Sydney Ludvigson

@LudvigsonSydney

Julius Silver, Roslyn S. Silver, and Enid Silver Winslow Professor of Economics at New York University, Co-Director NBER Asset Pricing Program

ID:1543317227176448004

http://sydneyludvigson.com 02-07-2022 19:36:23

62 Tweets

1,3K Followers

117 Following

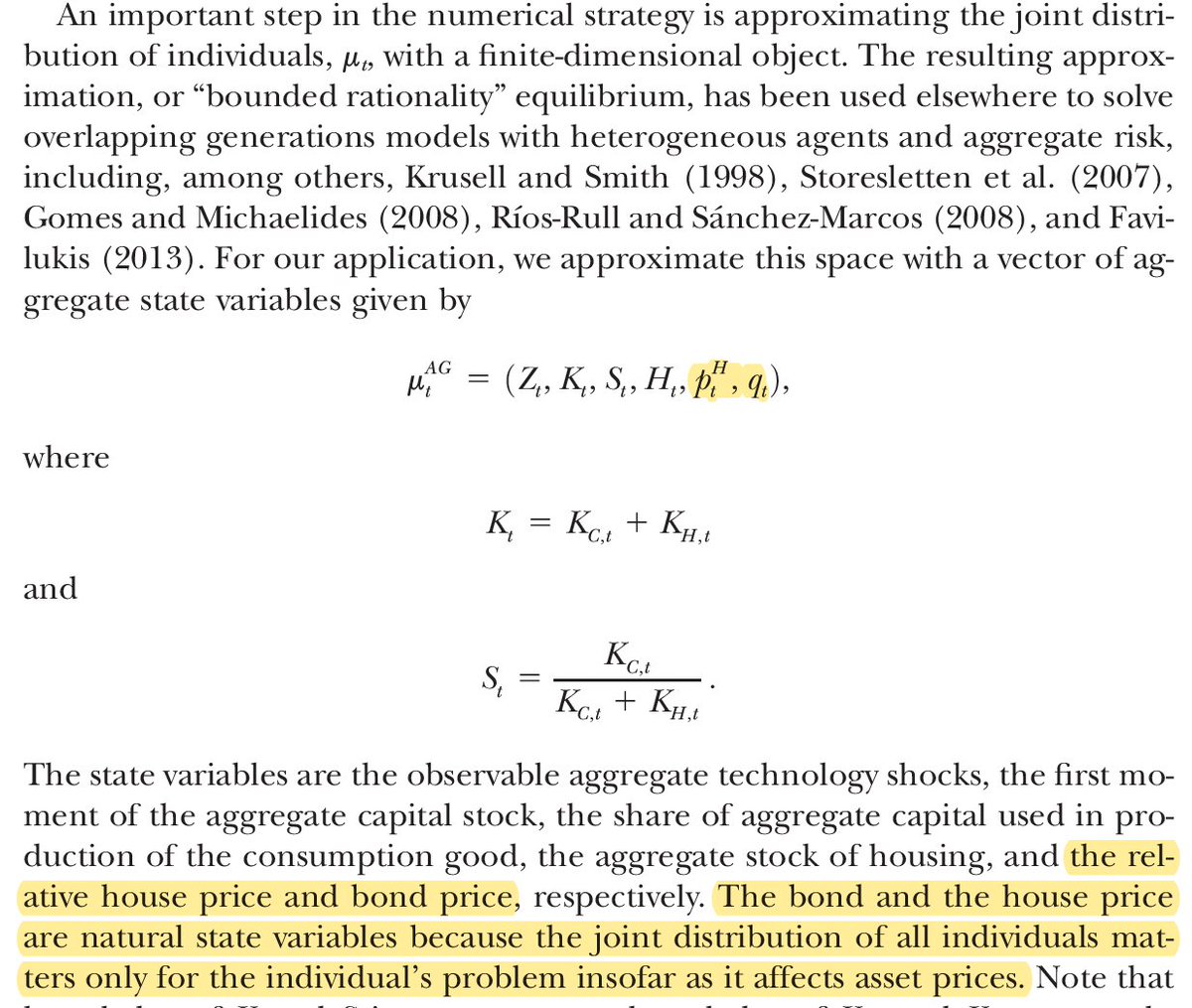

Mariacristina De Nardi Konrad Burchardi I do like one version of KS namely to use the prices as moments like in Favilukis Sydney Ludvigson Stijn Van Nieuwerbur. But I still it’s worth thinking about this more systematically again.

