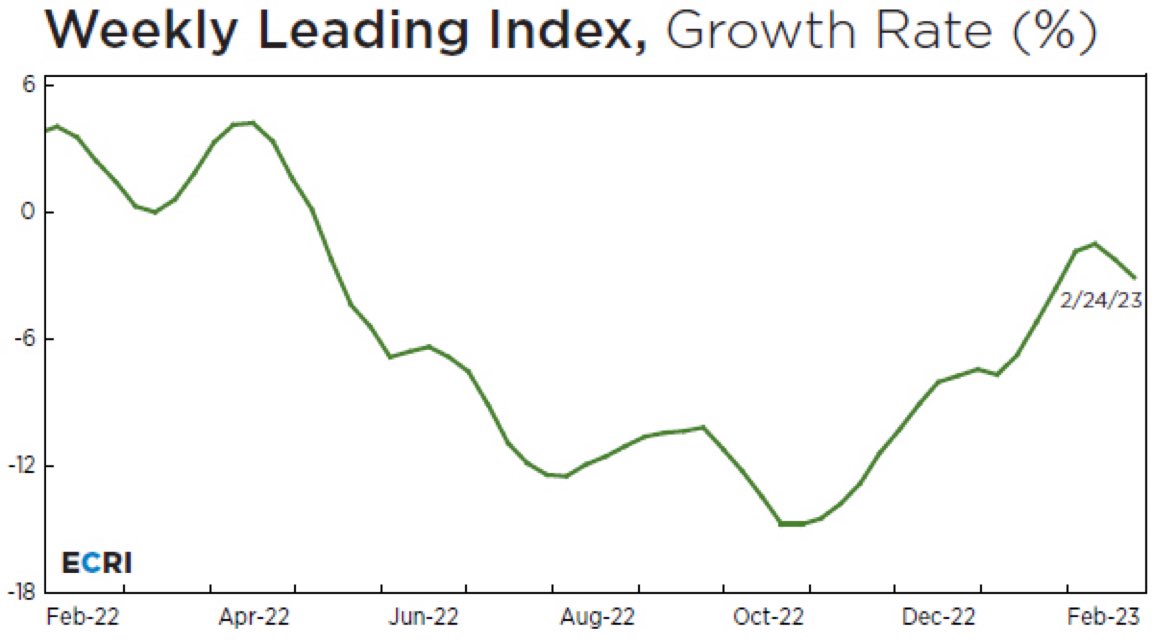

Proceed with caution? Despite the downward trend in inflation, Economic Cycle Research Institute (ECRI)'s Lakshman Achuthan warns we could see upside surprises next year making it difficult for the Fed to cut rates.

