📰Weekly Brief +🗓️FinAgenda

➡️Bruegel & Financial Times Economic choices for Europe: EU leadership debate 2024

➡️Deutsche Bundesbank for banking supervisors’ course

➡️European Commission ‘Macroprudential policies for non-bank financial intermediation’ workshop

🖇️mailchi.mp/ebf/weekly-fin…

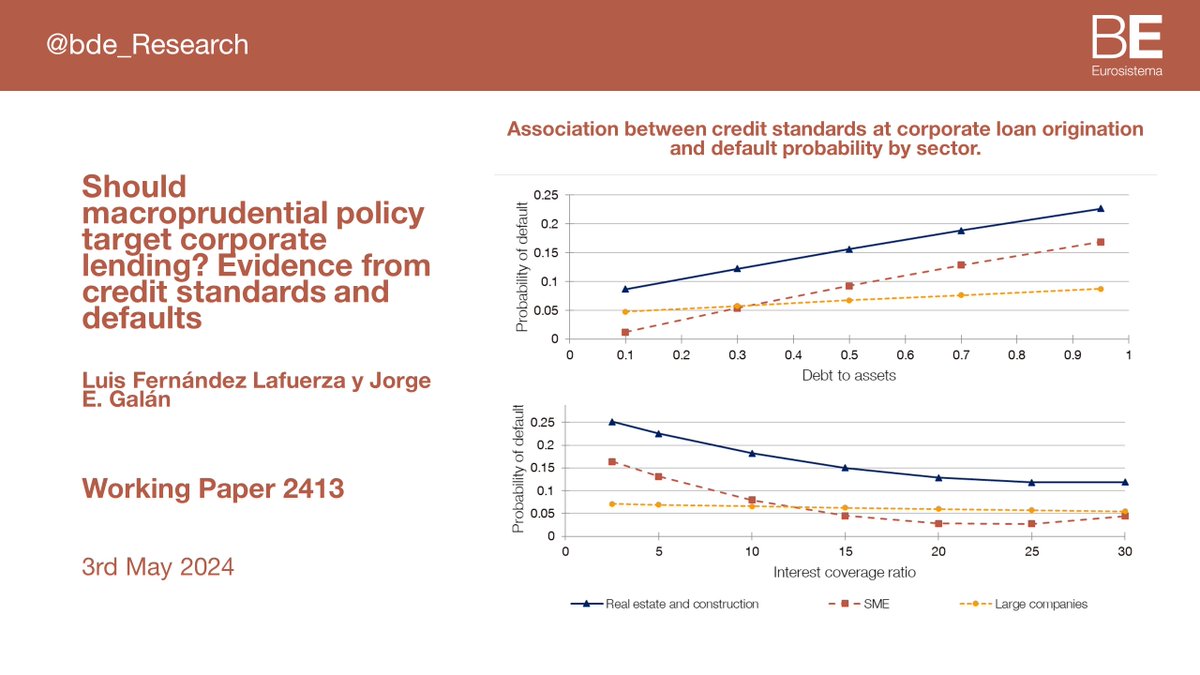

Credit standards at the origination of corporate loans are significantly associated with future default risk. Limiting debt-to-assets and interest coverage ratios in good times can mitigate credit risk in downturns #bdeResearch #macroprudential bde.es/wbe/en/publica…

In a brief talk with prof. Isabella M. Weber, I asked her: How can we sell 'Seller's Inflation' to these macroprudential bureaucrats?

Now that most technocrats are faced with their own uselessness, we see that it's not a question on how to sell but rather on how to impose.

Our seminar series continues on Monday! Pei Kuang will present the paper 'Macroprudential Policy and Housing Market Expectations'.

📅 Mon, 5th February

🕓 4pm (GMT)

📍 Masaryk Room UCL School of Slavonic & East European Studies

To learn more: cnetucl.co.uk/events

22 May: The impact of NBFIs on the EU #FinancialStability : ensuring effective monitoring and risk management for investment funds - workshop on #macroprudential policies for NBFI finance.ec.europa.eu/events/technic…

ถ้าธปทใช้นโยบายเดียวกับแบงค์ชาติอื่น กระตุ้นจนเศรษฐกิจฟื้น ตลาดแรงงานแน่น ครัวเรือนมีกำลังซื้อ หุ้นของเราก็จะฟื้นเหมือนกัน

ขอให้คุณ Srettha Thavisin กดดันให้ธปทประกาศว่าจะใช้นโยบายเดียวกับประเทศอื่น จะเลิกใช้ดอกเบี้ยควบคู่กับ macroprudential policy จะตั้งใจบริหารให้เงินเฟ้อเข้าเป้า

A central bank’s expanded balance sheet can play a macroprudential role, thus enhancing the effectiveness of #MonetaryPolicy #CentralBanks bis.org/publ/work1173.…

'Reserve requirements can be used as a #macroprudential tool to manage credit and systemic risks. They can reduce the build-up of #SystemicRisk and the frequency of financial distress episodes.' Bank for International Settlements bis.org/publ/work1182.…

The #BaselCommittee ’s revised Core Principles include lessons learned on how to better mitigate financial risks, strengthen the macroprudential aspects of supervision, promote operational resilience and reinforce corporate governance and risk management bis.org/bcbs/publ/d573…

Today at UIB Business Facultat d'Economia i Empresa - UIB we enjoyed the seminar “The Transmission of Macroprudential Policy in the Tails: Evidence from a Narrative Approach” delivered by Álvaro Fernández, from Universidad de Alicante UA.

Follow our seminars👇🏼

dee.uib.es/Investigacio/S…

#SeminarsDEE #FridayMood