Song Ma

@ProfSongMa

Economist and Teacher, Finance and Entrepreneurship @YaleSOM @YaleSOMVentures @nberpubs

ID:68558810

http://songma.github.io 25-08-2009 00:35:34

690 Tweets

2,6K Followers

708 Following

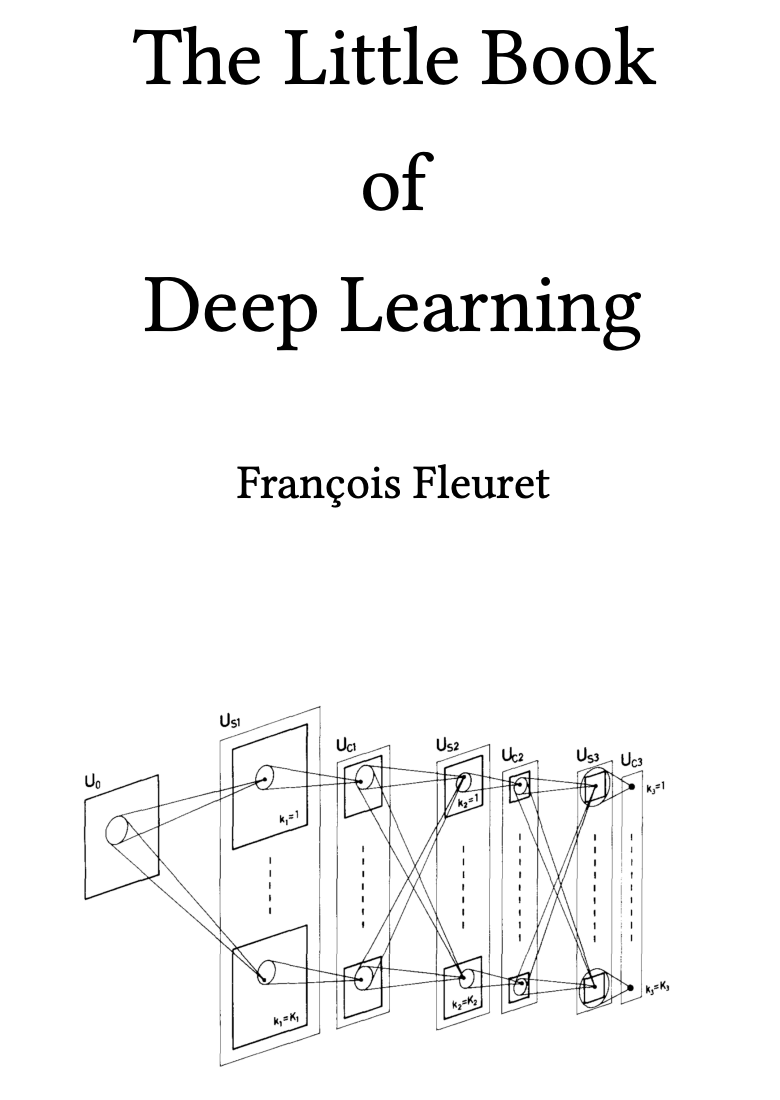

So I finished this beautifully written book by François Fleuret, highly recommend, like you wouldn't believe this, but if you know some statistics you can skim the whole thing and get a (obviously incomplete) very rough shape understanding of how all this works in like an hour

Announcing a short course! ifp.org/economics-of-i…

Pierre Azoulay (Pierre Azoulay)

Matt Clancy (@mattsclancy)

Janet Freilich

Ina Ganguli (@inaganguli)

Ben Jones (@bfjo)

Chad Jones (@ChadJonesEcon)

Kyle Myers (@KRoyMyers)

John Van Reenen (@johnvanreenen)

+ me (@heidilwilliams_)