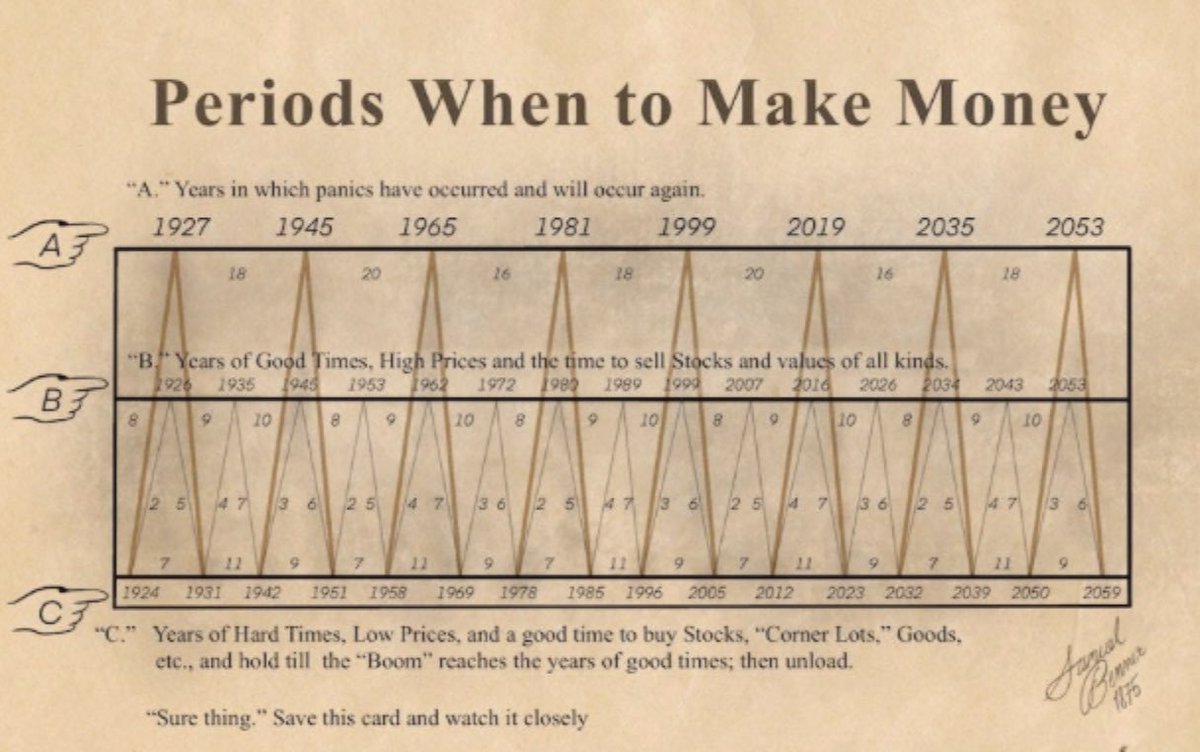

This chart, with a history spanning a CENTURY, has accurately forecasted nearly all significant financial ups and downs over the past 100 years. #businesscycle

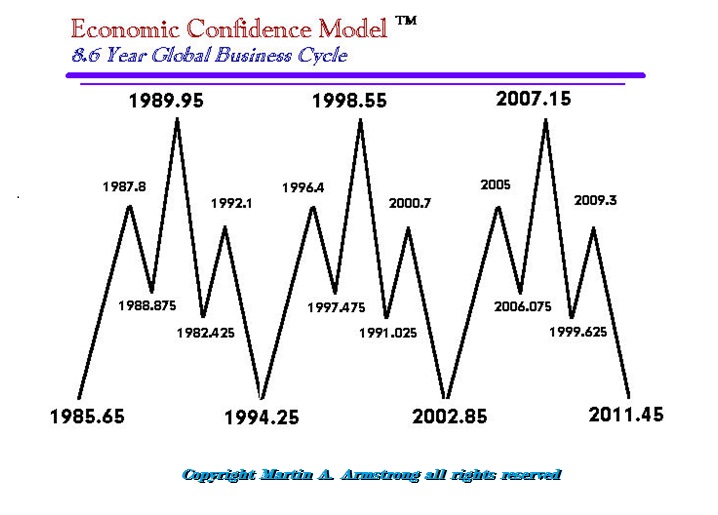

📌 Global Business Cycle by Martin A. Armstrong 📌

#cycles #businesscycle #marketcycles #GANN #timeforecasting #priceandtime #numbers

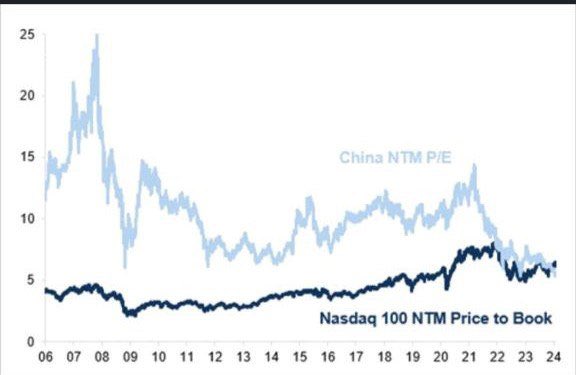

Nasdaq's price-to-BOOK ratio has surpassed Chinese stocks' price-to-EARNINGS multiple. While AI is set to revolutionize the world, economic cycles and inflated valuations remain inevitable. 🔄📊 #StockMarket #Valuations #BusinessCycles

