Lisa Abramowicz

@lisaabramowicz1

Co-host of @bsurveillance; Sign up for the newsletter here: https://t.co/4EBiPWI8En

ID:1327359720

https://www.bloomberg.com/btv/series/bloomberg-surveillance 04-04-2013 17:03:07

29,0K Tweets

377,4K Followers

1,4K Following

Follow People

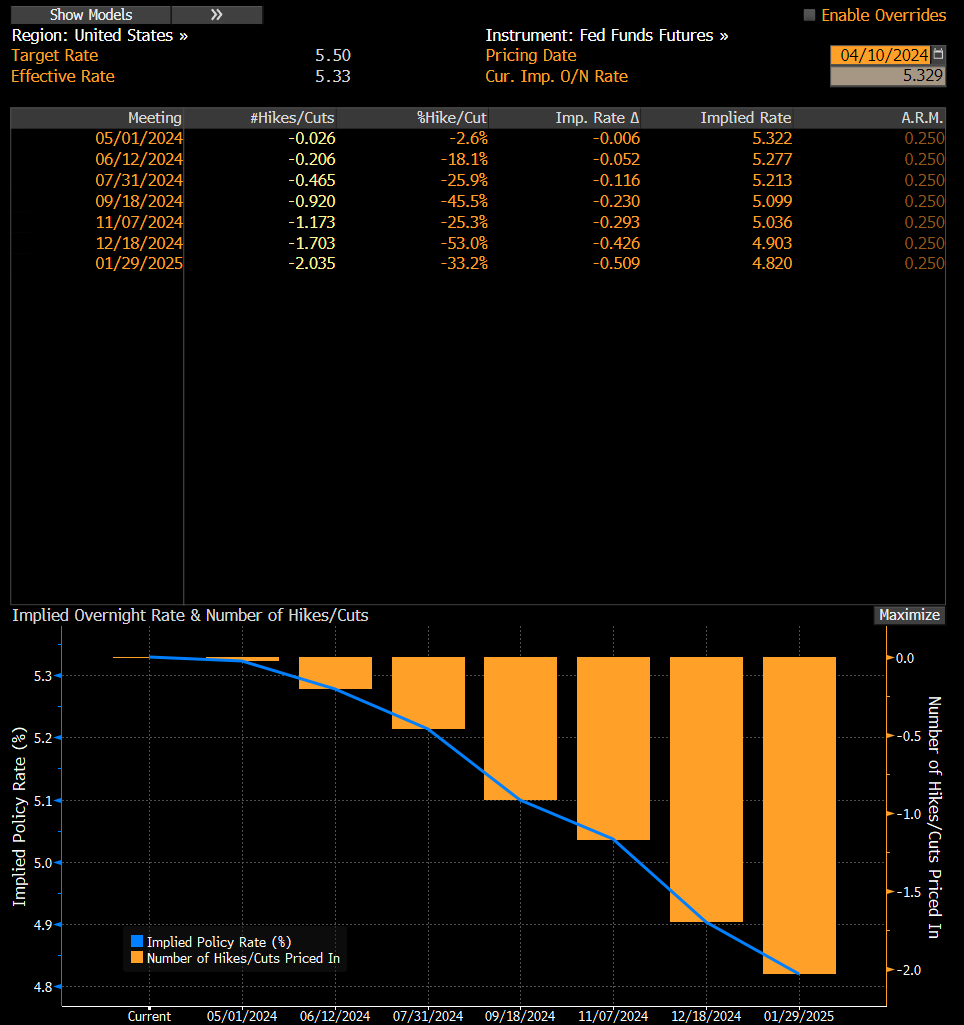

