Recent US CPI data indicates a rise in inflation, sparking concerns of prolonged higher interest rates due to economic resilience and sticky inflation. Australia's elevated CPI remains flat for three months. #Inflation #InterestRates #Economy #US #Australia #FinancialNews

The #Fed boards preferred mode of transport for tonghts meeting

#FOMC #InterestRates #Higherforlonger

Uh Oh, I’m hearing only one rate cut this year. The FED is meeting tomorrow and Wednesday. Buckle up, folks. #mortgagerates #Fed #interestrates

On #GMH w/ Rick Zamperin:

6:20 Canadian Baseball Hall of Fame and Museum 🇨🇦⚾️’s Scott Crawford

6:35 RATESDOTCA’s Daniel Ivans

7:20 Bob Huish

7:35 Mary Ormsby on #BenJohnson

7:50 Mike Naraine, PhD

8:20 BMO’s Sal Guatieri re: #InterestRates

8:50 🇨🇦 Marshall Ferguson 🏈

#HamOnt #Ottnews #CFLDraft

player.900chml.com

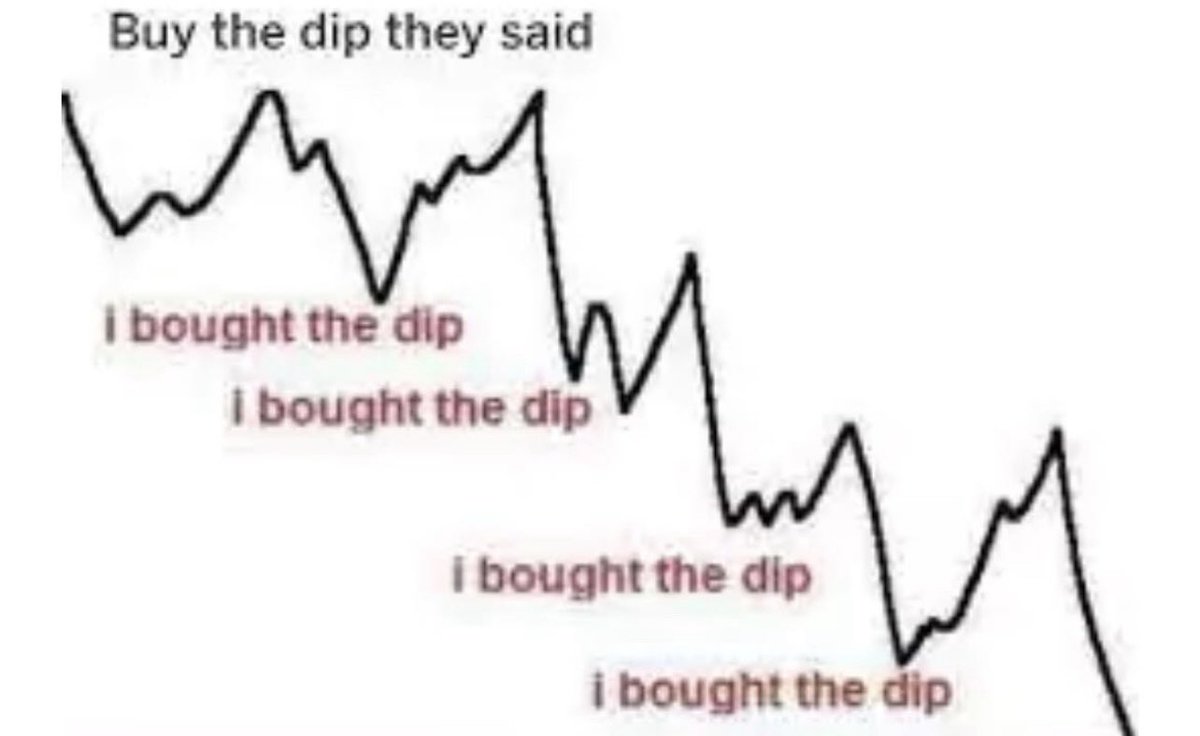

📉 Prediction: 36% chance NO interest rate cuts in 2024. 4 months ago: ~3%. Base case shifted from 6 cuts to only 1 this year. 31% chance of 2+ cuts. NO cuts more likely than 2+. Fastest Fed expectation shift ever! 📈💼 #InterestRates #Fed #MarketForecast