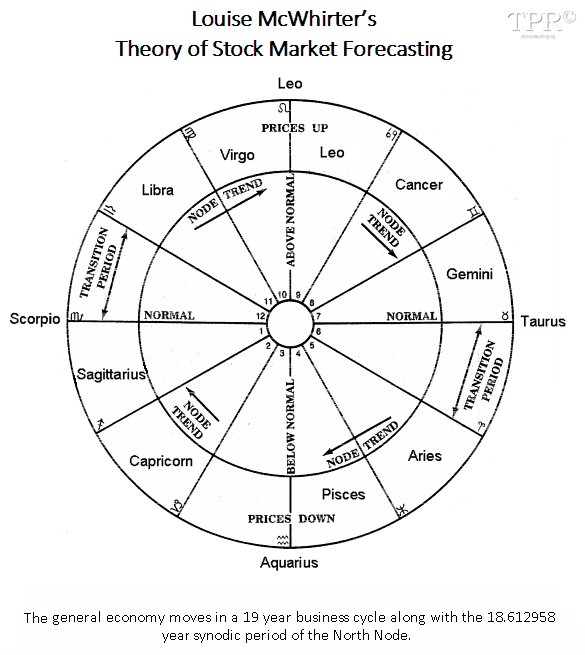

📌Louise McWhirter's North Node Cycle for the Financial Markets📌

This is a very important cycle to understand the economic activity cycle in the world. See what happens every 18.6 years.

#cycles #timecycles #GANN #businesscycles #astrology #financialastrology #Ganncycles

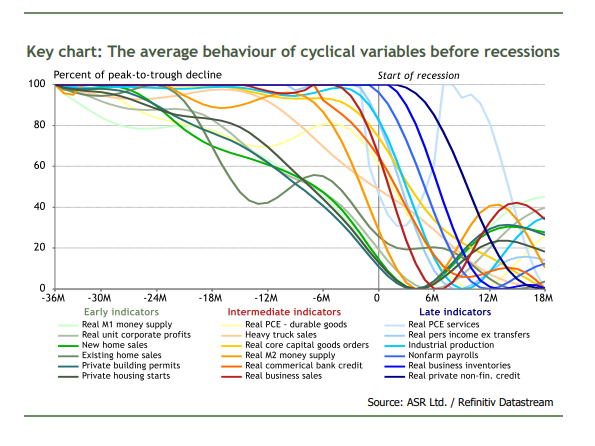

Our latest #Economics note was recently published: 'A roadmap for recession'

The ‘long and variable lags’ aren’t really behaving unusually.