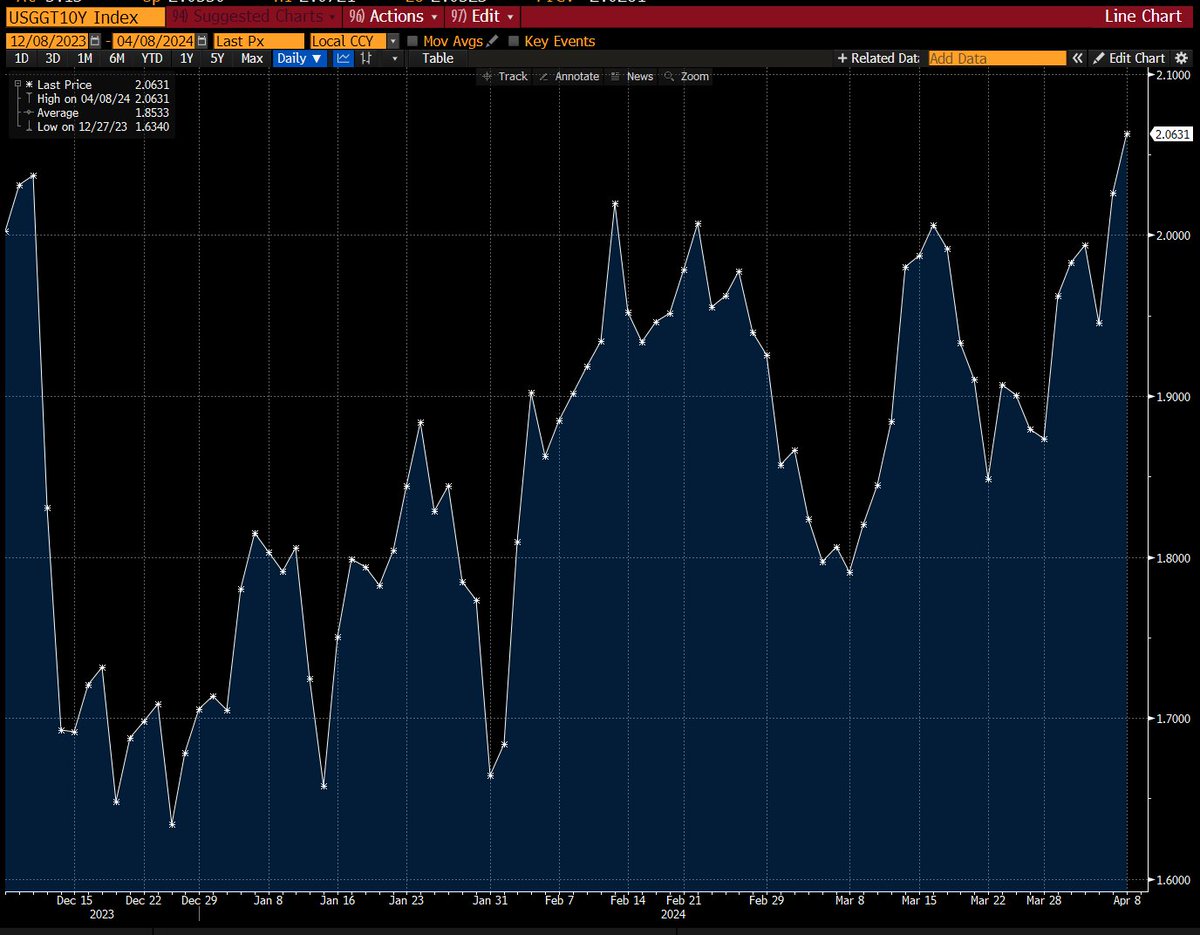

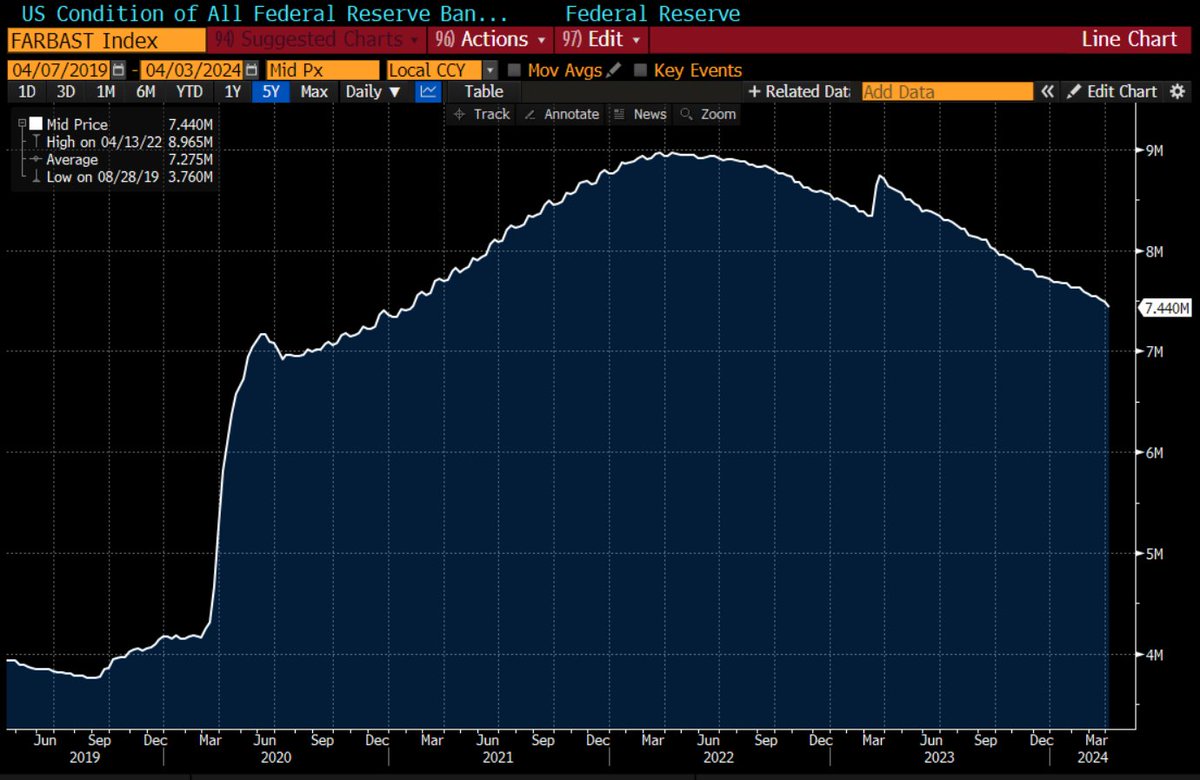

US 10-year Treasuries are having their worst day since May 2023, with yields surging after the one-two punch of a hot CPI and a bad auction. Peter Boockvar: '10 yr auction was bad...Dealers were left with 24% of the auction, which is the most since Nov. 2022.'

