#NewYork expanded #ChildTaxCredit eligibility to all children under age 16 effective TY 2023. Previously, the #credit was only available for children between 4 and 16 years old. The credit is worth $100 per child or 33 percent of the #federalcredit . #taxcredit #taxday2024

#Maryland made the state #ChildTaxCredit (worth $500 per child) permanent and expanded eligibility to all dependents under age 6 instead of only those with disabilities. It also increased the maximum income threshold from $6,000 to $15,000, effective #TaxYear 2024. #taxday2024

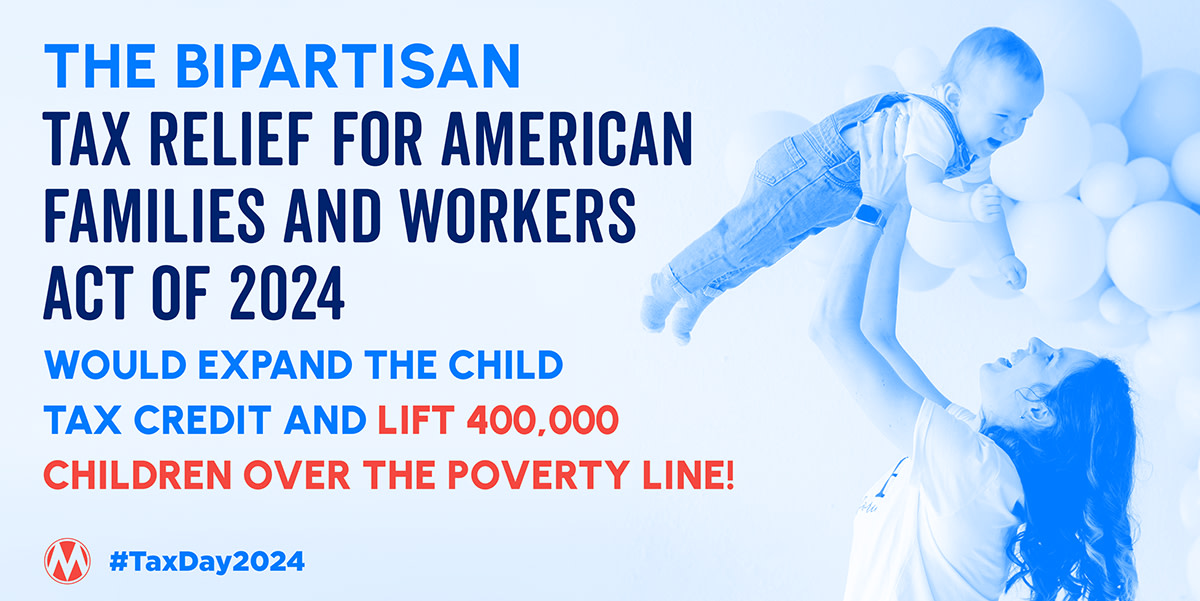

The expanded ChildTaxCredit (CTC) was a HUGE relief for families & a boost to the economy!

Join us today and urge your senator to pass the bipartisan 'Tax Relief for American Families & Workers Act of 2024' to expand the CTC for families.

#ChildTaxCreditForUS

Here’s a good news story worth sharing this Tax Day: 360,000+ Minnesota children and counting have benefitted from the state’s new #ChildTaxCredit . The $1,750 per-child-credit – created last year – is the highest child tax credit in the country. twitter.com/MNBudgetProjec…

Happy #TaxDay ! Today would be a good day for Congress to pass the Federal #ChildTaxCredit and the Ohio General Assembly to pass the #ThrivingFamiliesTaxCredit ! Learn more here ⤵️

The expanded #ChildTaxCredit (CTC) was a HUGE relief for families!

Join us this #TaxDay2024 to call your Senator and tell them to pass the Tax Relief for American Families and Workers Act of 2024, which will temporarily expand the CTC for families! actionnetwork.org/call_campaigns…

John Kennedy How many good folk in Louisiana missing out on that #childtaxcredit y’all shot down?

It is a critical piece to our nation's infrastructure; we must continue to build back better. #ChildTaxCredit

A lot of families used the #ChildTaxCredit on food… cash empowers families to use money that will be most effective to them —

Luke Shaefer #mlppforum

The day after #TaxDay is also a great time to remember the need to expand the #ChildTaxCredit -- and local advocates have already sent almost 50k emails to Senators urging them to get it done. Join in: actionnetwork.org/letters/tell-t… via Coalition on Human Needs

Members of our Missouri delegation presented Rep. Jason Smith with an award for his commendable bipartisanship on the Tax Relief for American Families and Workers Act. Thank you for fighting for families! #childtaxcredit

Parents use the #ChildTaxCredit to buy basic living amenities.

💰The wealthy and corporations use tax cuts to hoard wealth while raising prices.

Senate Democrats Senate Republicans, expand #CTC and start to make our tax code work for working families.

Yep, let's keep working on expanding the #ChildTaxCredit !

Tell the Senate to expand the CTC actionnetwork.org/letters/tell-t… via Coalition on Human Needs

The bipartisan House-passed #ChildTaxCredit expansion that benefits 16 million low-income kids isn't law yet. Why? A #GreatRead from Catherine Rampell.

washingtonpost.com/opinions/2024/…

Thank you Vice President Kamala Harris and President Biden for fighting for the #childtaxcredit . On Tax Day, families are being kept waiting- the expanded child tax credit in the #taxpackage would benefit 16 million kids across the U.S.