Pedro da Costa

@pdacosta

Fed reporter. Head of Policy for the Americas at @MNIMarketNews. Host of FedSpeak podcast. Opinions my own.

ID:65466158

http://www.marketnews.com 13-08-2009 20:59:18

257,5K Tweets

135,4K Followers

30,0K Following

Follow People

Chicago Federal Reserve Bank President Austan Goolsbee to Neil on FOX Business : We must get inflation back down

Later today: watch live as ECB President Christine Christine Lagarde explains the latest monetary policy decisions.

You have to take seriously the possibility that the next rate move will be upwards rather than downwards.

bloomberg.com/news/articles/… via Bloomberg Economics

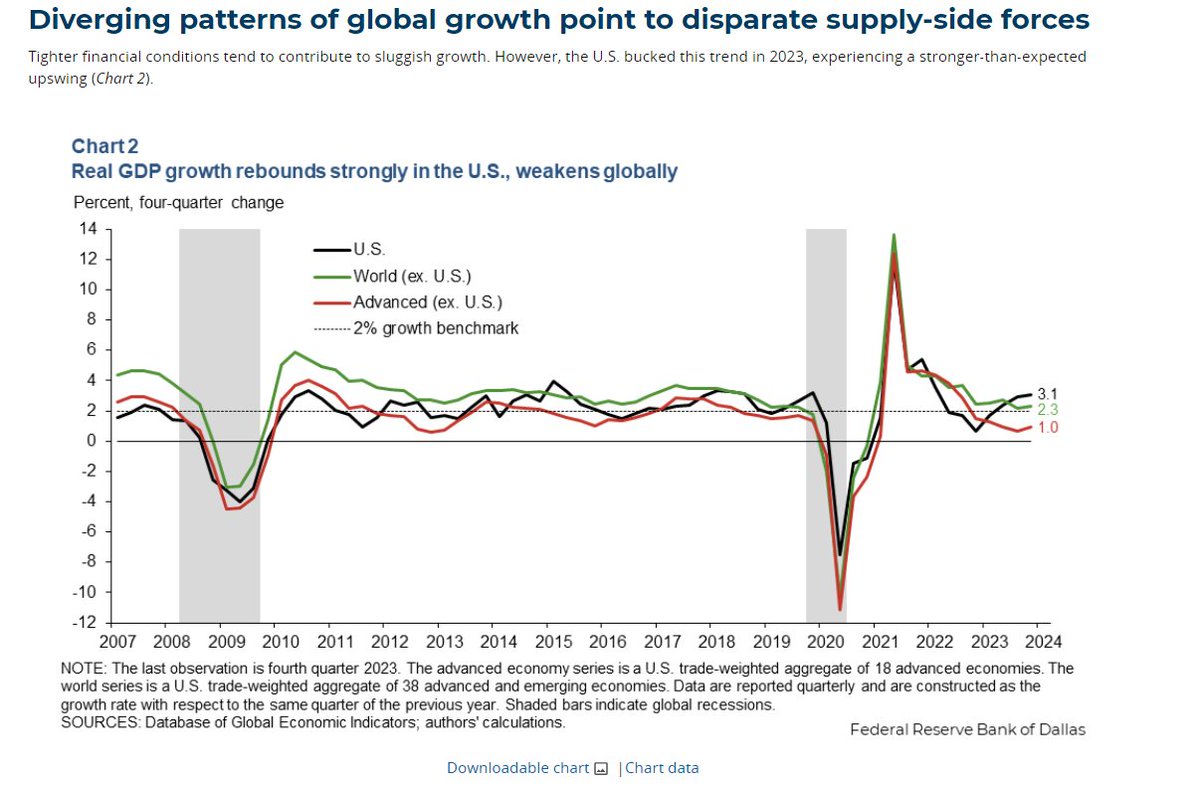

'The unwinding of pandemic-era supply-chain dislocations has boosted aggregate supply in the U.S. more than in other economies, mitigating the impact of tighter financial conditions.' - Enrique Martínez García at Dallas Fed dallasfed.org/research/econo…