Sebastien Cabral

@thetrinianalyst

ETFs. Markets. Economics. Opinions Are My Own. Research Associate @ @bloomberg @bbgintelligence

ID:1668961492589334530

14-06-2023 12:40:10

44 Tweets

1,1K Followers

55 Following

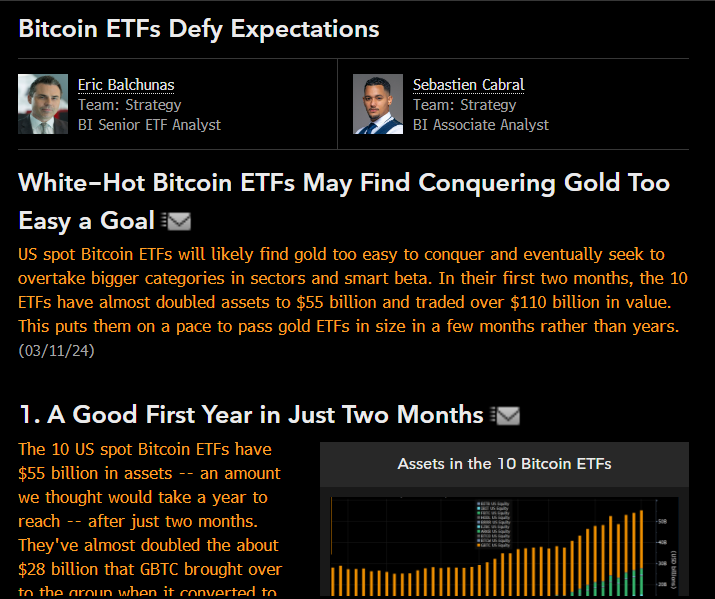

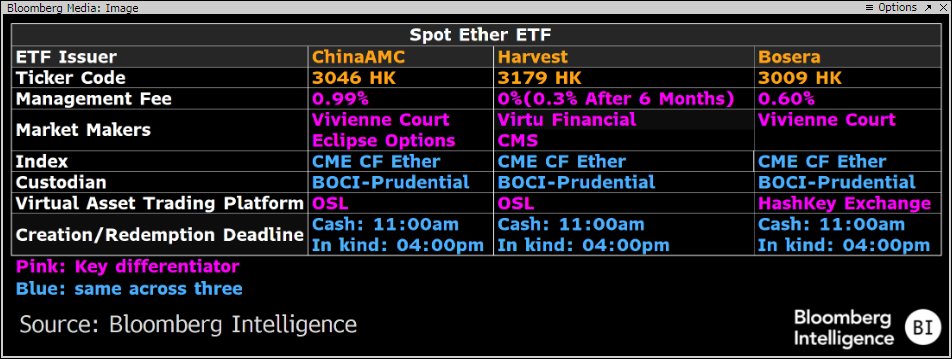

A potential fee war could break out in Hong Kong over these #Bitcoin & #Ethereum ETFs. Harvest coming in hot with a full fee waiver and the lowest fee at 0.3% after waiver. Tables are from my colleagues Rebecca Sin & Sebastien Cabral!

