Tom Rees

@tomelleryrees

UK economy reporter at Bloomberg. Want to get in touch? [email protected]. Views my own.

ID:813061358

09-09-2012 12:45:31

69 Tweets

2,1K Followers

907 Following

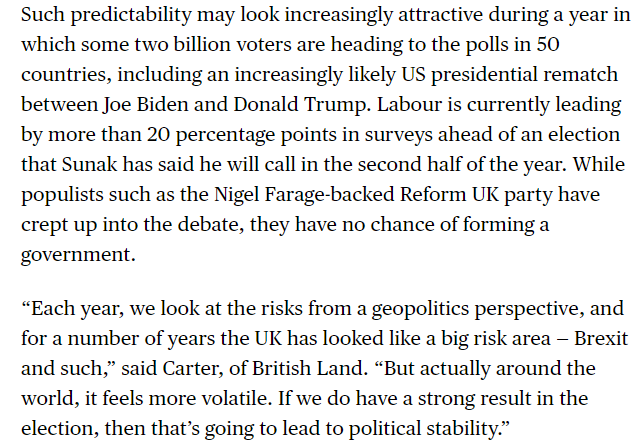

We've spoken to business leaders and others for Bloomberg UK and found sentiment on UK is improving. Growth is picking up, FDI strong, biz investment rebounding, living standards rising, our politics enviously stable right now. AI is productivity positive

bloomberg.com/news/articles/…

While the brilliant Ellen Milligan is away in Brussels, I'll be in Westminster covering her beat for the next two months. Anyone who wants to talk trade, business or energy, give me a shout!

The Government is consulting on new measures that encourage authorities to sell off assets to manage their deficits and stave off bankruptcy.

I spoke to Bloomberg UK's @TomElleryRees about the implications:

bloomberg.com/news/articles/…

I spoke with Bloomberg UK about the challenges facing local authorities.

You can read about Woking's experience here from @TomElleryRees:

bloomberg.com/news/articles/…

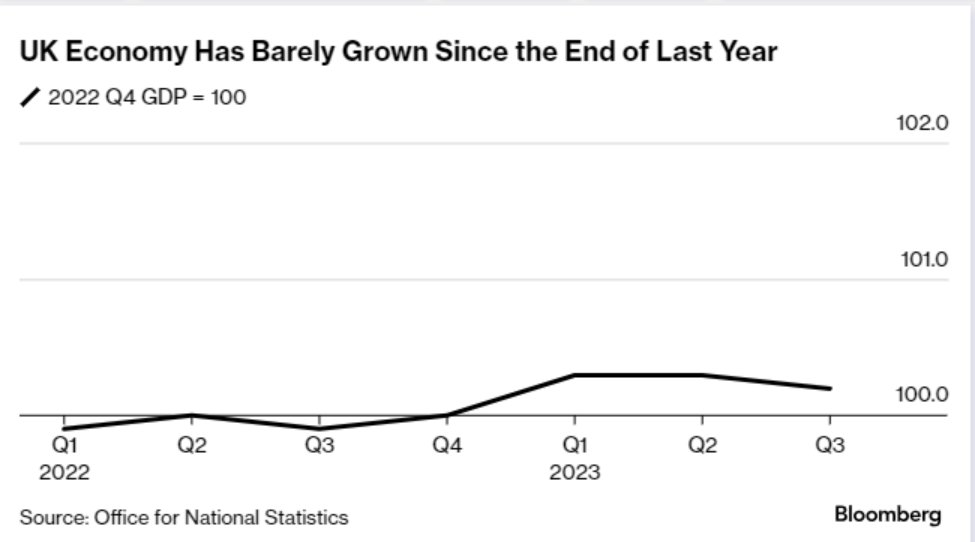

Merry Xmas everyone! The UK might be in recession after downgrade to Q3 data this morn. We warned there was a risk of this earlier this week. Fortunately inflation and rate expectations are starting to go in the right direction 👇

bloomberg.com/news/articles/… via Bloomberg Economics