CD Valet

@CDValet

Serving the "straight up rates," CD Valet® delivers the most competitive and unbiased CD rates from local and national financial institutions.

ID:1637902188910632960

https://cdvalet.com/ 20-03-2023 19:41:38

146 Tweets

117 Followers

99 Following

The Federal Reserve held interest rates steady at their May FOMC meeting as inflation rates continued to rise. MarketWatch asked experts including CD Valet’s Bryan Johnson how savers can continue growing their funds with CD rates as high as 5%. on.mktw.net/3whZbf4

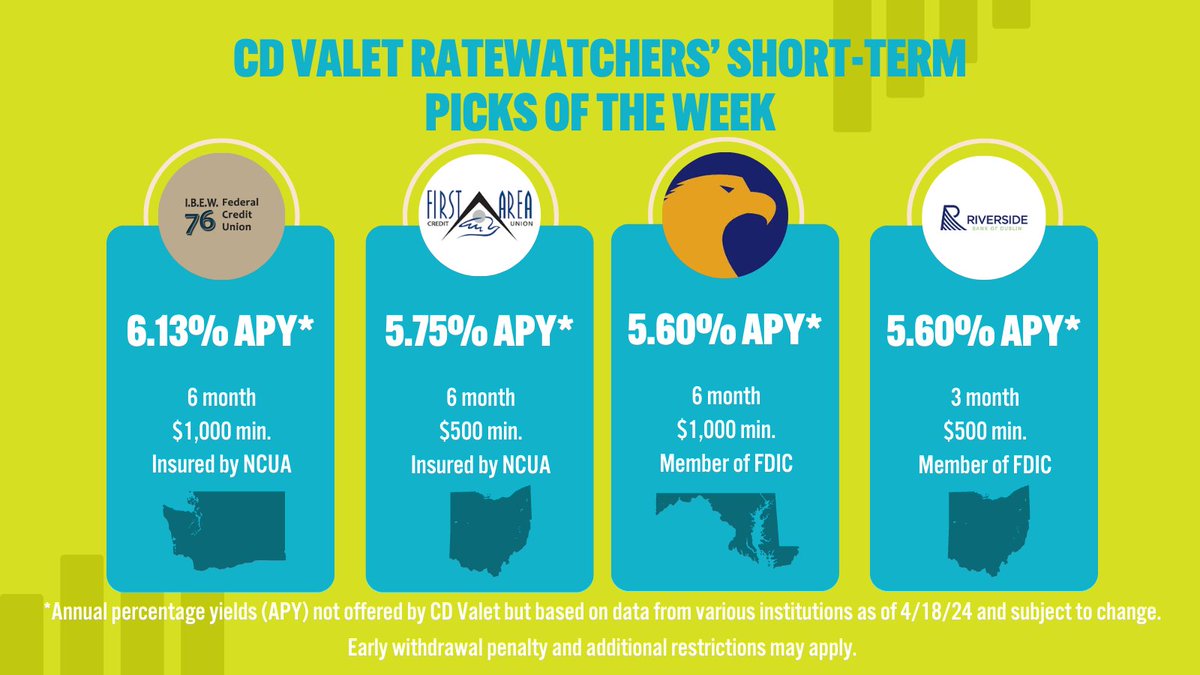

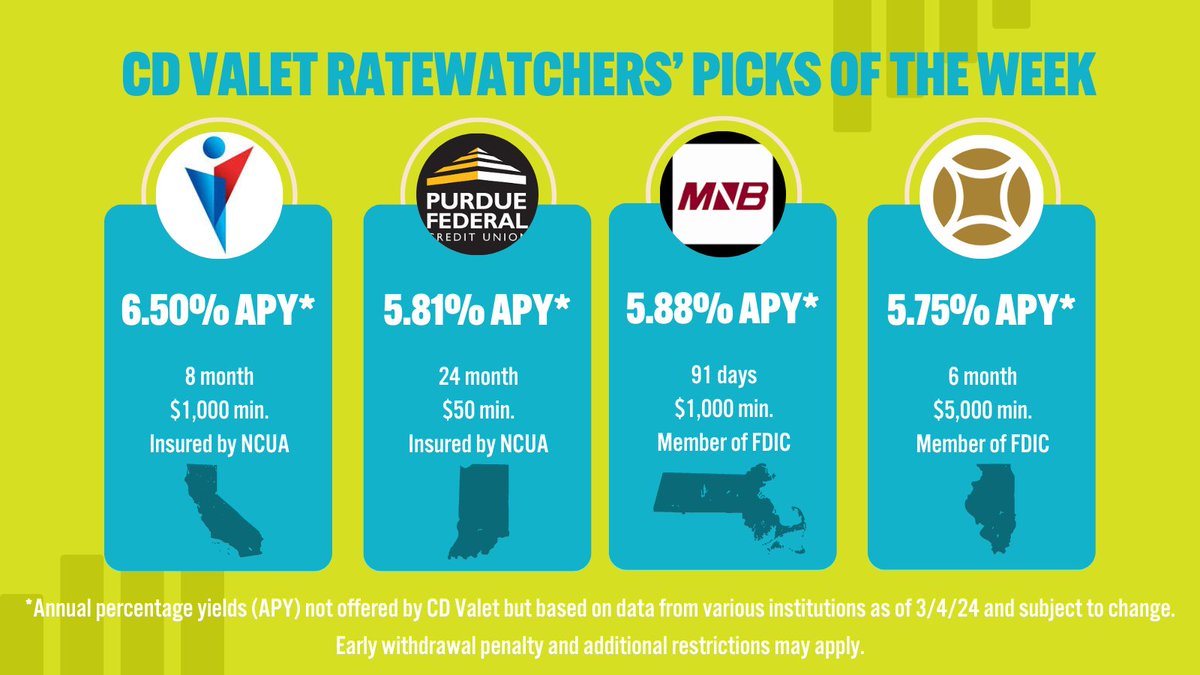

When to lock in a CD with a high rate continues to be a hot topic as these opportunities may be coming to an end soon. With rates well over 5.50% APY at many financial institutions, it’s time to snag a high-rate CD from the Ratewatcher’s Picks of the Week! Financial Partners Credit Union Purdue Federal Credit Union

Learn about the best practices to overcome obstacles & risks while staying relevant in a growing digital world. Join us at #FXT24 to bring the digital deposit landscape into focus: finxtech.com/event/experien… Finotta American Deposit Management Co. CD Valet Michelle King

Before the Federal Reserve hits the brakes on climbing rates, it may be time to think about grabbing one of 3,000 rates over 5%! Here’s our Ratewatcher’s Picks of the week... FFFCU of MD DEXSTA FCU #internationalbankofchicago Legacy Bank

With impending rate cuts on the horizon, MarketWatch talks to CD Valet's Bryan Johnson and fellow experts about what they predict is ahead for CDs in the coming month. ow.ly/a0uE50Qy2Ti

Are you afraid of a 5-year CD? How about a 2-year one? So many people are afraid to commit, even though all indications are that rates are slipping. My latest for @marketwatch, with thanks to Ken Tumin CD Valet TravisCreditUnion Jeremy Keil marketwatch.com/story/people-a…