The carbon offset of training one deep learning AI transformer model, equals the annual CO₂ absorption from 11,000 trees! #greenAIcloud

#Investigation : Emissions control

➡️ #China , #India responsible for a lot of world’s #greenhouse gases

➡️ #Emissions monitoring of coal-fired plants ‘unreliable’ in China, India

➡️ Funders can help wean Asia Pacific away from reliance on #coal

Read more: bit.ly/3MC05Ye

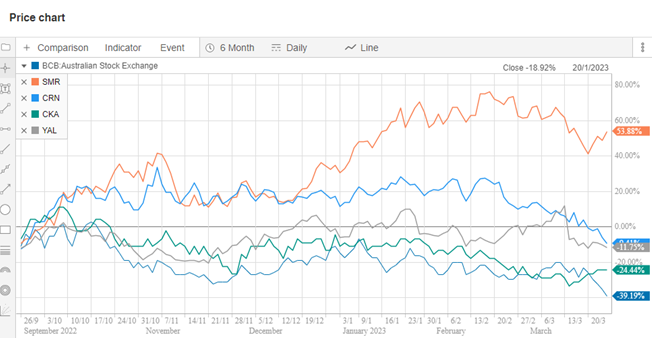

Curious PA on $BCB $BCB.AX (not held). Half-yearly due by Wednesday. No production figures provided in quarterly. Debt starting to amortise. But that big green bar last week was Regal buying 23M shares, now at 14.2%. Insiders selling past months. Something smells? 🧐 #CoalTwitter