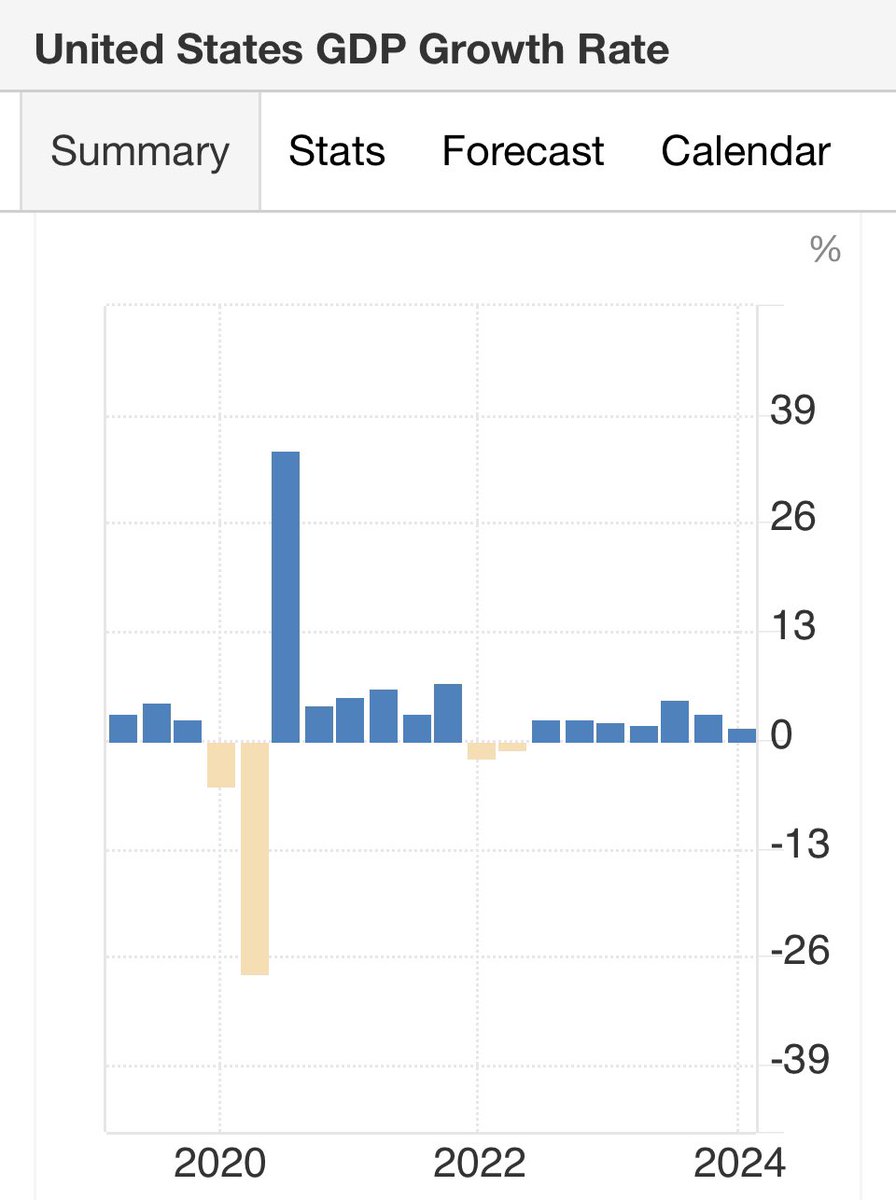

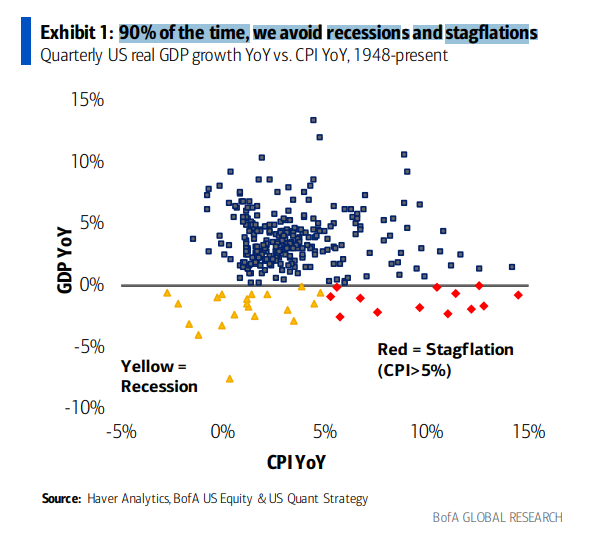

Banking failures coming. A #recession is right around the corner. The economy is not doing well. Combine that with pending political instability of a contentious presidential election and you have a big mess.