#macroeconomics #businesscycle #monetarypolicy #recession #economy #research

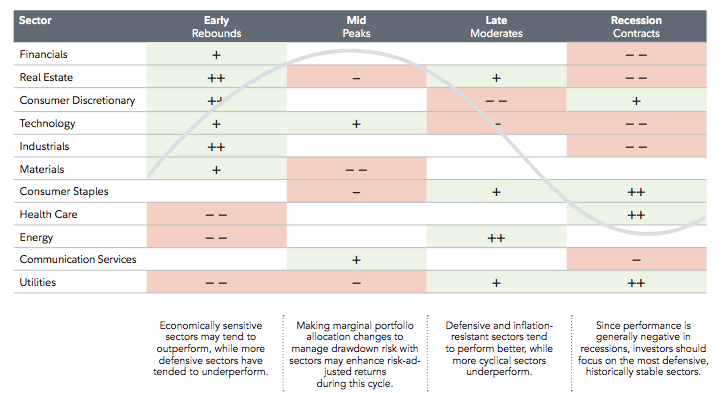

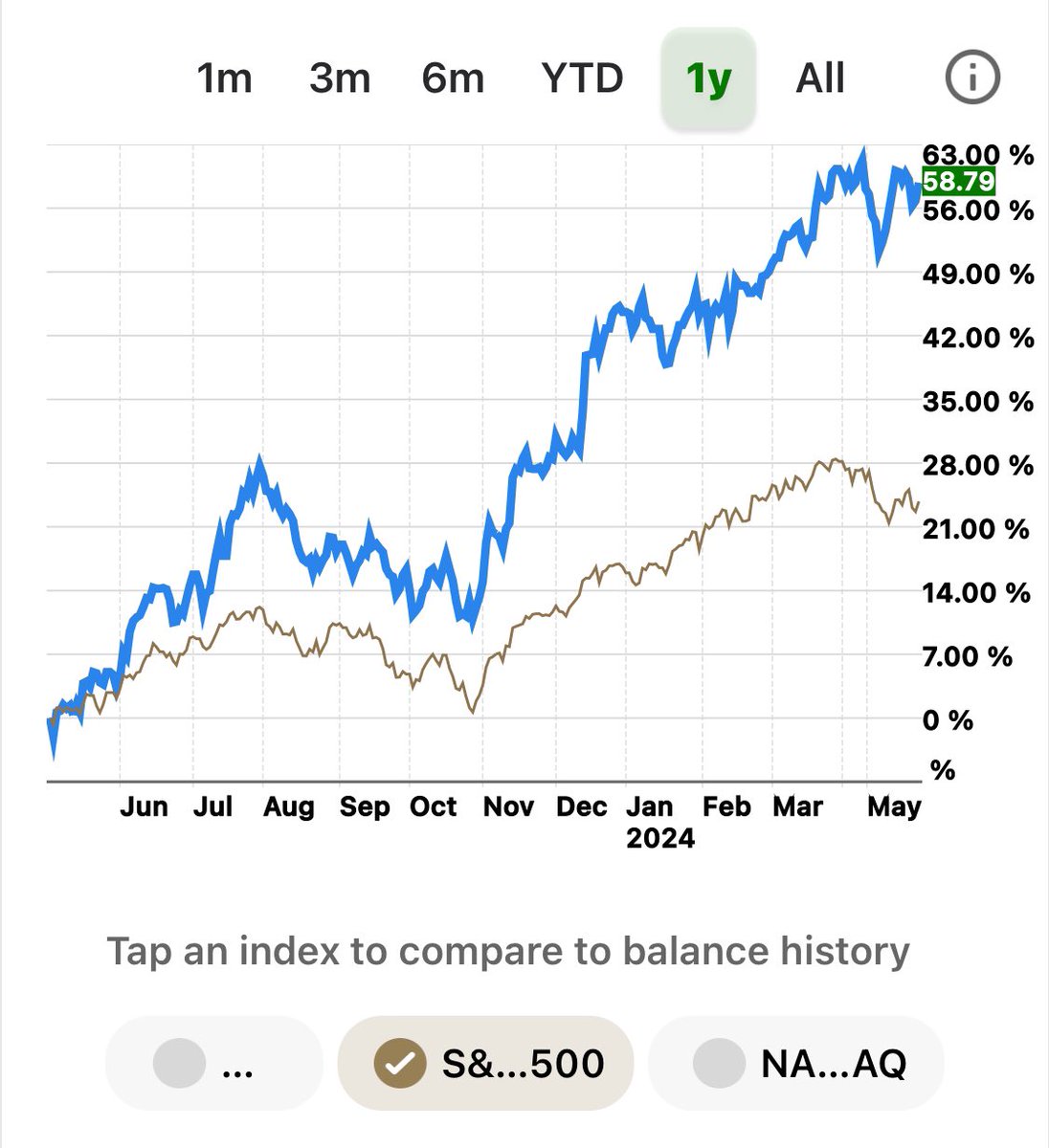

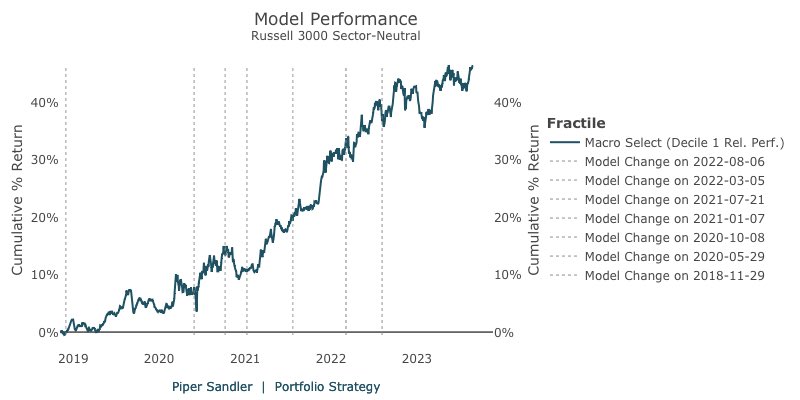

New high in our “Macro Select” model. Stock pickers can invest in macro through factor investing, with an understanding of what investors chase/avoid during different phases of the #businesscycle . Factors are just another label like sectors, but with fundamental commonalities.

