Brian Nichols

@b_nicks11

Founder of Angel Squad @hustlefundvc | Invested $50M+ leading syndicates & helped others do the same | On a mission to make angel investing accessible to 10k+

ID:1191560371816976384

https://ref.angelsquad.co/bn 05-11-2019 03:38:33

5,9K Tweets

7,7K Followers

1,3K Following

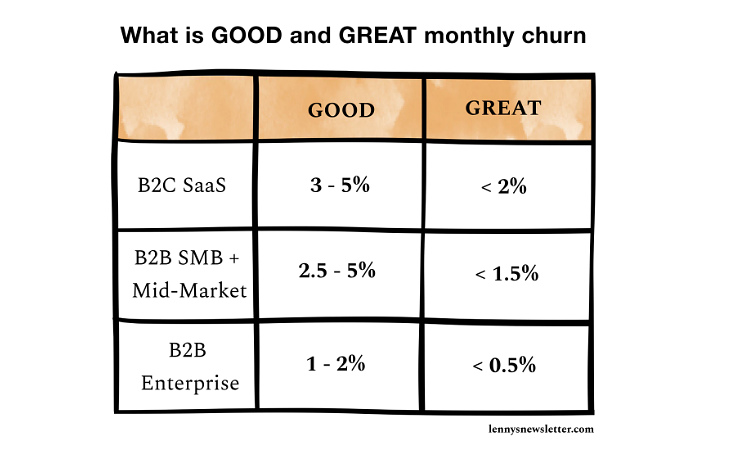

Sometimes as an angel, there's a firehose of metrics that a founder throws at you. It can be hard to know what good looks like.

For example: How can you tell if the SaaS company you’re evaluating has a good customer churn rate?

My friend Lenny Rachitsky has a newsletter (Lenny's