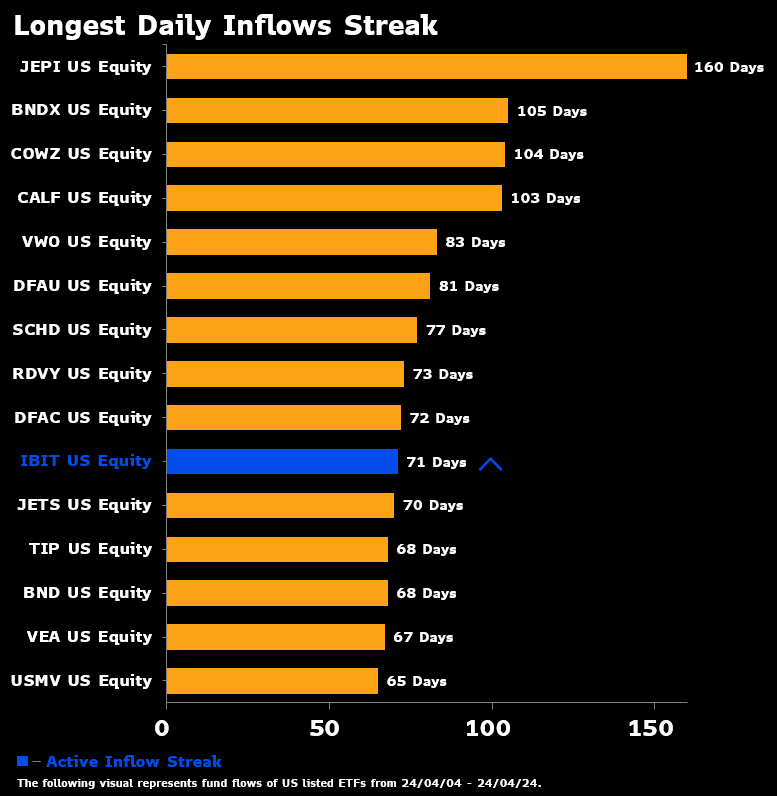

$IBIT inflow streak now 71 days which has it officially in the Top 10 all time after passing the ETF One Hit Wonder $JETS (remember JETSanity?). Also passed $BND and $VEA which are cash vacuum cleaners. Lot of mountain still left to climb tho. h/t Sebastien Cabral

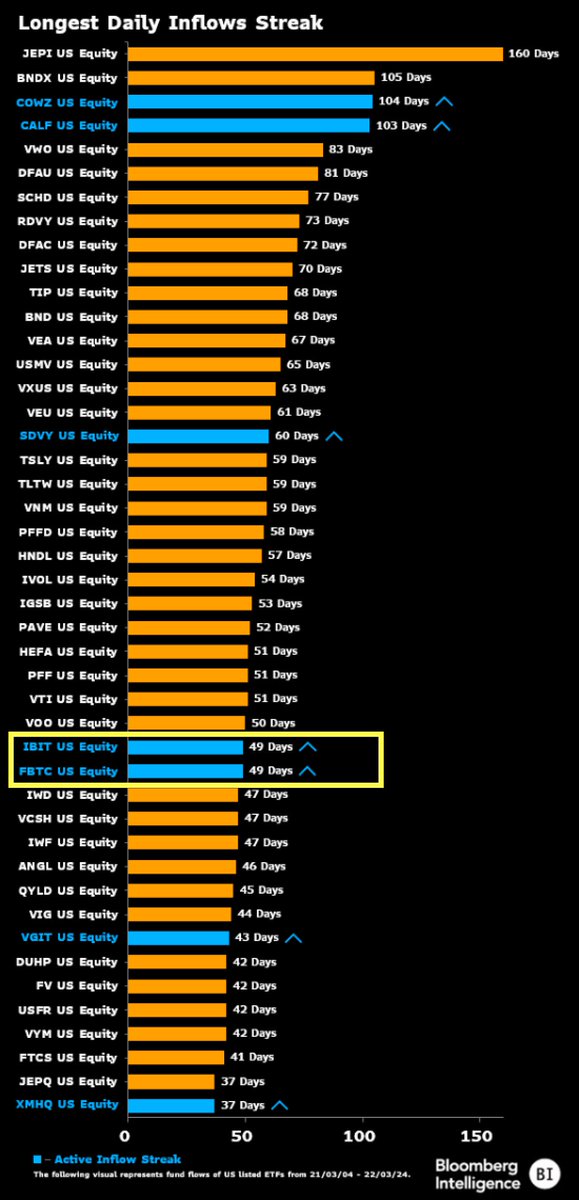

The BlackRock and Fidelity Bitcoin ETFs have seen inflows for 59 consecutive days, ranking them among the top 20 ETFs of all time!

