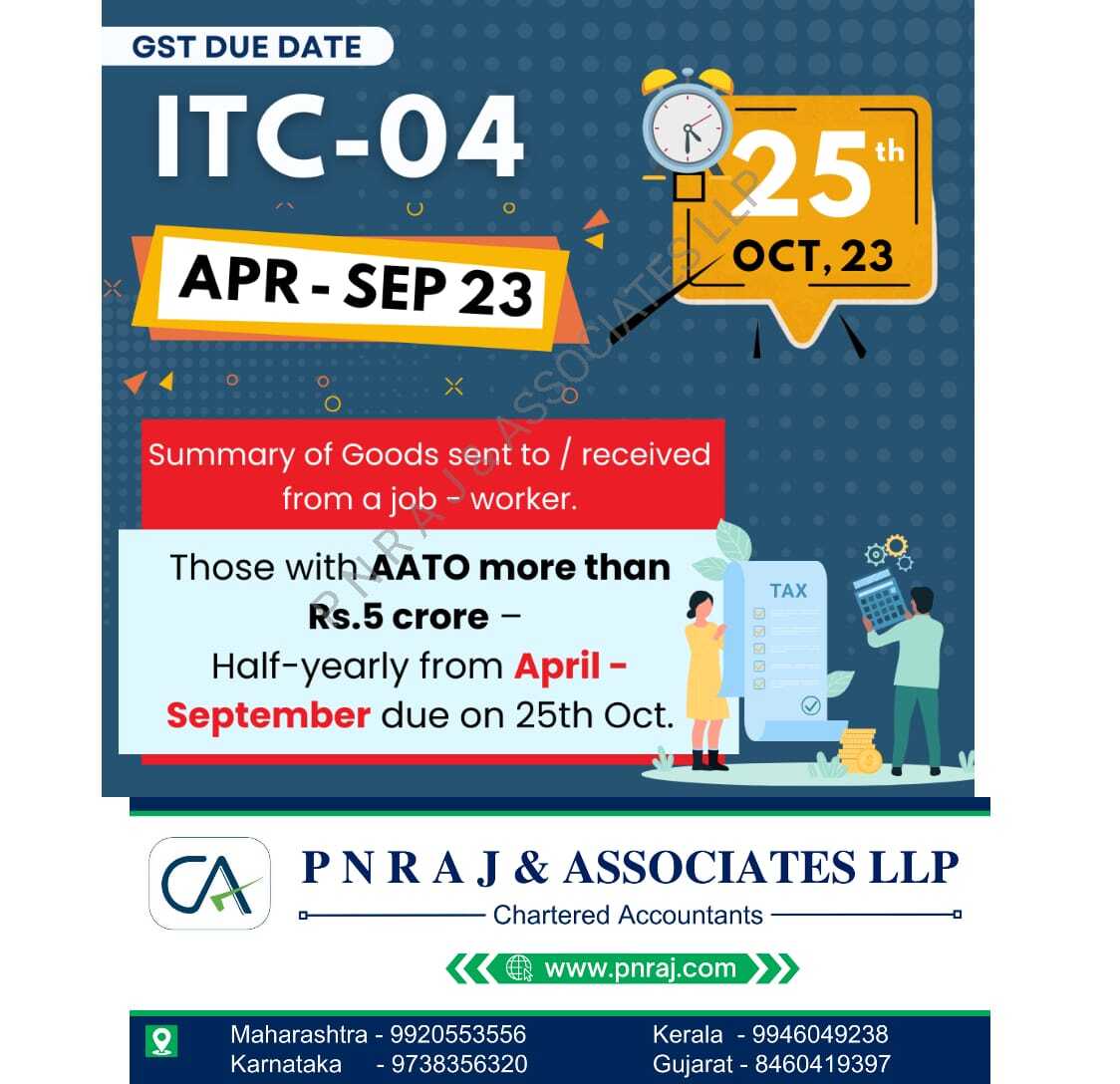

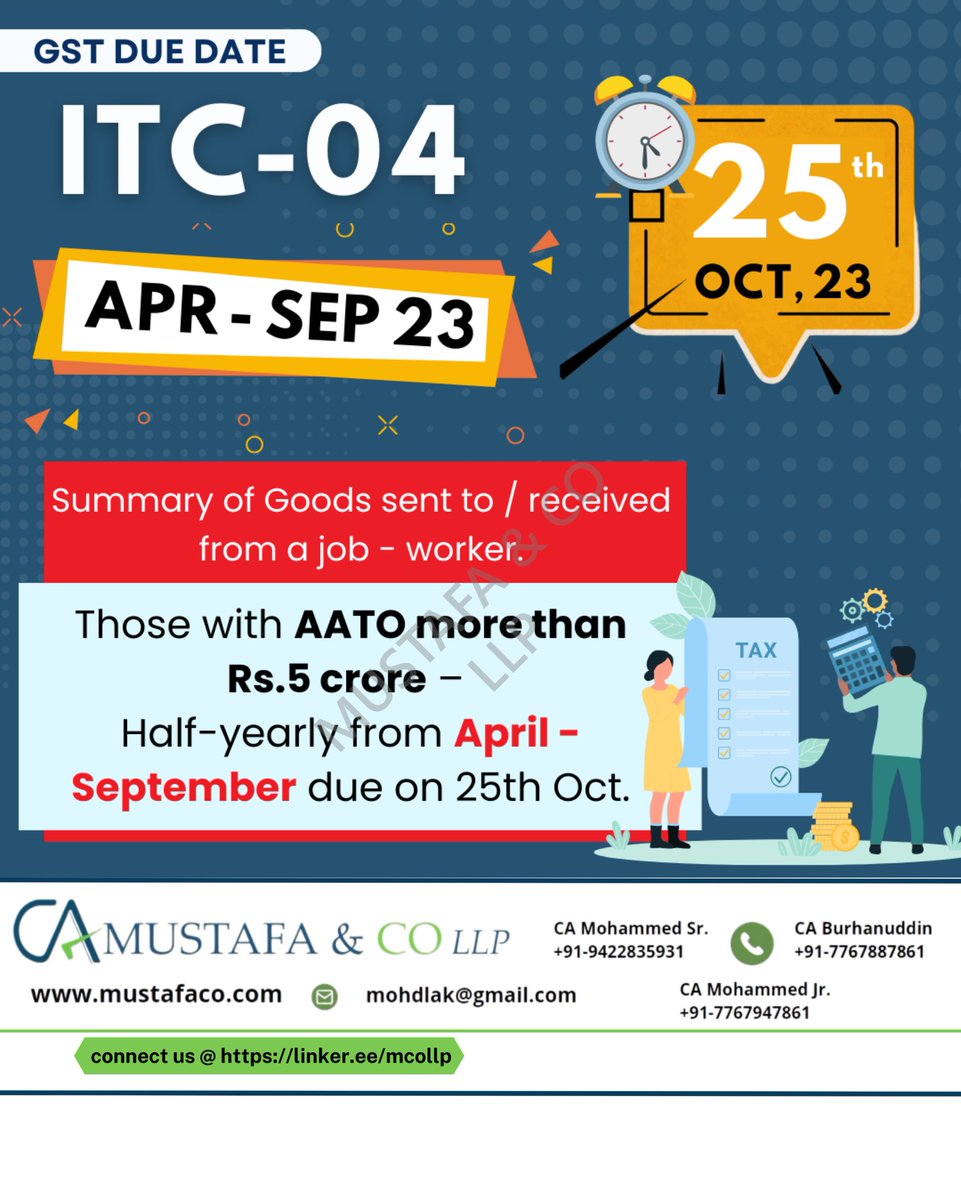

Summary of Goods sent to / received from a job - worker (1) Those with AATO more than Rs.5 crore - Half-yearly from April - September due on 25th Oct.

ITC-04 #GSTITC04 #GSTCompliance #ITC04Filing #GSTReturns #InputTaxCredit #GSTUpdates #GSTInvoices #TaxCompliance #GSTCouncil

GST DUE DATE

For ITC-04 Apr-Sept 23

#GSTITC04 #GSTCompliance #ITC04Filing #GSTReturns #InputTaxCredit #GSTUpdates #GSTInvoices #TaxCompliance #GSTCouncil #BusinessTaxation

