Ben Laidler

@laidler_ben

Data, perspective, morning analysis. Global markets strategist @eToro, via HSBC, JPM, UBS and 3 continents...Making astrology look respectable! 🚀🌍 Not advice.

ID:1450791456977956870

20-10-2021 11:50:50

828 Tweets

1,9K Followers

256 Following

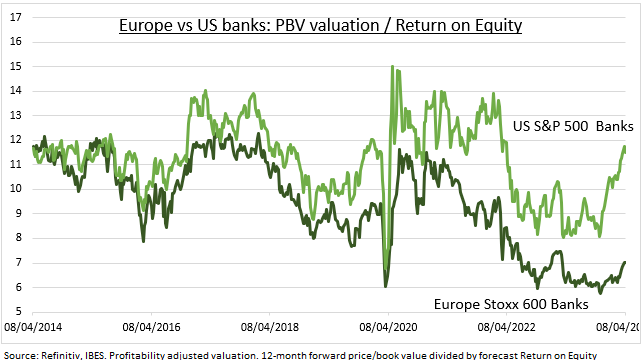

Thoughts on why not to fear the sell-off, tech's big guns to the rescue, and the case for Europe. Starts at '3:55. Thanks to Jonathan Ferro Lisa Abramowicz annmarie hordern eToro Bloomberg Surveillance 04/25/2024 bloomberg.com/news/videos/20…

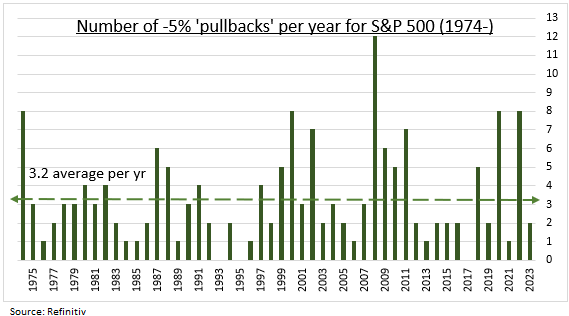

Four reasons why investors should take a deep breadth when considering this market sell-off. A pullback was overdue. GDP growth is fine. Inflation a worry but tomorrow's PCE report the key. And 80% earnings reports beaten so far. Thanks to Brad Smith Yahoo Finance