The record is 160 days.

#Bitcoin 🚀🚀🚀

h/t Eric Balchunas & Sebastien Cabral

Happy 50 Straight Days of Inflows to all who celebrate.. Here's look at top ETFs by 'active' inflow streaks, $IBIT and $FBTC on top, shows how weird 50 days is (and unheard of for new etf, altho long ways to beat all time record of 160 days set by $JEPI) via Sebastien Cabral

$IBIT and $FBTC have now taken in cash for 49 straight days, something only 30 other ETFs have ever done (and none of them did it right out of gate). Among active streaks they 4th after $COWZ $CALF (which are over 100 days, damn) and $SDVY. Great chart from Sebastien Cabral

Love working with Eric Balchunas! He brings the wildest ideas and we just test them! Love this chart, so many stories here!

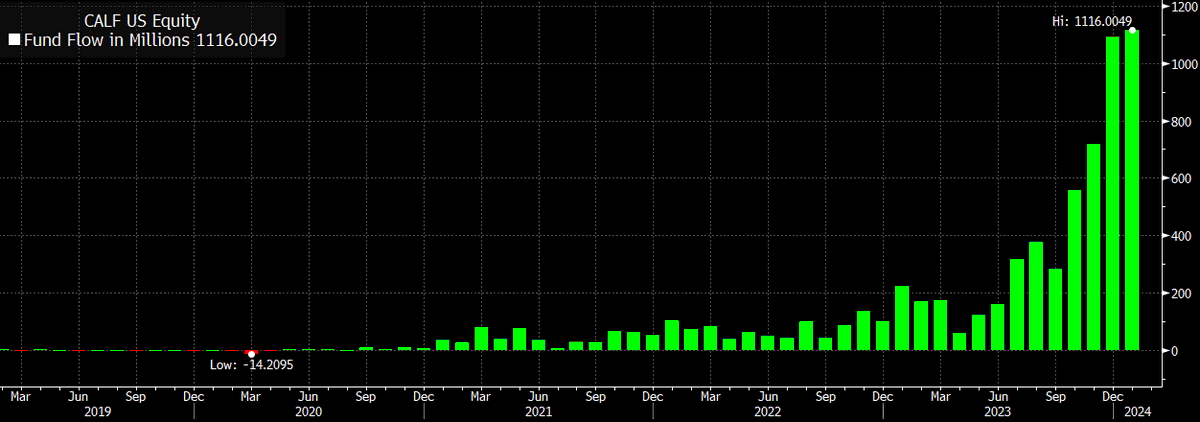

Another month, another record haul for $CALF, which is on a 46 month flow streak. No small cap ETF has taken in more cash in the past 12mo, impressive feat for an mid-level issuer in category includes Vgrd, Blk and DFA/Avantis from our upcoming Outliers note ht Sebastien Cabral

Eric Balchunas Sebastien Cabral Yeah, this shouldn’t be bid/ask spread for a US ETF. That isn’t allowed by the exchanges under Reg NMS. It could be discount to NAV

I am assuming this is the revert back to NAV trade, unwinding. Given it was trading at a discount, moving to an ETF should close that discount.

Eric Balchunas Sebastien Cabral Impressive analysis, showcasing the extensive listing reach of the $IBIT ETF across different exchanges and throughout the day. Its fascinating to observe the dynamics of trading volume by time and location. Kudos to Sebastien Cabral for the insights! #Finance #DataAnalysis

Eric Balchunas I think you've 100% nailed it. I suspect a lot of this may even be negotiated trades: 'I have 10k GBTC to swap to BITB' and market makers are packaging the pricing across pairs. (Not impossible to tease out by running all the tapes ... i'll poke at it if i have time later, love