Sydney Ludvigson, Martin Lettau, and I show that secular shifts in monetary policy + learning can generate very persistent movements in the real interest with significant asset pricing effects

Thanks to organizers for inviting me to a great conference and to present work with

Francesco Bianchi

and Sai Ma

Rayhan Momin Noah Williams There actually is a version of Krusell-Smith that makes more sense to me, namely to use the prices themselves as the moments like e.g. in this paper by Favilukis Sydney Ludvigson Stijn Van Nieuwerbur

sydneyludvigson.com/s/hwcJPE.pdf

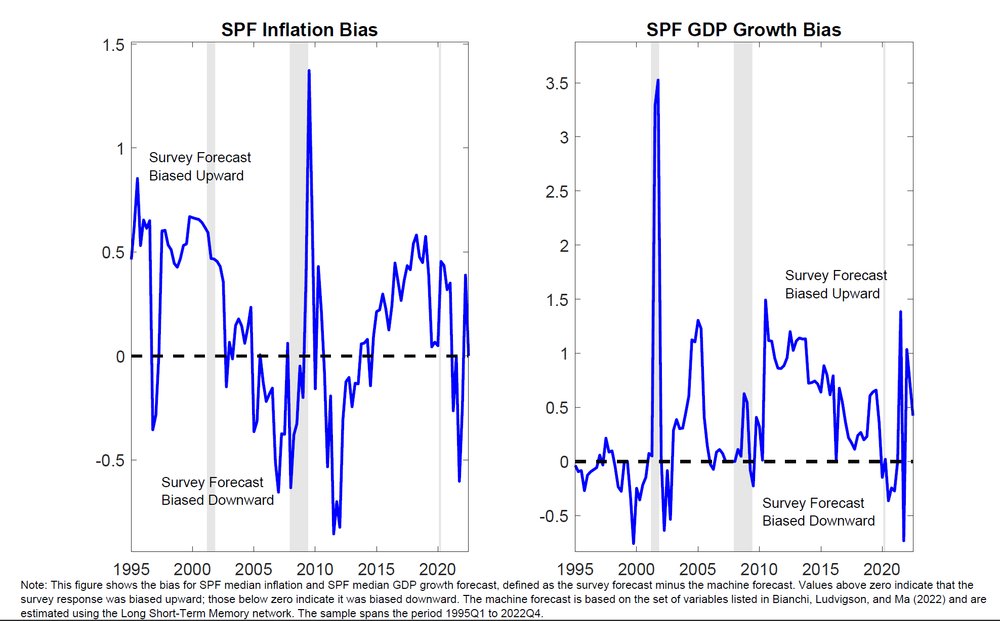

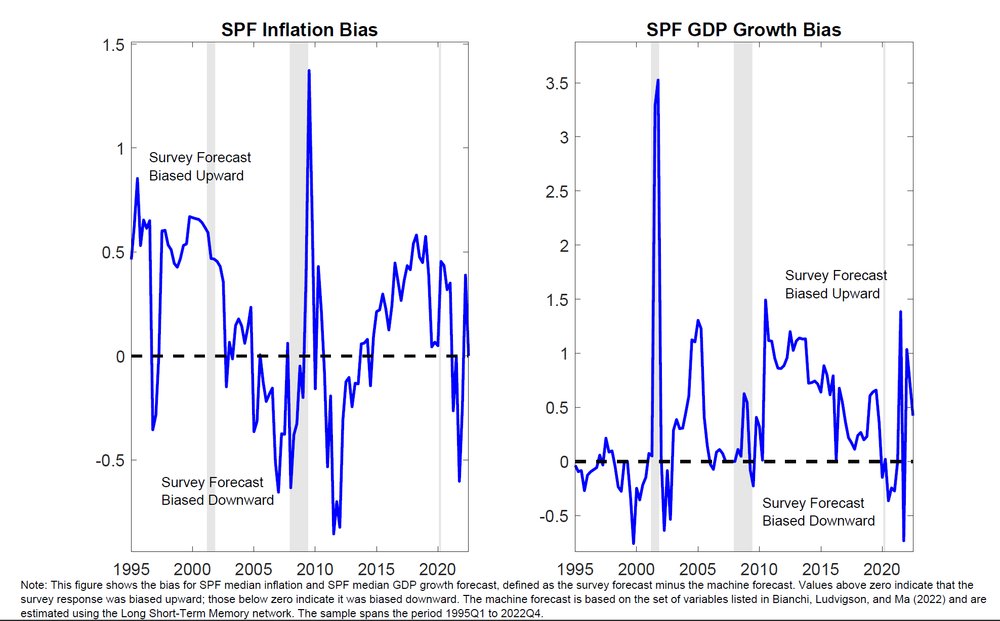

Sydney Ludvigson, Sai Ma, and I just launched a Bias Tracker website. The website posts data on a non-distorted/unbiased benchmark for measuring systematic expectational errors in survey forecasts of four-quarter-ahead inflation and GDP growth

sydneyludvigson.com/bias-tracker

Markets do not want to accept the possibility of a structural break in Federal Reserve policy. See work with Sydney Ludvigson for a formal analysis of these learning and signaling dynamics

What makes inflation costly? Who bears these costs?

In my JMP, I explore an understudied mechanism:

Inflation impairs households’ ability to save for precautionary reasons

How? Let’s take a look at households’ liquid assets portfolios

#EconTwitter #Econjobmarket

HUGE congrats and super well deserved, Elena Manresa!! I feel very lucky to have such an amazing colleague 💪💪 And not to forget wonderful friend 😊