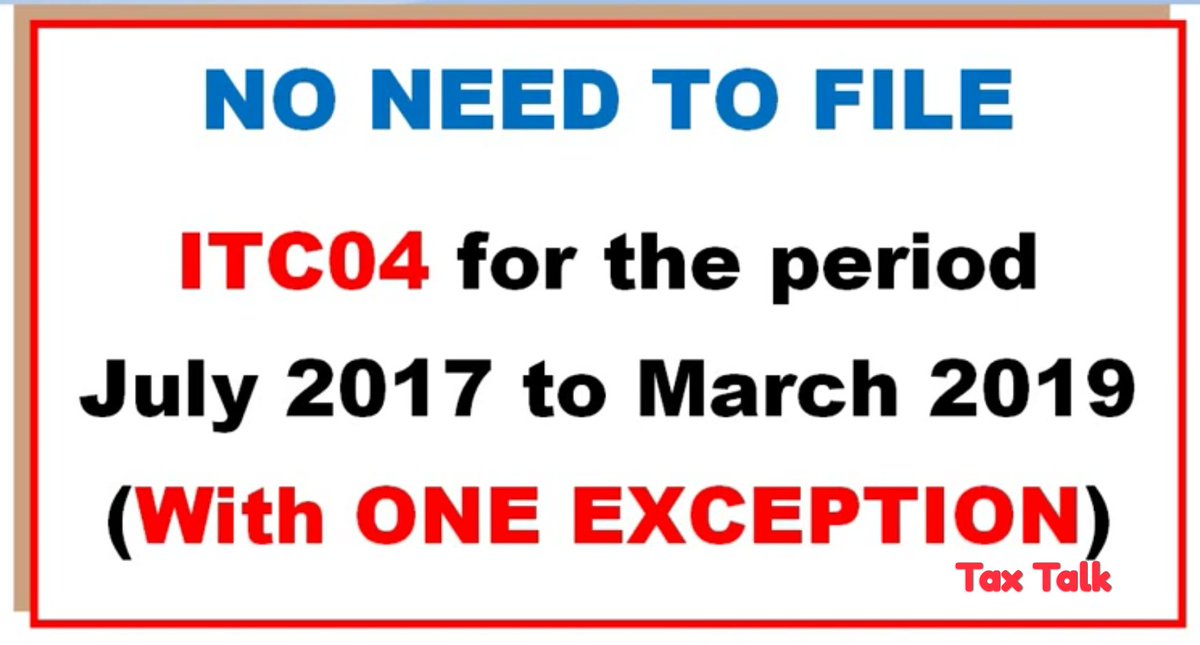

#gstITC04 #waivedoff #july2017toMarch2019 #ONEexception

#table4 #learn #stepbystep #newform

#GoodssenttoJobworker : NO NEED TO FILE Form GST ITC04 for July 2017 to March 2019 With ONE EXCEPTION facebook.com/82334456802594…

youtu.be/oe1BhPktK9Q

Finance and Taxation We have some pending goods of challan of September which are received in October after job work . When we are entering these challan in GSTITC04 received back in the column original challan date, the date of September is not accepting .