Eric Nuttall

@ericnuttall

Father of 3, husband, & energy investor. Proponent of the Canadian energy patch & occasional market commentator. https://t.co/WVA6oG8CCO

ID:49939647

https://www.ninepoint.com/funds/ninepoint-energy-fund/ 23-06-2009 10:18:21

3,0K Tweets

91,7K Followers

397 Following

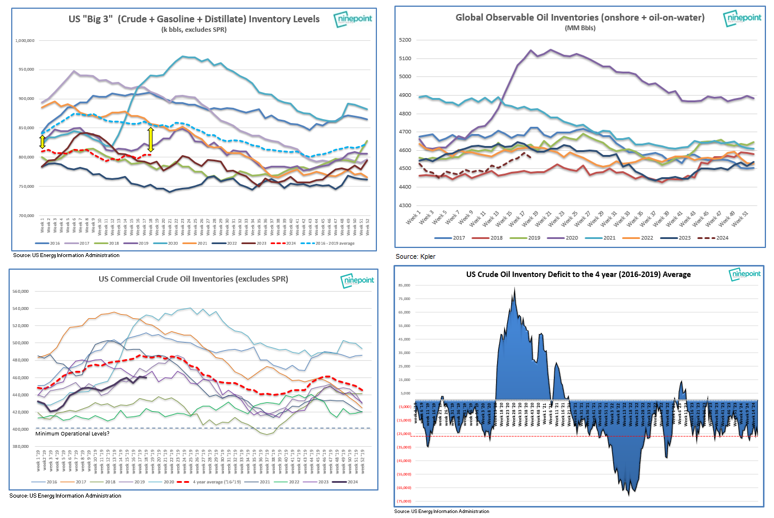

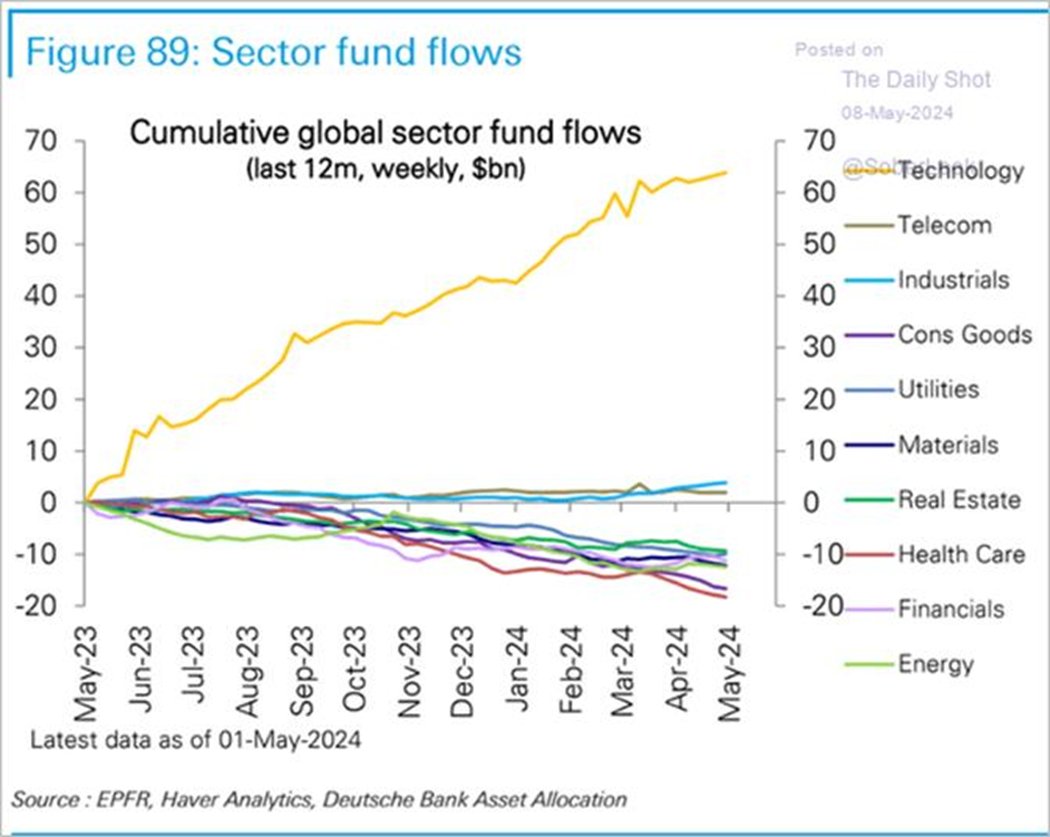

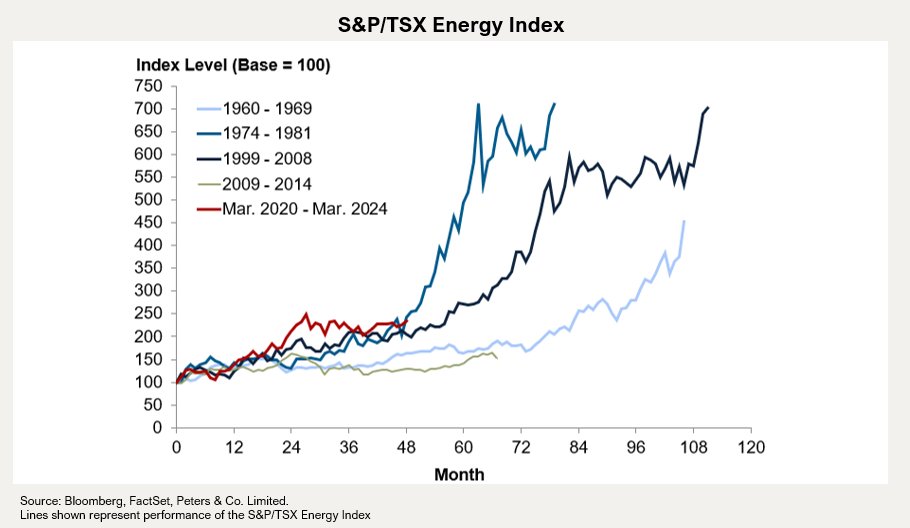

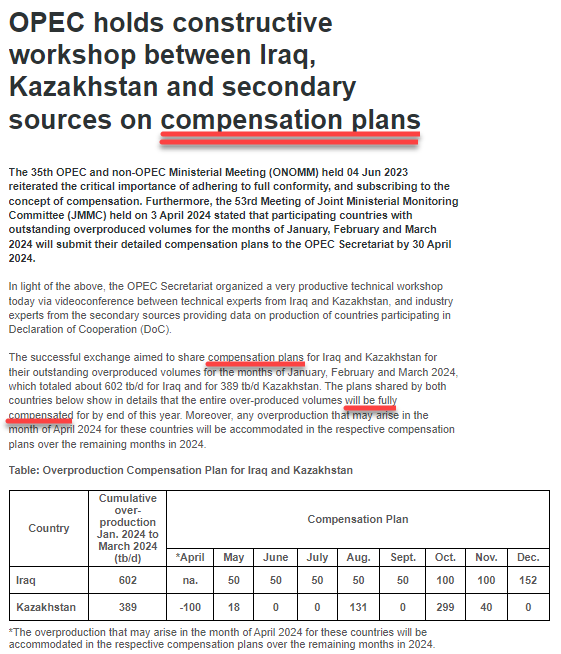

Another Market Call in the books with the focus on the value in long-dated inventory, why we have become medium/long-term bullish on natural gas, and where we continue to find opportunities...we remain bullish!

bnnbloomberg.ca/market-call/fu…