Despite rising rates, inflation pressures remain, and will cause rates to continue to move higher! The CRB index has also moved higher, confirming inflationary pressures.

The business cycle is ongoing and is set to peak in 2024. 📈

#inflation #businesscycle

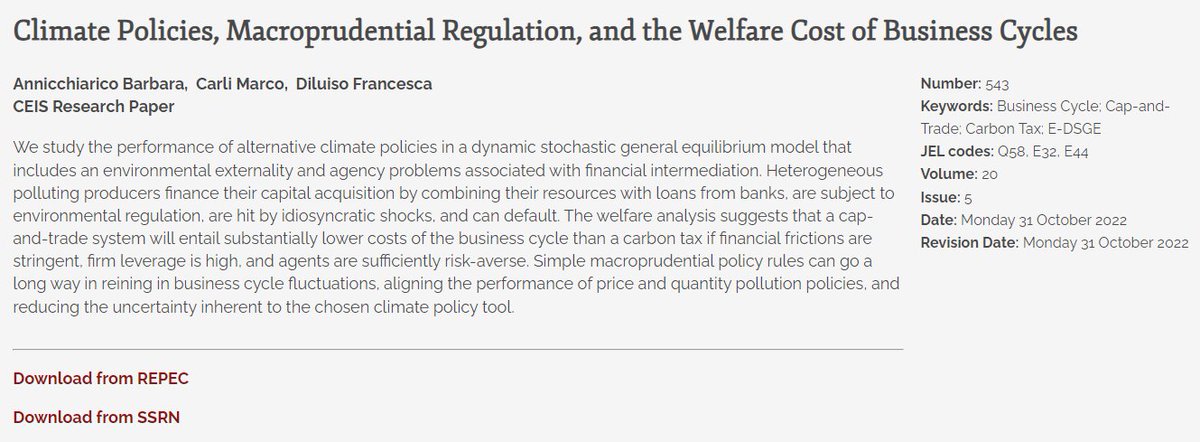

Climate Policies, Macroprudential Regulation, and the Welfare Cost of Business Cycles bit.ly/3RreDMk Barbara Annicchiarico MCarli Francesca Diluiso #BusinessCycle #CapAndTrade #CarbonTax #E_DSGE SSRN RePEc @EconTwitter DEF Tor Vergata Economia Tor Vergata Università di Roma Tor Vergata Uffstampa_RomaTorVergata

