Linda Giesecke

@LindaGiesecke

Energy analyst at Rapidan Energy, focused on oil markets

ID:2894854678

27-11-2014 16:43:17

69 Tweets

115 Followers

304 Following

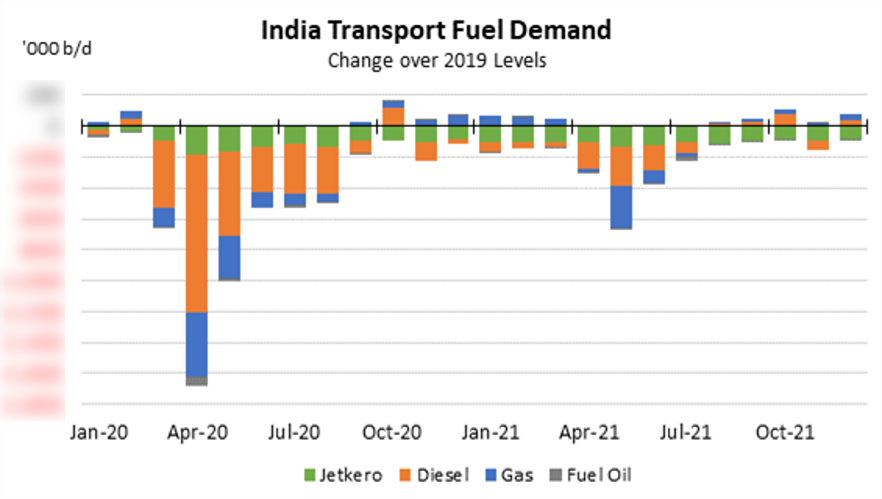

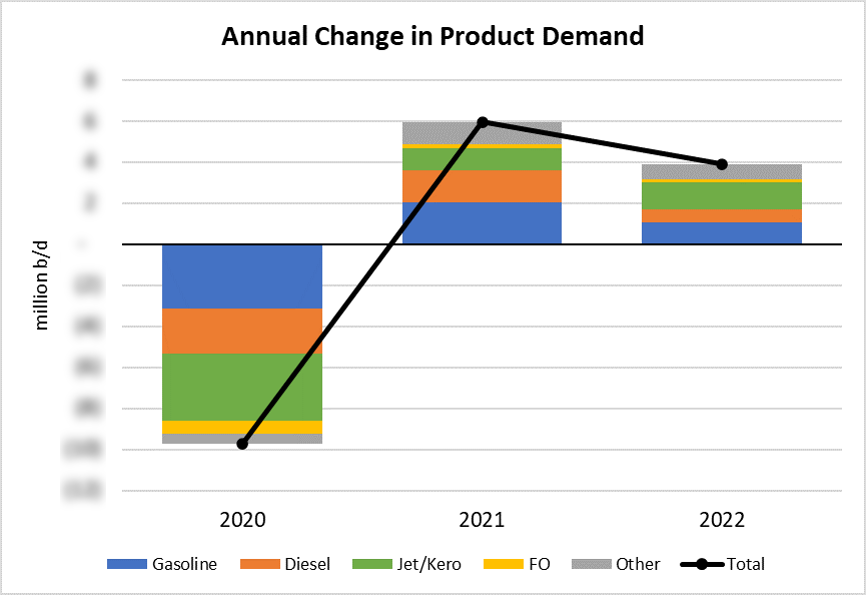

WEBINAR — WHAT’S UP WITH PRICES AT THE PUMP? Join ESAI Energy C.E.O. Sarah Emerson and the expert panel on May 26th as they discuss what’s driving prices at the pump and what we can expect next. Register here bakerinstitute.org/events/2315/ #gasprices #esai #fuelprice #bakerinstitute

