Vincent

@RockyBTrades

Options and Commodities Trader | Trading Education | NFA | #RockyRecap 🥊| Featured in the @WSJ. Message for 1v1’s / Mentorship.

ID:2239278468

https://linktr.ee/rockybtrades 10-12-2013 14:44:33

22,5K Tweets

31,0K Followers

322 Following

Follow People

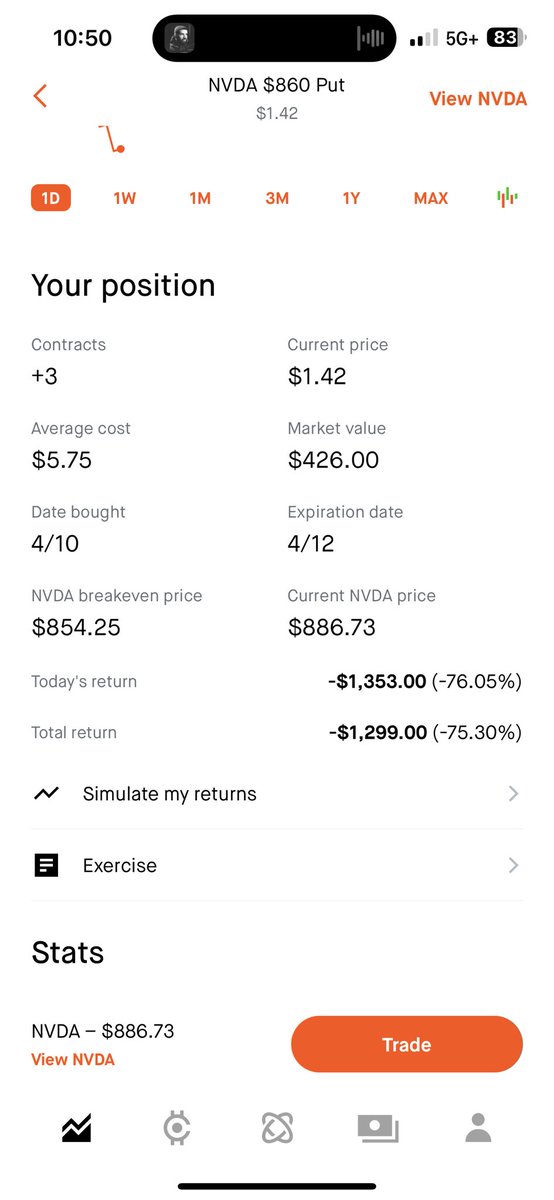

S/O to my Dad on his $NVDA

$900-$910 call debit spread

The spread is up 225%

1.00 to 3.25

I went short thinking $NVDA would sell off a PT upgrade and I was wrong

I took my loss, but happy to see my Dad find a good r:r #OptionsSelling trade

My friend told me there’s this new scammer

Vincent PRIVATE 𝕏

Everyone please report this virgin

Thank you, that’s not me and I’m definitely not discussing crypto