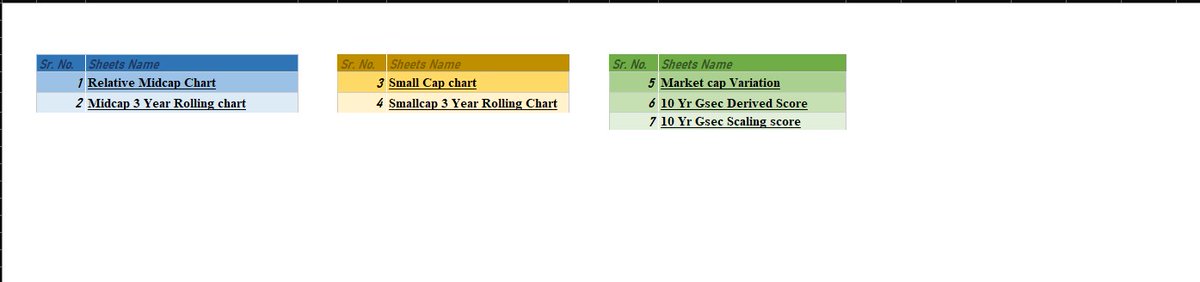

#nifty50 #valuation #businesscycle #suballocation

Algo for Category selection based on Valuation and Business cycle.

&

Sub allocation cycle between Equity :- Large , Mid & Small cap Fund + Long term/Short Term debt fund.

Find below the snapshot of link, each workbook carries.

