Lombard Odier

@lombardodier

Rethinking everything since 1796. Shaping global wealth whilst guiding our clients towards a sustainable economy.

ID:115613766

http://www.lombardodier.com 19-02-2010 08:22:18

2,7K Tweets

61,5K Followers

155 Following

Follow People

How do your daily activities impact the environment?

Find out how sustainable your lifestyle is by playing Home Truths, our immersive experience created with the Financial Times : spkl.io/601140V8f

Switzerland has become the first major developed economy to ease #interestrates , marking a return to more ‘normal’ conditions after the pandemic and energy shocks. We expect other central banks to follow suit later this year: spkl.io/60114LNtF

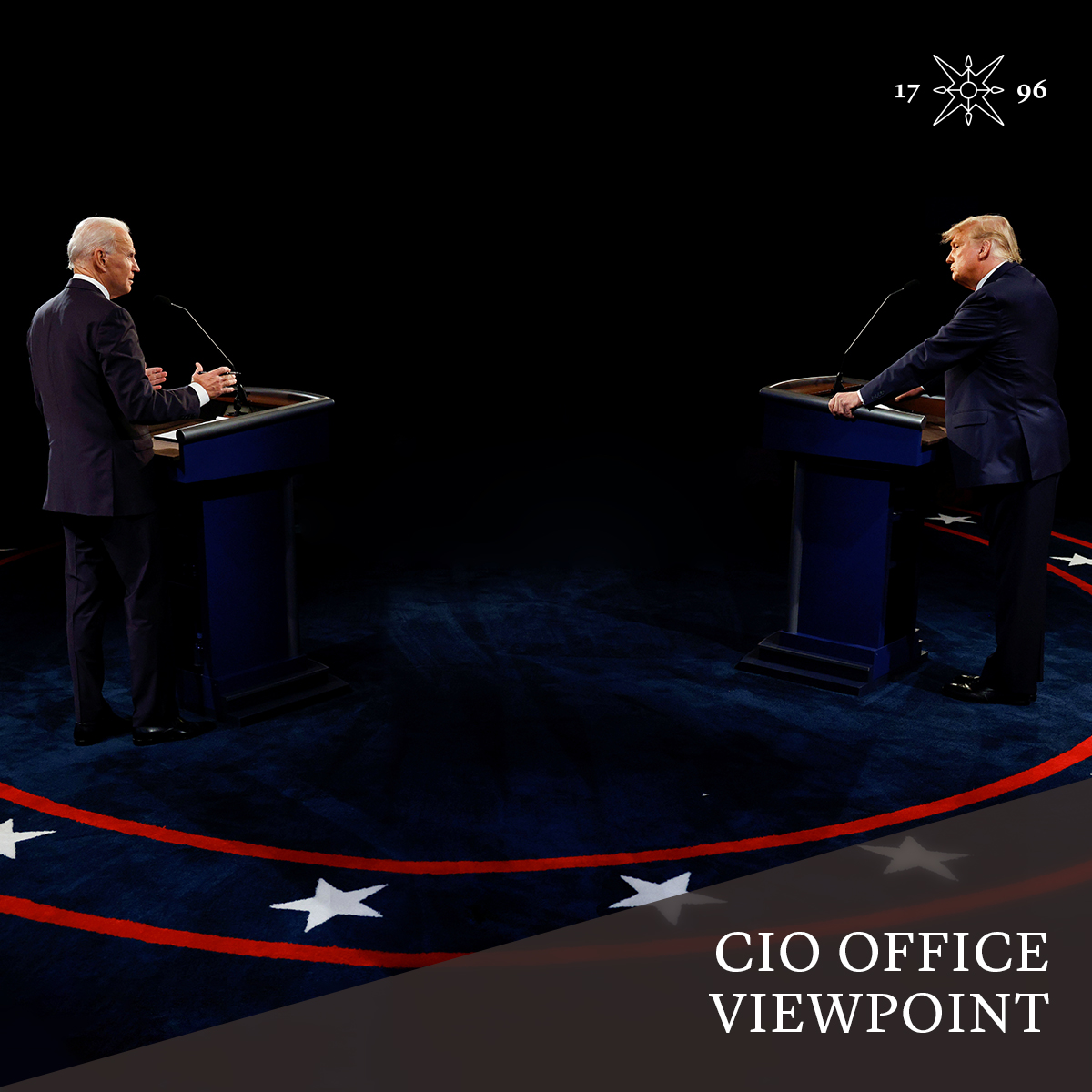

The likelihood of a re-match of 2020’s #USpresidentialelection is growing. The choice for voters may be the same as four years ago, but the implications for investors, and the US economy, look rather different. Read more: tinyurl.com/4be5npv5

Investments in Saudi #tourism to accelerate in 2024, says top expert arab.news/nvccr

Samy Chaar, PhD | Lombard Odier

Downturn or reacceleration? Historically, when two-year Treasury yields surpass ten-year ones, US recessions follow. Other indicators hint at a soft landing. We analyse models, probabilities, and present our #investment strategy: spkl.io/60124aXvq

How should investors view 2024?

Modest growth, falling inflation and rate cuts aren’t a recipe for a boom. Geopolitics add a loud note of caution. But we see a manageable slowdown ahead. Discover our #macroeconomic views & investment strategy implications: tinyurl.com/mrxe6ph8

We are pleased to welcome Bettina Ducat as Co-Head of #LombardOdier Investment Managers. Based in Geneva, she will be a Limited Partner within the Group and lead LOIM in collaboration with Managing Partner Jean-Pascal Porcherot.

Read more here: tinyurl.com/4th6hvdy