Our Stephen Millard speaks to Times Radio's

Dominic O'Connell about UK spending, #publicdebt and #interestrates 🎙️

'What really matters is core #inflation . If it's seen to come down quickly we could see a cut in June. I think it's more likely that the #MPC will wait until August'🎧👇

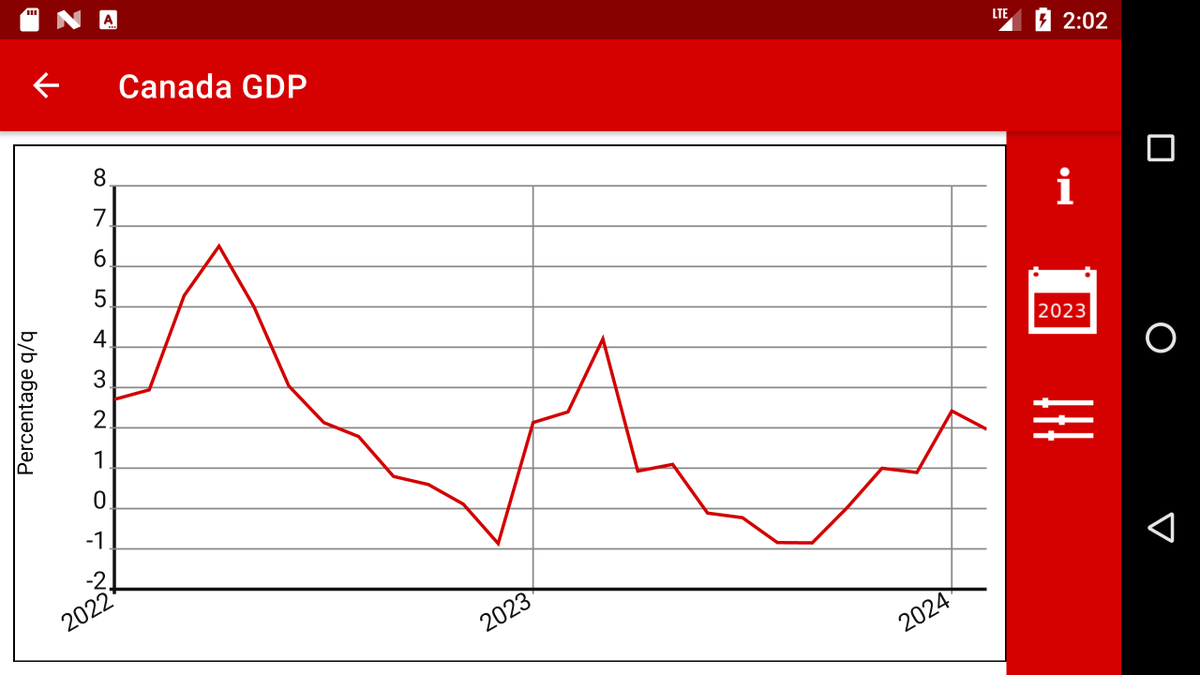

Quarter over quarter (annualized) paints a picture of a peak that lost steam. Either way well below population growth. We are in a private sector and per capita stagnation / recession.

#gdp #cdnecon #inflation #interestrates

Here's the incentive to lower rates.

Our annual interest payments at $1T are Orwellian to think about.

#InterestRates

While our technocrats at the Federal Reserve start their meeting today, the 2-year yield is back above 5%.

A reaction to the uninspiring presser of Treasury Secretary Yellen of today?

When it rains it pours!

#economy #InterestRates #investing