Sanjeev Sanyal Amish Tripathi Prof. Krishnamurthy V Subramanian Harsh Madhusudan Rajeev Mantri Another heuristic which I found useful when understanding all this was that the dollar system is unbundled with UoA being the sovereign USD, MoE being Eurodollar, SoV being US Treasuries

Now Monetary Policy & Fiscal Policy should dance in rhythm to balance UoA & SoV tradeoffs

🇺🇸🇪🇺 #RIPPLE COOPERATES WITH THE ' #EURODOLLAR ' THROUGH ITS MEMBERSHIP IN THE DIGITAL EURO ASSOCIATION ➡️ THE EURODALLAR IS A NEW ENTRANT TO THE #STABLECOIN MARKET AND IS FULLY COMPLIANT WITH #MiCA ➡️ THIS FINTECH INNOVATOR IS ISSUING A DIGITAL DOLLAR - MADE IN EUROPE #EUD …

Current U.S. Dollar LIBOR Rates - May 2, 2024:

> The 1-, 3- and 6-Month U.S. Dollar (Eurodollar) LIBOR Rates All Rose Today <

MORE: >> libor.fedprimerate.com/2024/05/banks-… <<

MORE: >> fedprimerate.com/libor/libor_ra… <<

MORE: >> fedprimerate.com/libor/libor_ra… <<

MORE: >> fedprimerate.com/usprimerate-vs… <<…

When we said “hey let’s recapitalize $USTC and turn it into a fully backed RWA digital eurodollar because rates high, there is money to be made + need for a tether competitor” ultra moronic NaatiePaat SolidVote LUNC Validator called our plan a “pipe dream”

F king losers

#LUNCcommunity

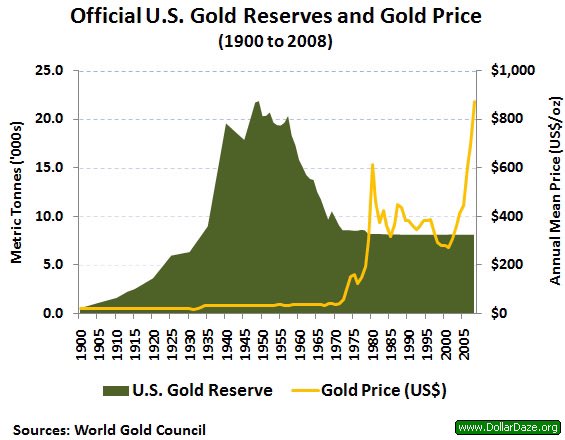

Espen Gaarder Haug Bretton Woods was dead on arrival. Keynes was right.

When BW got implemented in 1958 outflows started and never stopped until Nixon closed the window.

“Luckily” for regulators the Eurodollar system had taken over the heavy lifting by that time.

BLACK SWAN YOOOOO want to do a space sometime and add in USD milkshake and Eurodollar topics too? I would definitely be there and want to discuss that ❤️🔥. LOTS to discuss

EUR/USD is projected to face first resistance at the weekly high of 1.0752 (April 26),

To join us click on link

chat.whatsapp.com/H2o7Tgxafp2Eka…

#eurusdsignal #eurodollar #eurusdanalysis #eurusdforecast

#eurusdchart #eurusdtrading #eurusdsignal s #eurusdstrategy

#eurusdpips #EURUSD