Francesco Bianchi

@Francesco_Bia

I am a Professor of Economics ...that is less boring than it sounds! @JohnsHopkins @JHUArtsSciences professor, @PrincetonEcon PhD, @unibocconi laurea

ID:1124336498487300097

https://sites.google.com/view/francescobianchi/home 03-05-2019 15:34:45

1,7K Tweets

4,6K Followers

361 Following

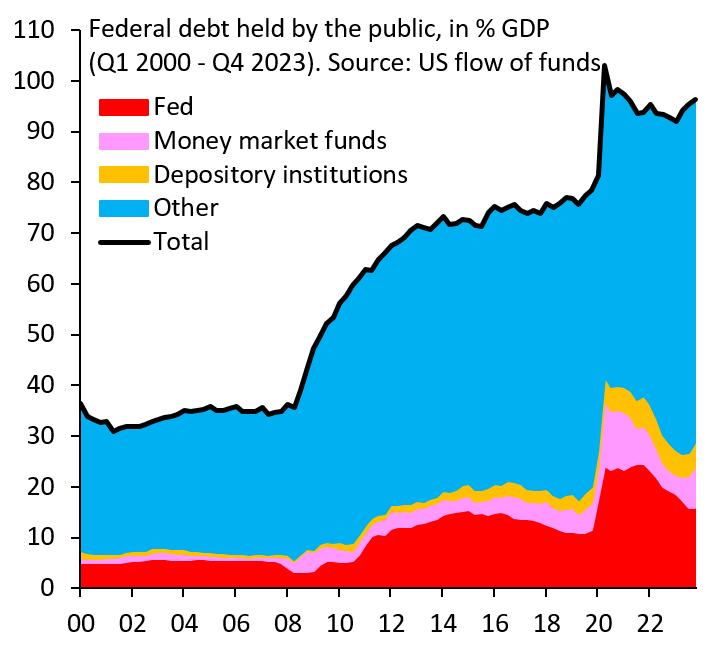

Glad to see that the topic of monetary/fiscal policy interaction is gaining traction. We need all minds that we can get to make progress Leonardo Melosi renato_faccini John Cochrane Klaus Masuch

We discussed the issue two years ago at #JacksonHole in a paper with Leonardo Melosi and more recently in a QJE paper with Leo and renato_faccini: Monetary policy has changed, but fiscal policy arguably not. Both need to adjust

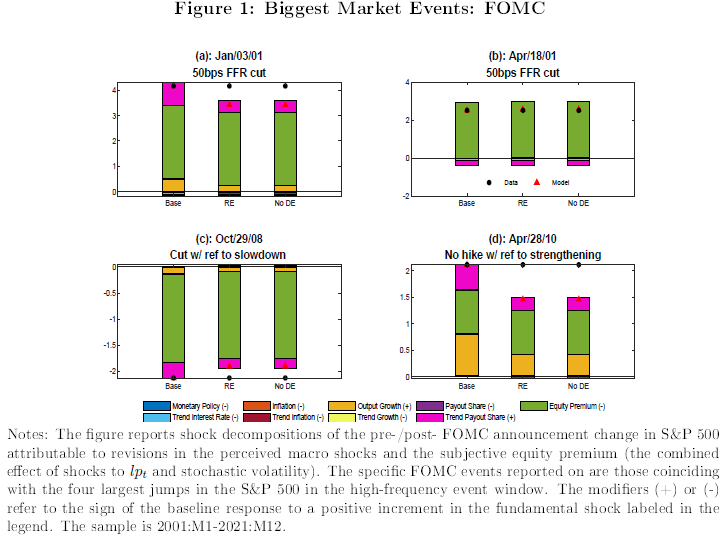

Investor overreaction to news events may reduce market volatility: “the sum total of different individual overreactions to multiple simultaneous shocks can dampen rather than amplify their combined market impact.” Francesco Bianchi Sydney Ludvigson

edwardconard.com/macro-roundup/…

Increase in spending even past the pandemic was predicted by my work with Leonardo Melosi and renato_faccini and is consistent with post-war experience described in the work of Sargent and coauthors