N-Soft is revolutionizing the way governments use technology to increase transparency and expend the tax base.

#governance #taxtransparency #visibility

This time may be the charm to update US #accounting standards requiring more explicit breakdowns on the income taxes corporations pay. Brett Weaver, Tax #ESG leader at KPMG US, tells CFO Dive that companies should begin preparing for #taxtransparency . bit.ly/3oexjVe

Cooperation between national taxation authorities: Council puts the spotlight on crypto-assets and the wealthiest individuals lsnn.net/en_EU/ladysilv… #tags #TaxCooperation #CryptoAssets #TaxTransparency #TaxAvoidance #TaxFraud #tokens #nonfungible #lsnn via LSNN

Opinion: WPC’s tax transparency website proposal a step closer to reality.

bit.ly/3MmjFHs

#Opinion #Columns #Commentary #ChrisCorry #WashingtonPolicyCenter #GovJayInslee #OperatingBudget #TaxTransparency #2023LegislativeSession #VancouverWa #ClarkCountyWa

[NEWS] Global Forum counts 168 members after 🇸🇱 #SierraLeone 's adhesion.

🗞️ Read more ➡️ oe.cd/50p

#GlobalForum #taxtransparency

![OECD Tax (@OECDtax) on Twitter photo 2023-05-15 15:09:57 [NEWS] Global Forum counts 168 members after 🇸🇱 #SierraLeone's adhesion.

🗞️ Read more ➡️ oe.cd/50p

#GlobalForum #taxtransparency [NEWS] Global Forum counts 168 members after 🇸🇱 #SierraLeone's adhesion.

🗞️ Read more ➡️ oe.cd/50p

#GlobalForum #taxtransparency](https://pbs.twimg.com/media/FwLaKl_WYAAWdi5.jpg)

This time may be the charm to update US #accounting standards requiring more explicit breakdowns on the income taxes corporations pay. Brett Weaver, Tax #ESG leader at KPMG US, tells CFO Dive that companies should begin preparing for #taxtransparency . bit.ly/458hSP0

Unlock more tax revenue for your government. N-Soft’s solutions generate the necessary transparency to monitor major sectors in the economy, paving the way for better governance. Revenue Mobilisation - Africa (RMA)

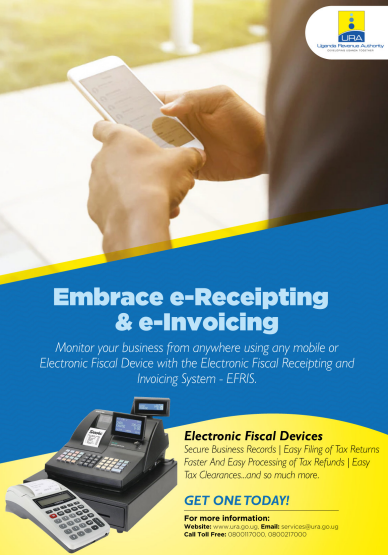

Uganda Revenue Authority

GRA

Kenya School of Revenue Administration

Liberia Revenue Authority

Khyber Pakhtunkhwa Revenue Mobilization

Board of Revenue, Revenue & Estate Department KP

Invoice trading is a VAT fraud scheme engineered by taxable persons manipulating the value addition chain by creating and issuing fictitious invoices to claim more input tax credit in their businesses than has been incurred. #TaxTransparency

This time may be the charm to update US #accounting standards requiring more explicit breakdowns on the income taxes corporations pay. Brett Weaver, Tax #ESG leader at KPMG US, tells CFO Dive that companies should begin preparing for #taxtransparency . bit.ly/43bLQA1

South Carolina taxpayers deserve to know where their money is going! #TaxTransparency #SCAccountability #SouthCarolinaTaxpayers scstatehouse.gov #thenervesc #

twitter.com/thenervesc/sta…

🚨 #DAC8 concluded!

Today, the #EU Finance Ministers agreed on a new set of rules for #cryptotax reporting. Altough an instrument with certain flaws (as highlighted yesterday), this is an important step towards more #taxtransparency in the European Union.

This time may be the charm to update US #accounting standards requiring more explicit breakdowns on the income taxes corporations pay. Brett Weaver, Tax #ESG leader at KPMG US, tells CFO Dive that companies should begin preparing for #taxtransparency . bit.ly/41Vxdzq

Recently, 7 companies involved in suspicious transactions like invoice trading were netted, having caused tax losses worth UGX 2.8 billion as a result of falsifying trade invoices.

bit.ly/3BztQUr

#TaxTransparency

📢 [JOB VACANCY] Join the #GlobalForum as a Research Assistant! Support the implementation of #AEOI standards through research, analysis & peer review processes.

Apply now and contribute to global #taxtransparency .

🗓️ Deadline: 2 June 2023

➡️ bit.ly/3BBDi9P

#TaxJobs

![OECD Tax (@OECDtax) on Twitter photo 2023-05-19 08:08:53 📢 [JOB VACANCY] Join the #GlobalForum as a Research Assistant! Support the implementation of #AEOI standards through research, analysis & peer review processes.

Apply now and contribute to global #taxtransparency.

🗓️ Deadline: 2 June 2023

➡️ bit.ly/3BBDi9P

#TaxJobs 📢 [JOB VACANCY] Join the #GlobalForum as a Research Assistant! Support the implementation of #AEOI standards through research, analysis & peer review processes.

Apply now and contribute to global #taxtransparency.

🗓️ Deadline: 2 June 2023

➡️ bit.ly/3BBDi9P

#TaxJobs](https://pbs.twimg.com/media/FwegC9uWYAEOu-a.jpg)

EFRIS is helping to curb illicit trade and eliminate uneven playfields for taxpayers and most probably why it is hated by unscrupulous traders. The solution helps to iron out and mitigate challenges such as Invoice trading a popular VAT fraud scheme. #TaxTransparency

Now is the time for tax to support and drive #ESG initiatives. Gain practical guidance on how to enhance the value your company receives from #TaxSustainability and #TaxTransparency . Read more in our 'Tax and ESG: From Risk to Opportunity' report:

ow.ly/qZT550OrZot

Thus, Uganda Revenue Authority can easily tell whether one is under-declaring their sales or overstating the input credit to collect unjustified refunds. This is what unscrupulous traders are most afraid of, and there have been several prosecutions bit.ly/3OlSMWX

#TaxTransparency

EFRIS is one of the smart Information technology business solutions, an initiative under the Domestic Revenue Mobilization Program, aimed at improving the collection of Value Added Tax (VAT) βillionair£ Mind$€T™

#TaxTransparency

Multinational #TaxTransparency is about to become a reality. What does this mean for US multinationals and how can boards ensure their company is prepared? Jessie Coleman, Alistair Pepper and John DerOhanesian KPMG US Tax share a few points to consider. bit.ly/3I3Wv7J

This time may be the charm to update US #accounting standards requiring more explicit breakdowns on the income taxes corporations pay. Brett Weaver, Tax #ESG leader at KPMG US, tells CFO Dive that companies should begin preparing for #taxtransparency . bit.ly/42XoOx6