Matthew B

@boes_

Burned all my notebooks, what good are notebooks? Covering the economy for Bloomberg

ID:42570063

http://www.bloomberg.com/authors/AR2mfz_VWJM/matthew-boesler 26-05-2009 05:12:45

28,0K Tweets

30,0K Followers

6,9K Following

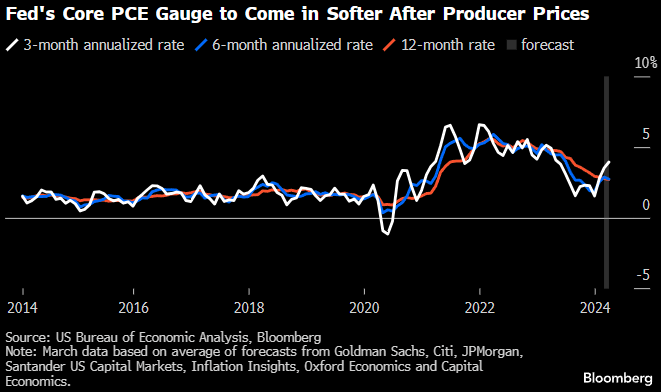

'Right now core PCE is on track to run at a 2.75% year-over-year pace as of March, 75 basis points above the Fed's 2% inflation target for PCE ... Rent is contributing 42 basis points to the 75 basis point core PCE overshoot'—Skanda Amarnath on today's inflation data

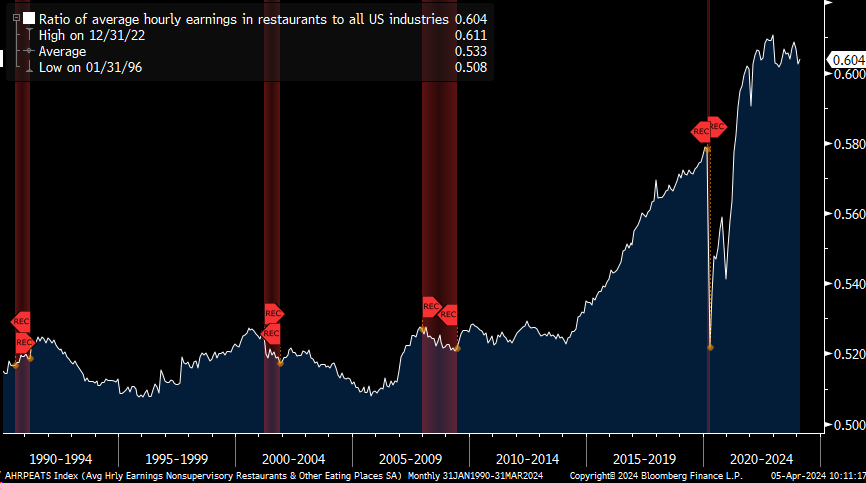

Powell reframes signs of tight labor markets as evidence of room for more non-inflationary growth: 'There may be more supply-side gains to be had. Surveys of businesses still show difficulties in hiring people, difficulties in getting the inputs they need' bloomberg.com/news/articles/…

Added Omair Sharif comments: (1) PPI data out Friday could show a big jump in the portfolio management component, reflecting the recent market rally; (2) that could give January core PCE a big boost; (3) after that, core PCE is on track to hit 2% year over year by May or June

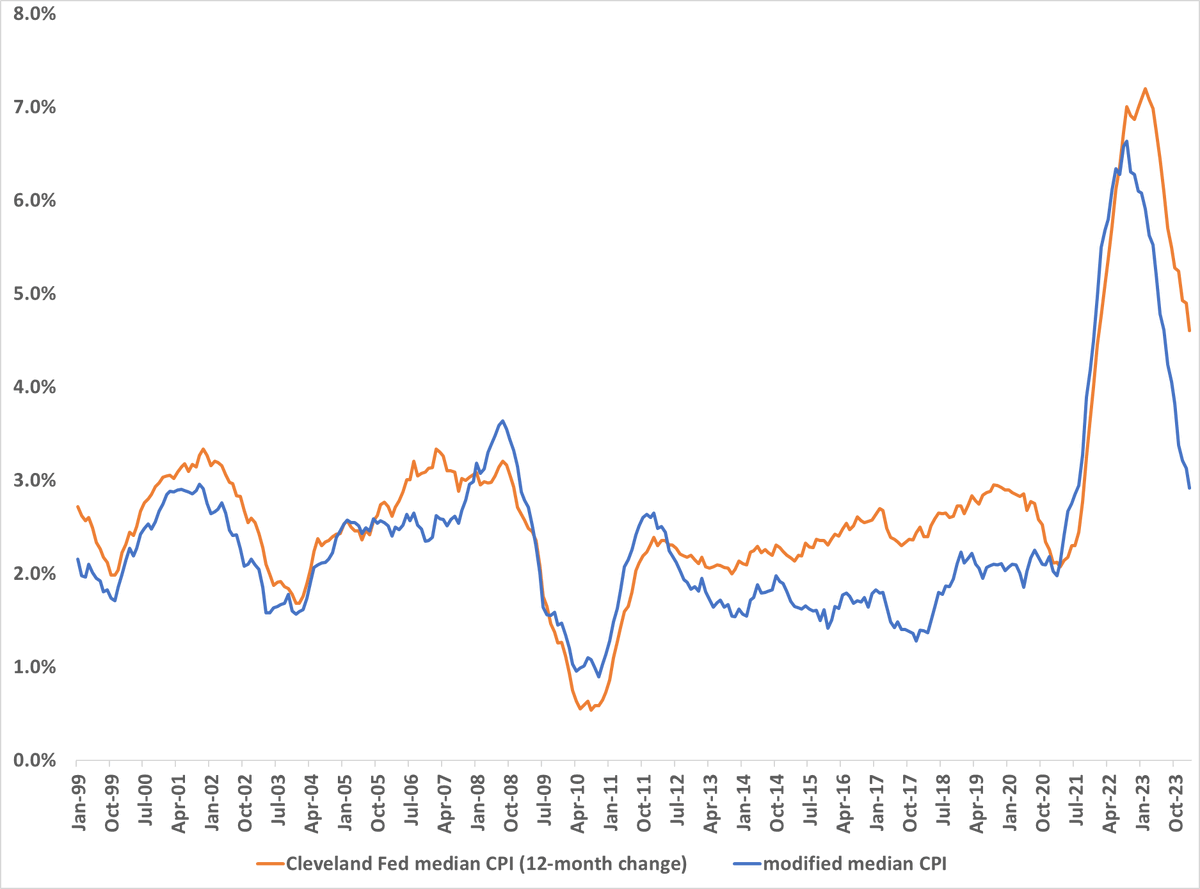

'On the inflation side, the Fed is running out of reasons not to cut. If concerned about growth, it speaks to a renewed belief in the Phillips Curve, which most economists view as having been flat for about 25+ years'—karim basta on today's CPI revisions (bloomberg.com/news/articles/…)

“The prospect of a strong economy galvanizing voters to believe that it’s morning again in America … hasn’t materialized yet. But Trump perceives enough of a threat that he’s begun predicting a crash and criticizing Powell”—Joshua Green (JoshuaGreen.bsky.social on 🟦) on Biden vs Reagan bloomberg.com/news/newslette…