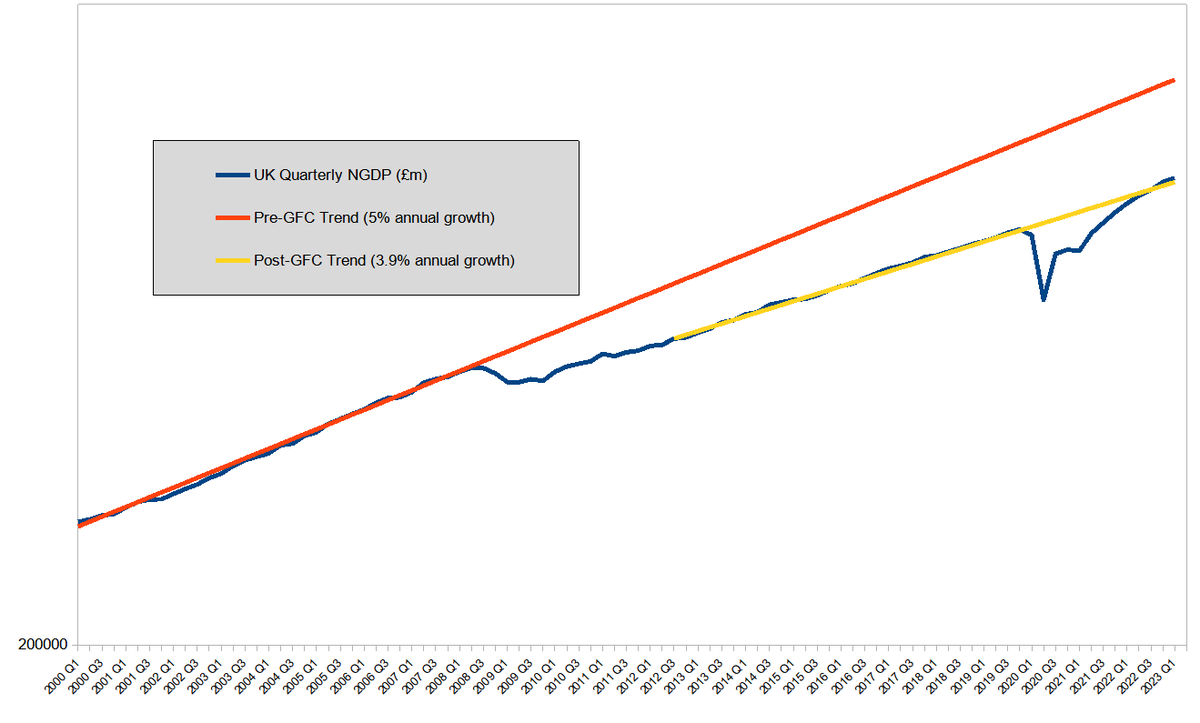

The 2Q23 UK NGDP 9.1% annualised g looks ridiculously high, less so at 7.1% YoY, up a touch on 1Q23 but barely registers above the hopelessly low 3.8% post-GFC pre-COVID trend (pushing the post-GFC trend to a mere 4.05%). Enough with the tightening Bank of England #LetTheMedsWork

own HM Treasury 'house in order' not easy but indexing benefits, state pensions, public sector pensions, govt debt int, min wages, utility (inc telcos) bills (+ 3% on top) AND inevitably allowing state sector wages catch up in the end MEANS costs of a recession are unaffordable

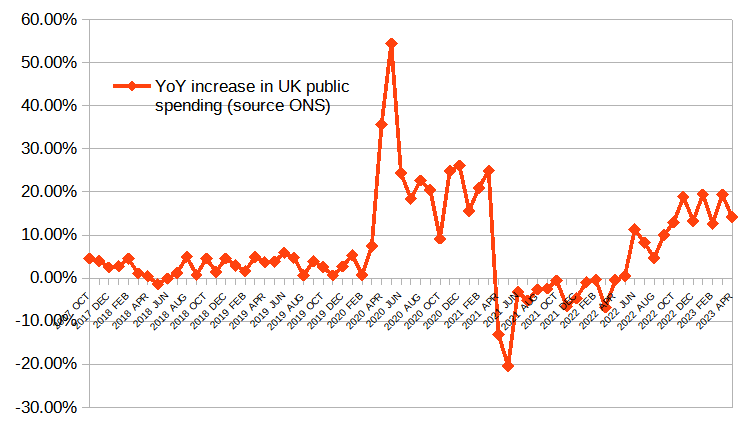

RGDP g down, NGDP g falling too Bank of England shouldn't panic over& tighten, those calling for recession to control inflation are dangerous when gov spending/fiscal easing already going gangbusters HM Treasury should sort own house out starting with triple lock Giles Wilkes