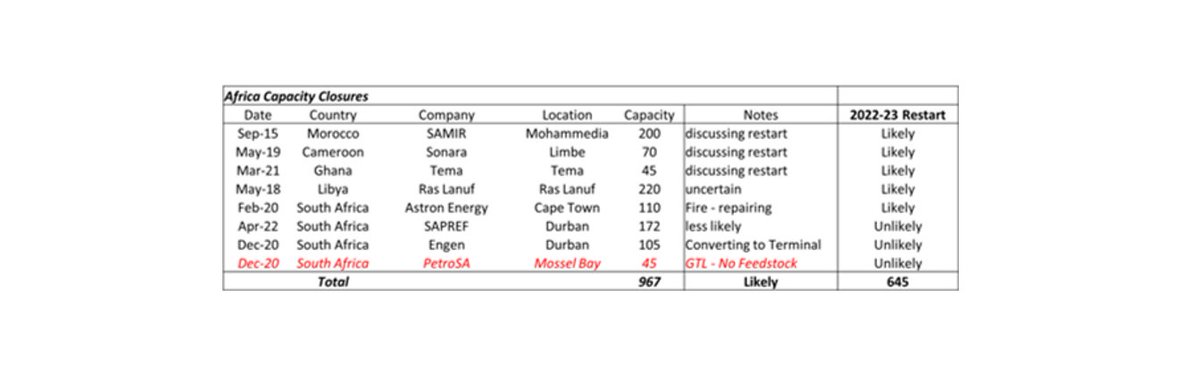

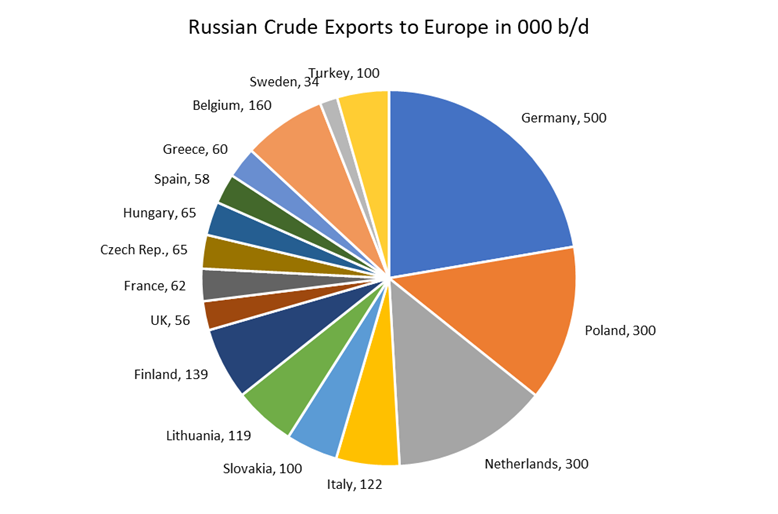

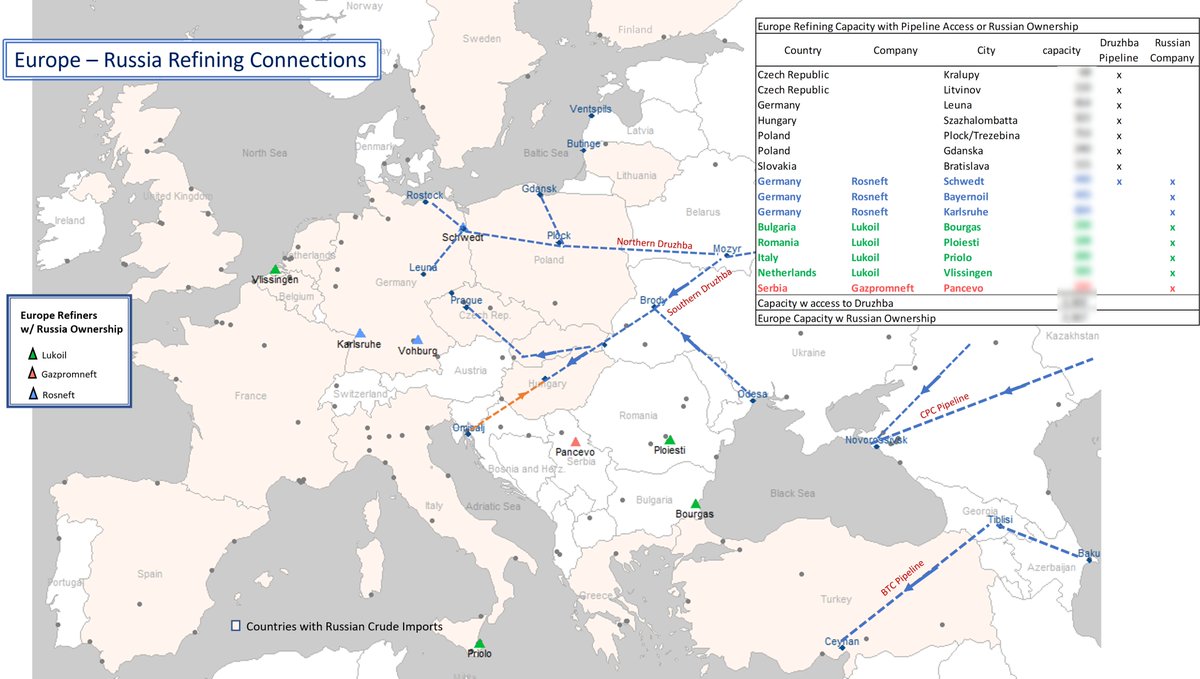

In the current situation, ESAI Energy expects refiners with access to the Druzhba pipeline and #European refineries with #Russian ownership to be less vulnerable to disruptions. #OOTT #RussiaUkraine #oilandgas

ESAI Energy's Sarah Emerson talked to Robinson Meyer from The Atlantic about the theories for why gas prices are so high. Trust us when we say that it's worth the read for our clients and others interested in gas prices! #OOTT #oilandgas #gasprices