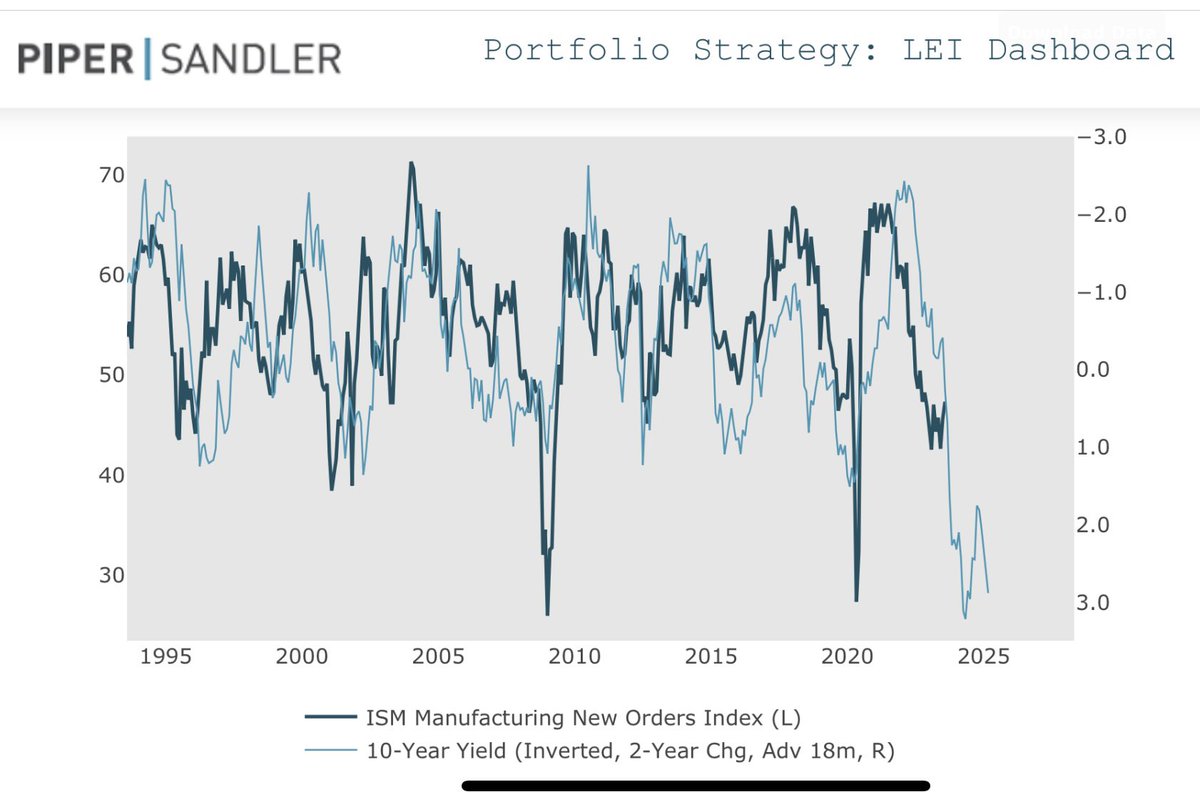

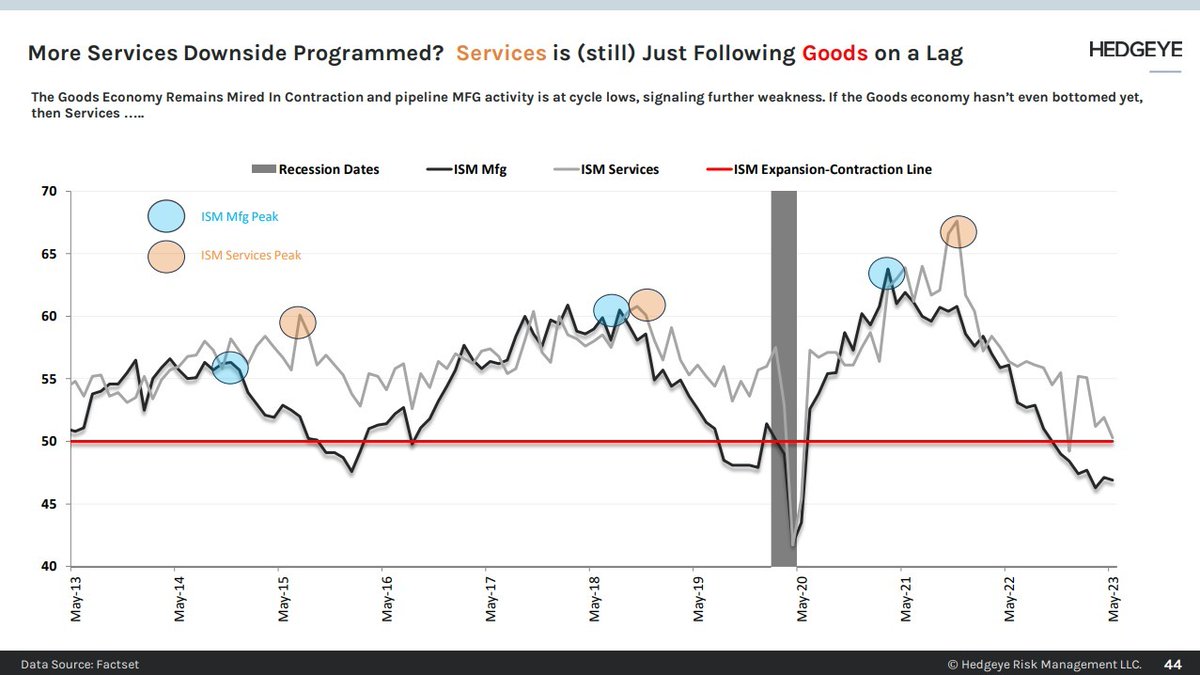

Kayfabe Keith McCullough Economic Cycle Research Institute (ECRI) Here is a chart from Hedgeye from a few weeks back: we have had 2 instances since 2013 of Mfg going into an extended decline but no corresponding Services contraction or Recession. In 2020, Mfg bottomed and then bounced back to above 50, before Covid crushed everything.

Is 2024 the year to buy a home or avoid at all cost? Daniela Cambone-Taub talks with Lakshman Achuthan from Economic Cycle Research Institute (ECRI)

Watch Now 👉🏼

youtu.be/ZLstStjqMls

#Housing #USD #economy

Housing Is Set To Crash (Maybe) With Lakshman Achuthan dlvr.it/SlKSVX | Lead Lag Report Michael A. Gayed, CFA Economic Cycle Research Institute (ECRI) #MichaelGayed #HousingMarket #LakshmanAchuthan #Market #HomeValues #Leadlagreport