Sonu Varghese

@sonusvarghese

Musings on investing, the economy & all else. VP, Global Macro Strategist, @CarsonGroupLLC Advisory services through CWM, LLC, Registered Investment Advisor.

ID:247006547

03-02-2011 22:20:19

9,3K Tweets

6,7K Followers

1,2K Following

Our latest Carson Investment Research Facts vs Feelings podcast is out!

This week, Sonu Varghese and I discussed:

* Staying in May vs selling

* The economy is just fine

* Why inflation likely improves over the coming quarters and more.

youtu.be/NlReoOdLPNE?si…

Buy in May and Stay? At Least in an Election Year

I take a look at why you shouldn't go away the next six months in our latest Carson Investment Research blog.

carsongroup.com/insights/blog/…

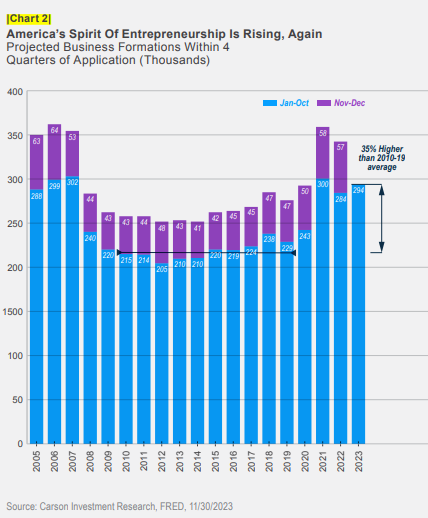

Business dynamism is increasing 👇

Also part of the productivity story, as we highlighted in our 2024 outlook

Carson Investment Research Ryan Detrick, CMT

carsongroup.com/economic-outlo…

One of my favorite charts from Sonu Varghese.

Inflation might be higher than anyone wants, but disposable income and employee compensation are both still growing faster.

We've been showing this for 15 months now as a reason there wouldn't be a recession.

The Q1 GDP report masked underlying strength.

Cyclical investment is rebounding 👍

But don’t discount the fact the consumer remains strong 🙌

More in my new blog 👇

Sign up there for our weekly newsletter Carson Investment Research Ryan Detrick, CMT

carsongroup.com/insights/blog/…

Be sure to listen to 15 Minutes to the Bell with Carson Investment Research.

Sonu Varghese and I covered a ton of ground, breaking down the economic data this wk, along with the bounce in stocks.

Also, we were joined by Joe Bell, CFA, CMT, CFP® of Meeder. I'm a big fan of Joe.

Contrary to popular belief, it turns out stocks can go down!

Sonu Varghese and I discussed this in our latest Carson Investment Research Take Five.

youtu.be/Q-wsO3eAkbA?si…

Inflation was hot in Q1, but incomes outpaced!

Disposable income: +4.8% (annualized)

Employee compensation: +7.3%

PCE: +4.4%

DPI pulled down by income from assets (interest/dividends)

No wonder real consumption is above trend, esp. services!

Ryan Detrick, CMT Carson Investment Research

TGIF

Be sure to join Sonu Varghese and I tomorrow before the Opening Bell, as we break down the week that was and what to watch for next week.

Sign up here.

x.com/i/spaces/1ypKd…

Inflation ran hot in Q1 😓

Headline PCE: 3.1%

Core: 3.7%

Also means nominal GDP ran hot (and that's directly related to profit growth)

Q1: +4.8%

2010-'19: +4%

Inflationary growth is why we have managed futures with equity overweight.

Ryan Detrick, CMT

carsongroup.com/insights/blog/…

4/

Our latest Facts vs Feelings podcast is out!

This week, Sonu Varghese and I discuss:

* Why this won't turn into a 10% correction

* Why real rates suggest the economy is stronger and worries about inflation are overblown

* How Sonu can't book a hotel

youtu.be/m9l8mu98-vw?si…