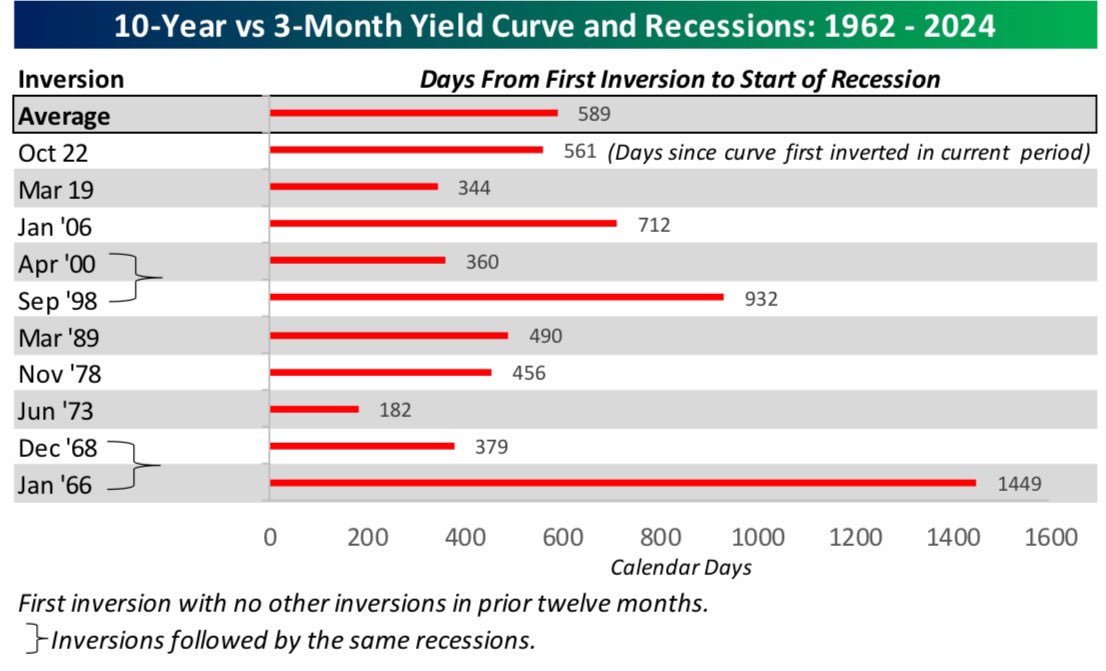

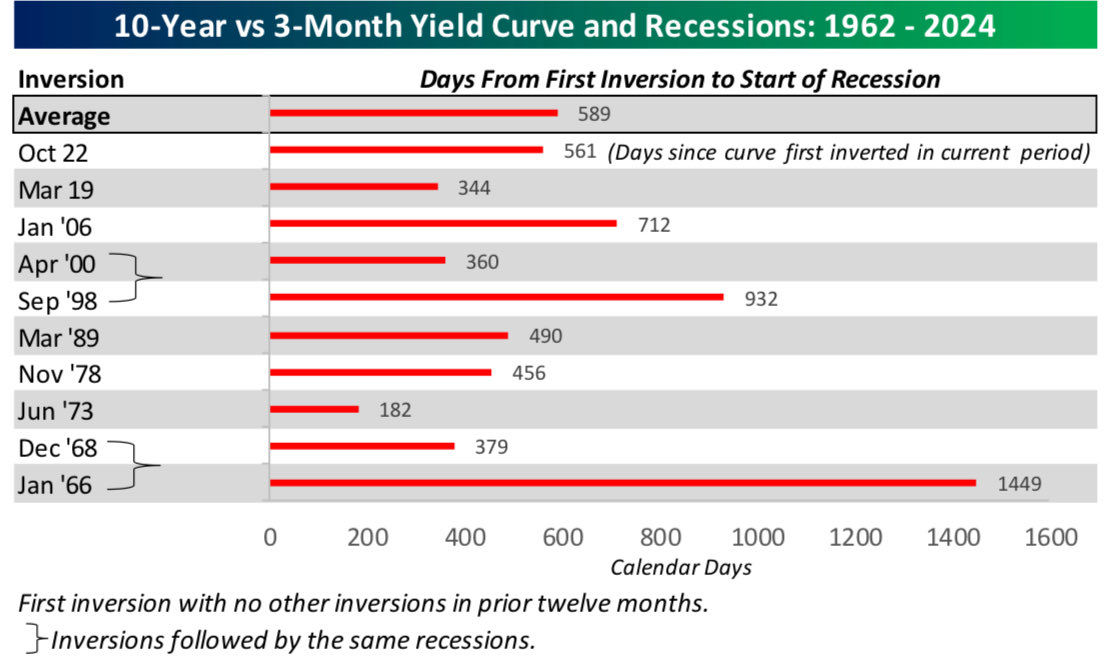

Nobody has a crystal ball, but recessions happen every 6 to 10 years

new Friday webinar! gold, silver, copper, global stocks, recessions, relative strength, dividends(?), semiconductors and a toasty breakout to look at as we digest markets this week #WhereDoWeStand $SPX

email [email protected] to subscribe...

FACE ECONOMY TO END ALL RECESSIONS

STRAY KIDS REAWAKEN MET GALA

#StrayKids_MetGala

#스키즈_멧갈라_축하해

Stray Kids

🏠 Myth Buster: Did you know that in most recessions, home prices have actually risen, not fallen?

🤔 Thinking of buying? Let’s talk data and opportunities.

📞 (978) 376-5389 | 🔗 chrisgravesmortgageexpert.com

#HousingMarket #RecessionProof #RealEstateTips #ChrisGravesMortgageExpert