UK NGDP figures show nominal growth only just hit recent trendline in 1Q23 and slowing rapidly if not quite crashing as Office for Budget Responsibility forecast, so Bank of England most likely over-reacting but HM Treasury not helping by losing control of public spending in last 9 months

Giles Wilkes

Jeremy Hunt HM Treasury should put his own house in order, control explosive public spending too, 15-20% annual growth is way too high

Public spending out of control due to indexing of benefits pensions (the triple lock) many govt debt payments & low wages (via min wage indexing) + energy subsidies (seemingly earmarked for other stuff) inf will be stubborn as a result unless Bank of England (or Treasury act)

There is no such thing as wage inflation or food inflation, inflation is 'always and everywhere, a monetary phenomenon' caused by too much money vs output

For 6 months public sector spending has gone out of control and the Bank of England is not offsetting enough.

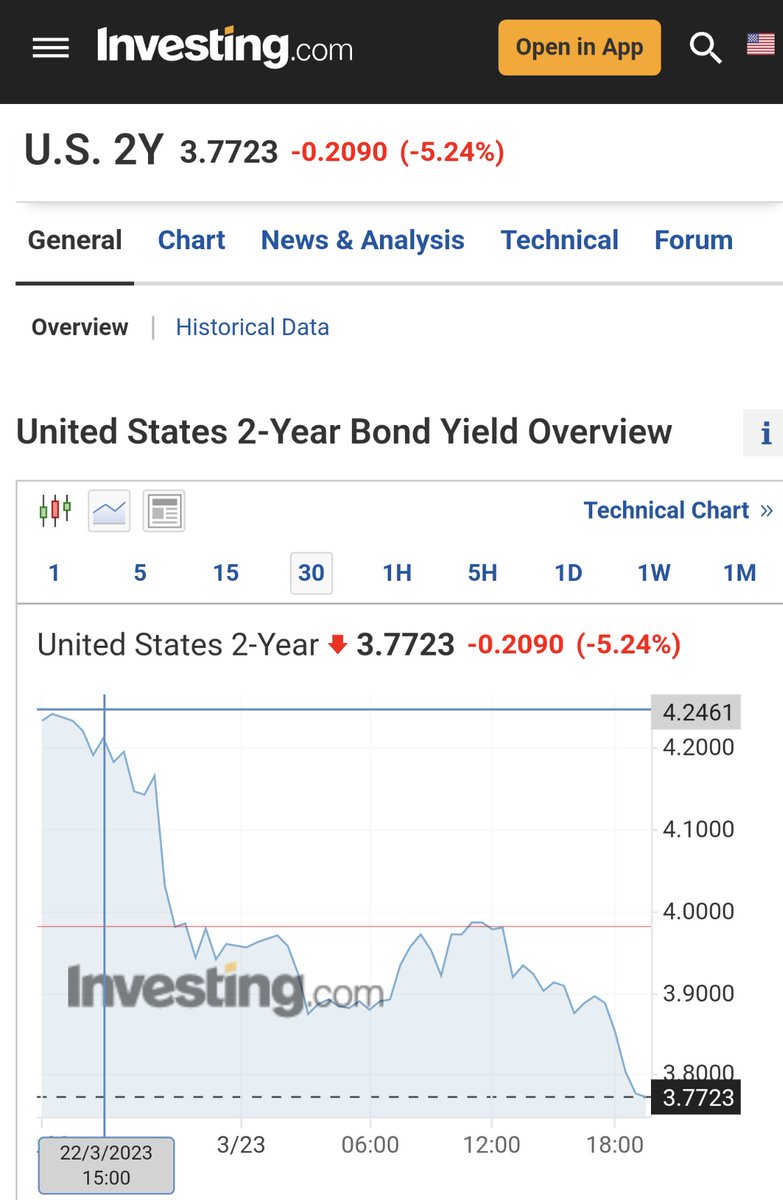

Fed yesterday and UK BoE today raise 'rates' only for rates to fall - markets say monetary policy too tight, central banks behind the curve and on course to ease very soon as economies heading for the wall. Well done, lads.

David Beckworth

The Fog that shrouds inflation Nick Rowe Patrick Horan☘️✝️ David Cervantes Ááron Sepúlveda-Cué AlanReynoldsEcon

marcusnunes.substack.com/p/is-inflation…

The challenge with working out what 'should' be the trend path in NGDP is to know whether/how much trend growth has been hit by the ultra-hard Brexit and then Long COVID on both people (long-term sickness etc) and the public sector (eg NHS productivity down 16% on 2019) Giles Wilkes