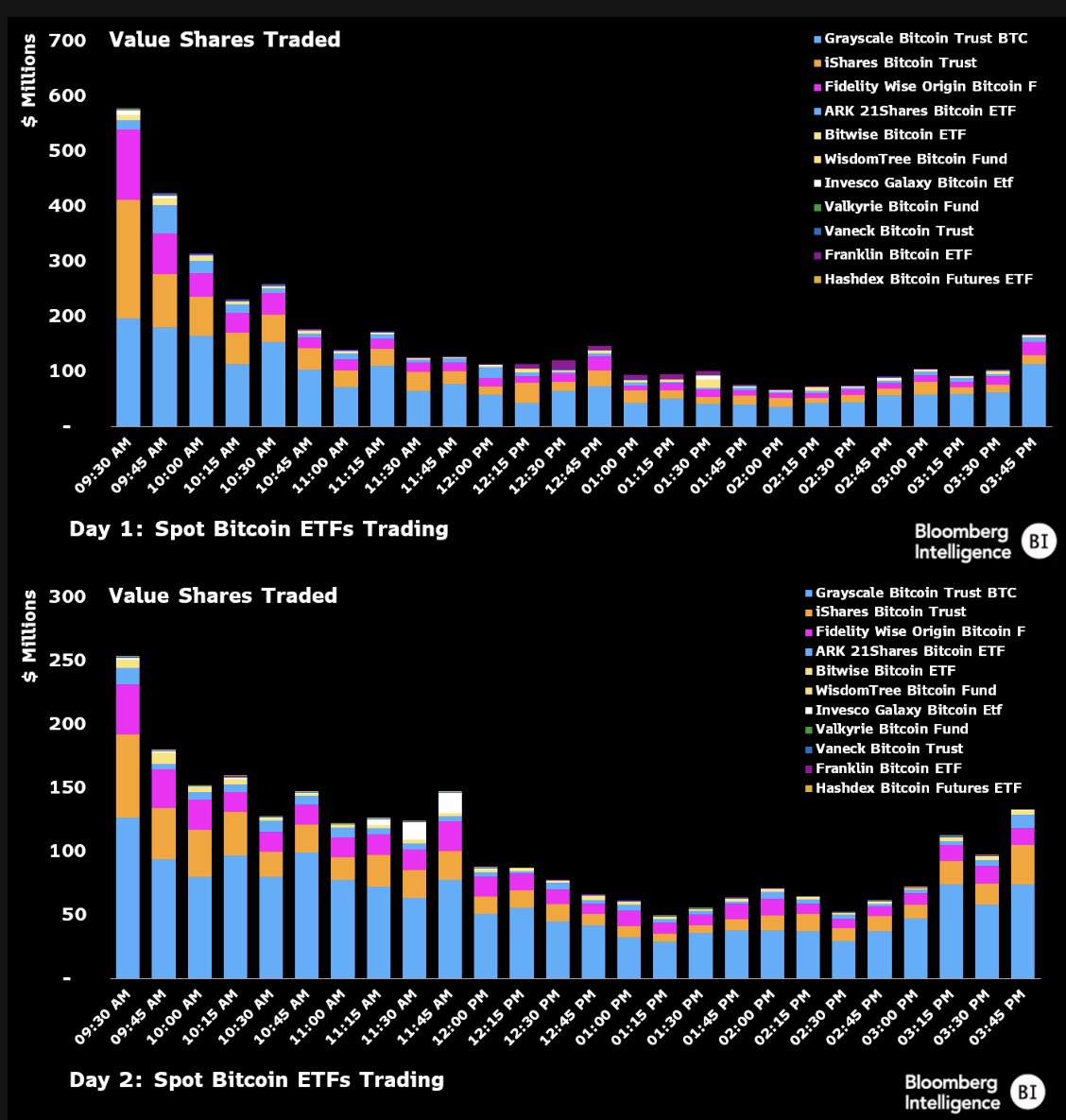

Here’s another one showing Day One vs Day Two volume by ETF and time of day. Notice the middle of the day got stronger on Day Two, that’s good sign of organic usage vs day one being heavy on pre-lined up volume via Sebastien Cabral