theatlantic.com/science/archiv…

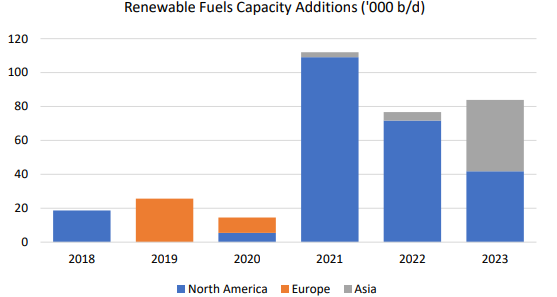

Refiners continue to announce projects to produce #renewablefuels . Investment in additional capacity continues to expand in the U.S., Europe and Asia. Various policy-driven premiums and #CarbonPricing mechanisms create incentives to shift to non-traditional feedstock. #OOTT

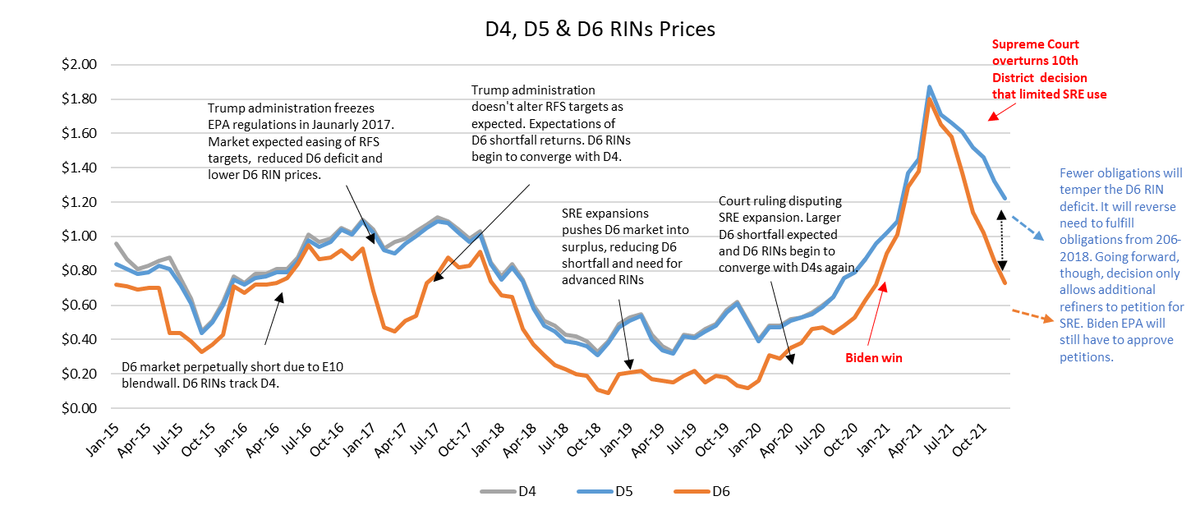

Happy to be quoted along with old friend Bob McNally and CSIS’s Ben Cahill #OOTT #SPR #RIN spglobal.com/platts/en/mark…