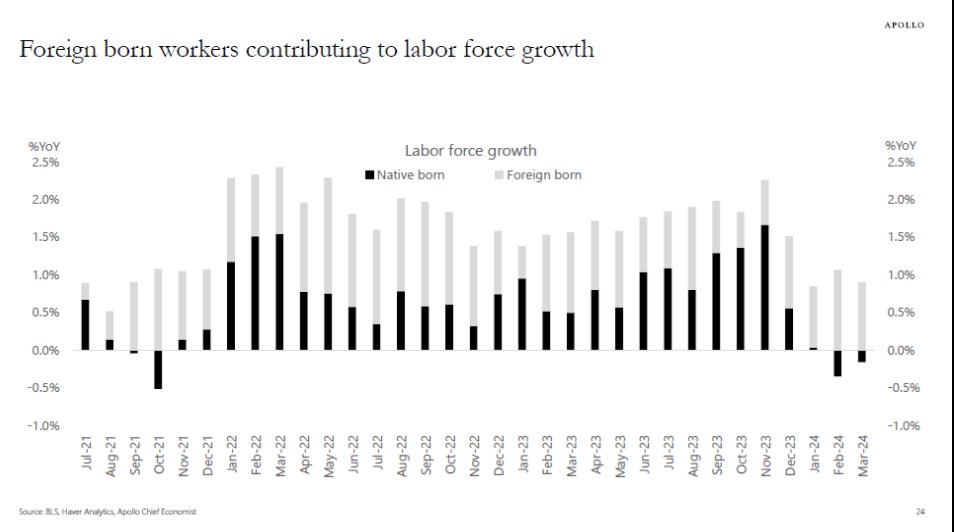

The big mistake in 2021 was people didn't listen to companies, which 'were clearly saying we have inflationary pressures:' Mohamed A. El-Erian. 'This time around listen to the earnings call & they are worried about the outlook for the rest of the year.' bloomberg.com/news/newslette…