We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financial planning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...]

![Amazing Financial LLC (@amazingfinan) on Twitter photo 2023-06-27 01:30:44 We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financialplanning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...] We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financialplanning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...]](https://pbs.twimg.com/media/Fzl7Gt1XwAEBqXL.jpg)

Even the smallest business needs metrics. Here’s an outstanding piece on #SmallBusiness KPIs: what they are, why you need them, and how they can boost profits.

Visit #MagentaEdge to learn more: t-mo.co/3N6T9lM

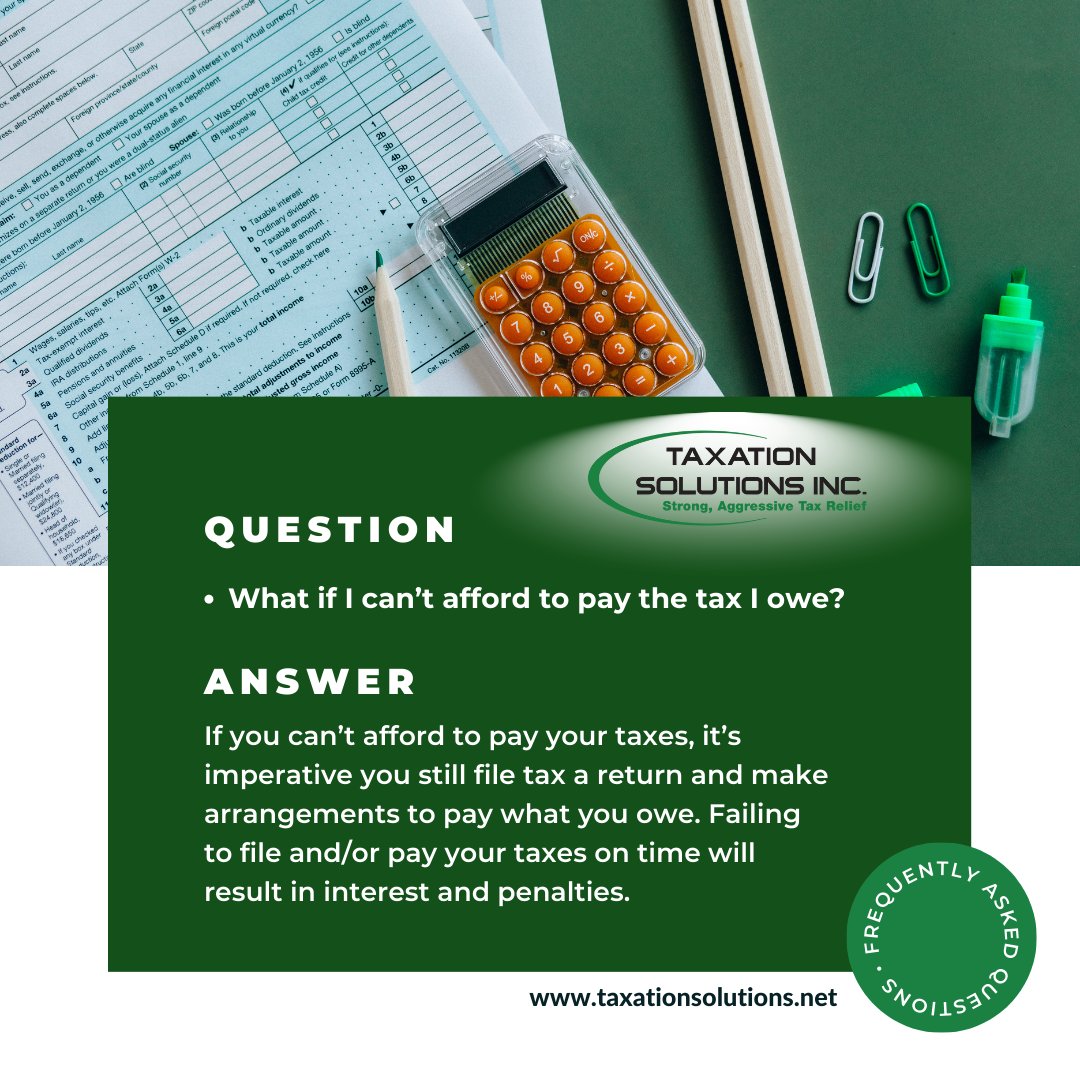

It's #FAQ Day!

