David Smith

@dsmitheconomics

David Smith is economics editor of The Sunday Times. His website is https://t.co/9Gs503sy0H. His latest book is Something Will Turn Up.

ID:112150907

http://www.economicsuk.com 07-02-2010 12:12:06

27,5K Tweets

40,1K Followers

470 Following

I hate to be pedantic (and no doubt this will mean I'll be labelled as one of those doomsters Kemi Badenoch is calling out here) but there's a few problems with the data the biz/trade sec is quoting here.

When you correct them, the picture looks a little different...

🧵

Very good analysis from David Smith pointing that strong growth in UK services may keep inflation problematic for longer- in The Sunday The Times and The Sunday Times

thetimes.co.uk/article/306fb7…

Belle Tout Lighthouse, Eric Ravilious, 1939. The lighthouse is located overlooking Beachy Head in East #Sussex on the South Downs Way. The original Ravilious artwork was sold at Christie's in 2015 and I believe it is now in a private collection.

It is hard to imagine though that in the absence of the election, Hunt would be in such a rush to cut taxes.

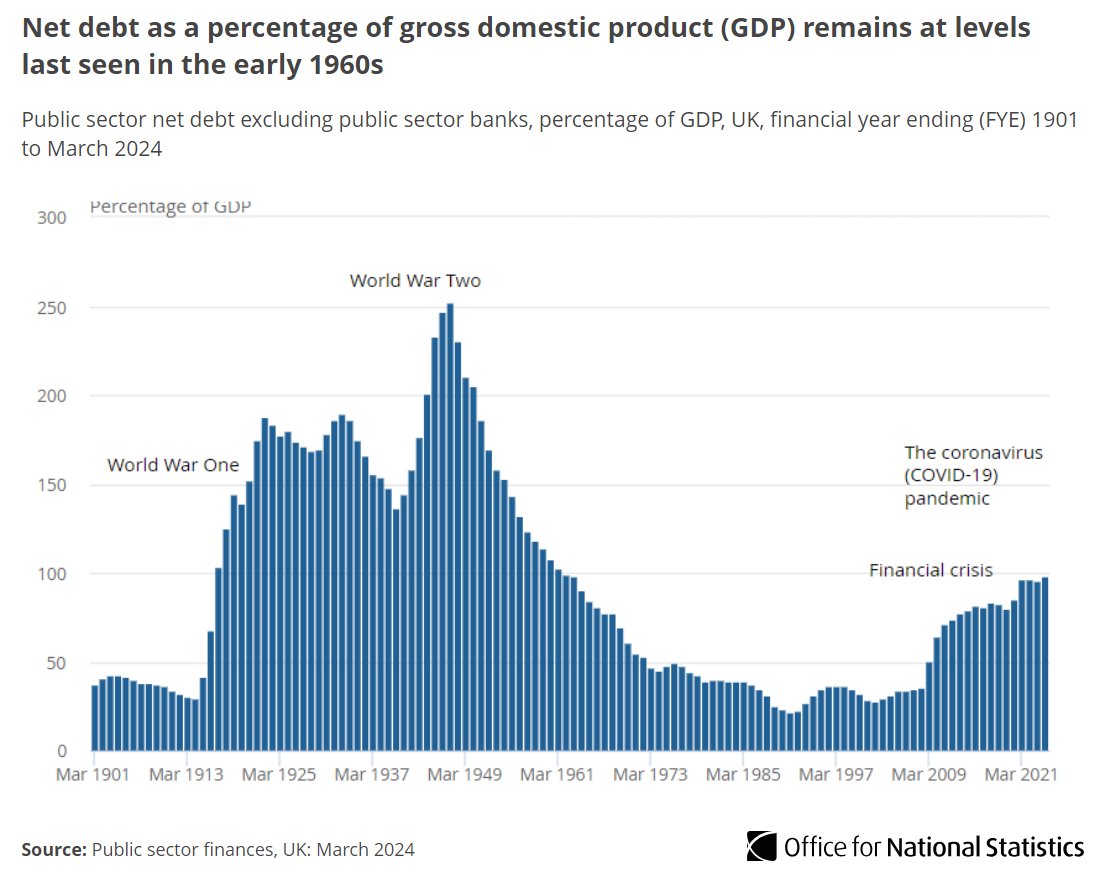

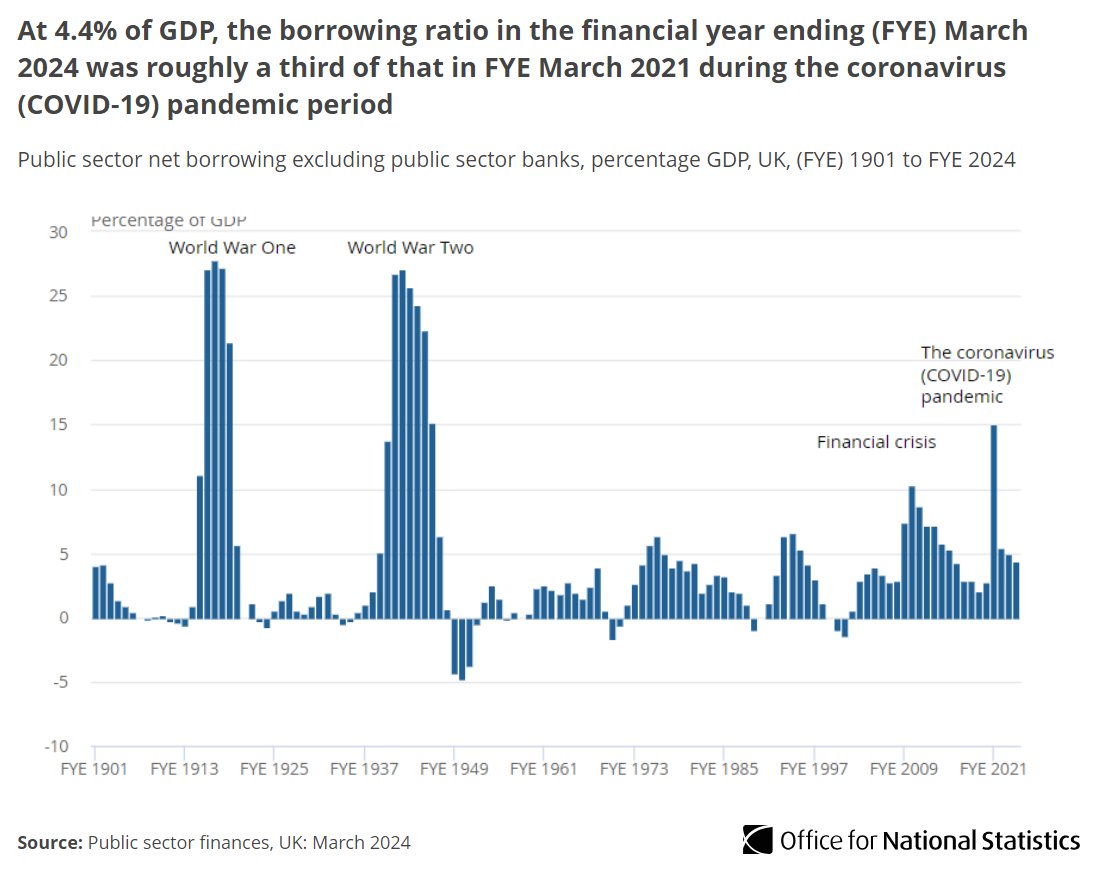

Public borrowing in 2023-24, £120.7bn, 4.4% of GDP, was £6.6bn higher than OBR’s latest forecast.

(£)thetimes.co.uk/article/electi…

By David Smith

A timely article by David Smith given this is exactly what’s happening with yesterday’s announcement on defence spending increases as well as earlier tax cut announcements ahead of the election

A ‘soft landing’ for the economy looks harder to achieve: Central banks have been striving to tame inflation without killing growth. But new economic figures, and rising geopolitical tensions, suggest that struggle is far from over thetimes.co.uk/article/the-so… via David Smith