Ellen Xiyue Li B-School Silvia Dalla Fontana USI University SFI Yingxiang Li UBC Sauder School Xiameng Hua UC San Diego Caroline Genc (@caroline_genc, Université Paris Dauphine - PSL) studies entrepreneurial and behavioral finance. Her JMP shows that past failure does not impact serial entrepreneurs' edge over 1st-timers. 🔗 carolinegenc.com

x.com/caroline_genc/…

Ellen Xiyue Li B-School Silvia Dalla Fontana USI University SFI Yingxiang Li UBC Sauder School Xiameng Hua (@XiamengHua, UC San Diego) studies contract theory and entrepreneurial finance. Her JMP applies matching and information theory to study the role of VC's reputation startup investment+hiring. 🔗 xiamenghua.com

x.com/XiamengHua/sta…

Ellen Xiyue Li B-School Silvia Dalla Fontana USI University SFI Yingxiang Li (@YingxiangLi, UBC Sauder School) studies financial intermediation, PE, and entrepreneurial finance. His JMP investigates the implications of heterogeneous investors on investment and returns in PE markets. 🔗 yingxiang-li.com

x.com/YingxiangLi/st…

Ellen Xiyue Li B-School Silvia Dalla Fontana (@silviadieffe USI University SFI) studies entrepreneurial finance. Her JMP explores VCs' specialization as a potential mechanism for the recent decline in non-software investments. 🔗 silviadallafontana.com

x.com/silviadieffe/s…

Ellen Xiyue Li (@UBCSauder) studies entrepreneurial finance and corporate innovation. Her JMP shows startups may strategically select projects to align with potential VC expertise to lower information frictions. 🔗ellenxiyueli.com

x.com/EllenXiyueLi/s…

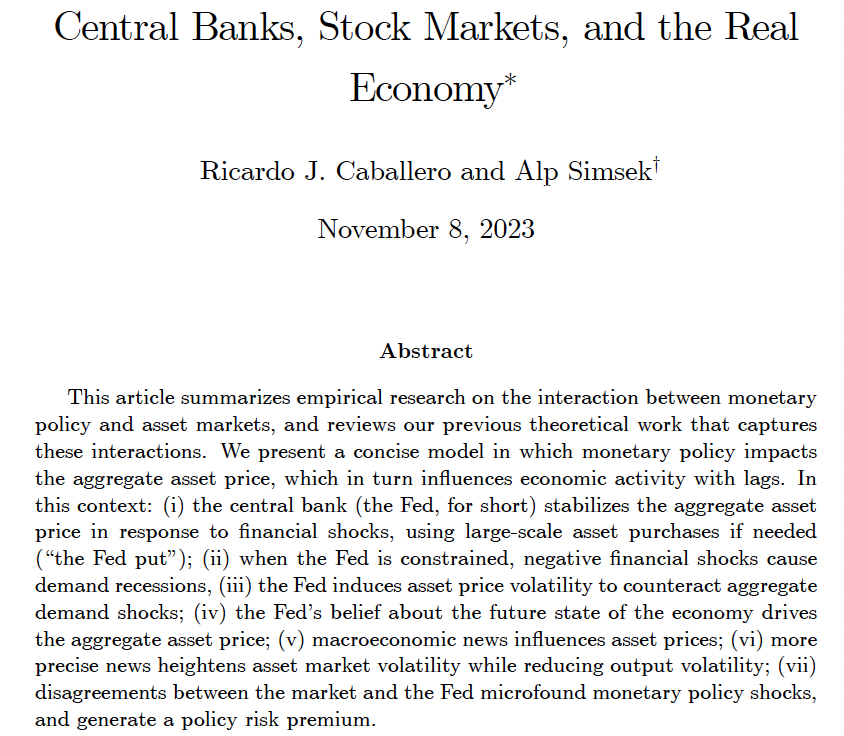

Ricardo Caballero and I have written a review article on interactions between central banks and stock markets for the Annual Review of Financial Economics

Review of the evidence and our previous theoretical work capturing these interactions

Annual Reviews

dropbox.com/scl/fi/h1z978n…

Congratulations to all the awardees, and particularly my dear coauthor and friend Ernest Liu, well deserved!

A year ago, I posted some images that I created with DALLE 2 to illustrate some of my research papers.

I recently began playing around with DALLE 3… and it blew my mind. Thus, I decided to do a part 2.

My favorite creations below 👇

#EconTwitter

'Financially constrained firms tend to front-load their revenue by selling data, which can have negative consequences for consumers in the long run.'

More from Ernest Liu, Song Ma, and Laura Veldkamp: bit.ly/3ZTf3ip