Follow us for more! 💪

#tax ationsolutions #tax problems #tax es #irs #tax #tax preparer #tax resolution #tax season #tax help #accounting #businesstaxes

Filed a tax extension? We can help you get your business financials ready in time for the September deadline!

#atozhelpers #FinancialGrowthSupporters #bookkeepers #businesstaxes #virtualbookkeepers #taxes

atozhelpers.com

Friday is finally here! We don't know about you but we feel like Friday is relax day! This is how we feel.

#summer #summer fun #summer days #summer ishere #summer weather #summer feeling #summer memories #RiverCityCPAs #businesstaxes #bookkeepingforsmallbusiness #payrollservices

It's finally here! The first day of summer! We hope this is the beginning of a fun and relaxing few months!

#summer #firstdayofsummer #summer fun #summer days #summer ishere #summer vacation #summer ready #RiverCityCPAs #businesstaxes #bookkeepingforsmallbusiness #payrollservices

Deduction or Credit. Take the confusion out. #BusinessTaxes #Taxes #SelfEmployed taxvid.resourcesforclients.com/rZhQ4cWSmcNR/s…

ACCOUNTING & BOOKKEEPING SERVICE!

Visit our website :- kbsoni.com

#TaxPrepServices #TaxExperts #TaxPreparation #TaxHelp #TaxSeason #MaximizeDeductions #IncomeTaxFiling #TaxPlanning #BusinessTaxes #PersonalTaxes #ExpertAdvice #FinancialServices #TaxProfessionals

We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financial planning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...]

![Amazing Financial LLC (@amazingfinan) on Twitter photo 2023-06-21 12:15:45 We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financialplanning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...] We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financialplanning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...]](https://pbs.twimg.com/media/FzJVNFQagAEs3xm.jpg)

The effects of the new government budget can mean:

A raise in operational costs.

A reduce your profits.

Increase in ability to invest and expand.

New tax laws.

#Budget2023 #cassianandassociates

#BusinessTaxes #TaxImpact #BudgetChanges #Entrepreneurship #StayInformed

#businesstaxes #businessidea#smallbusinessadvice #smallbusinesshelp#businessownership #smallbusinessownership #businesscredit #businesscredit building

We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financial planning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...]

![Amazing Financial LLC (@amazingfinan) on Twitter photo 2023-06-20 12:15:47 We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financialplanning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...] We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financialplanning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...]](https://pbs.twimg.com/media/FzELnwmaQAAhHwm.jpg)

Looking for advice from a CPA? Our firm offers expert advice on accounting, tax planning, and much more. Focus on the business, we focus on the books.

#advice #taxes #taxplanning #businesstaxes #businessowner #entrepreneur #cpa #financialadvice #accounting

#businesstaxes #businessidea#smallbusinessadvice #smallbusinesshelp#businessownership #smallbusinessownership #businesscredit #businesscredit building

Affected by COVID-19? Employers, do your due diligence! Emergency Employer relief is here. Earn up to $26,000 per employee.

See what you qualify for now: my.mtr.cool/xpvfokgfsv

#taxincentives #businessadvice #taxservices #businesstaxes

QBI deduction allowed for the fair treatment of a business that wasn't a C Corp when the corporate tax rate was reduced to 21%. Meaning Schedule C, S Corps, and Partnerships can qualify for a 20% reduction of taxable income. #taxes #taxmatters #businesstaxes #taxplanning

We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financial planning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...]

![Amazing Financial LLC (@amazingfinan) on Twitter photo 2023-06-27 12:15:47 We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financialplanning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...] We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financialplanning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...]](https://pbs.twimg.com/media/FzoOvuMXwAAjewK.jpg)

We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financial planning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...]

![Amazing Financial LLC (@amazingfinan) on Twitter photo 2023-06-23 12:15:44 We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financialplanning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...] We are accepting new clients. 'More than just taxes💛✨' Need to book services? You can here #taxes #marketing #socialmedia #virtualavailable #virtualassistant #bookkeeping #financial #financialplanning #taxplanning #businesstaxes #taxcredits linktree.tr/amazingfinanci…[...]](https://pbs.twimg.com/media/FzToYQAakAECaDe.jpg)

We file taxes in over 45 States.....

#personaltaxes

#businesstaxes

#virtualtaxes

#taxpreparation

#fallscreditntax

#taxhelp