GlobalData.TSLombard

@TS_Lombard

Independent macro, strategy and political research. Request a trial (investment professionals only) https://t.co/BHxLsWw5qE

ID:510529116

http://tslombard.com 01-03-2012 17:01:12

7,2K Tweets

7,9K Followers

776 Following

For equity markets, not a bad thing for the Fed not to cut because of strong growth and inflation stubbornly in the 3% to 4% range. It is a bad thing for the FOMC to ignore whether the real funds rate is high enough to generate the slow walk to 2% inflation. steven blitz

Marriage between the FOMC and disinflation is heading for a divorce “Participants generally noted their uncertainty about the persistence of high inflation and expressed the view that recent data had not increased their confidence that inflation was moving sustainably. steven blitz

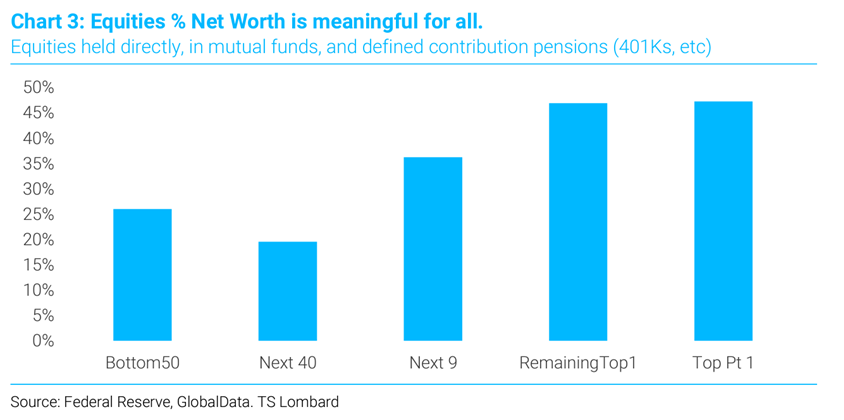

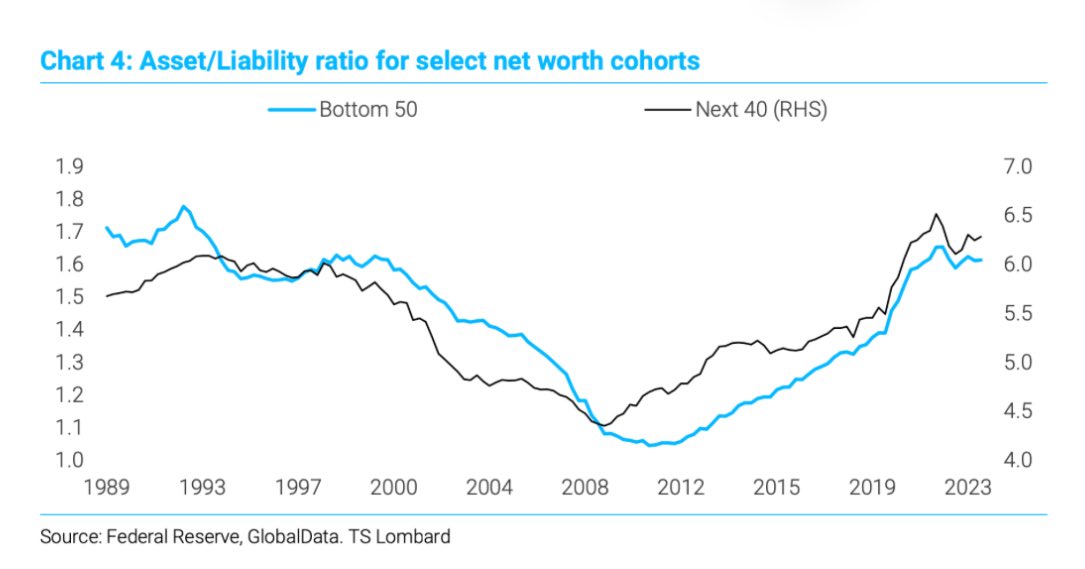

“.. Largely because of the rise in equities .. and the deleveraging of household balance sheets in the past decade, asset/liability ratios have not been this high since the late 1990s.' 🇺🇸

- GlobalData.TSLombard steven blitz Daily Chartbook

For equity markets, not a bad thing for the Fed not to cut because of strong growth and inflation stubbornly in the 3% to 4% range. It is a bad thing for the FOMC to ignore whether the real funds rate is high enough to generate the slow walk to 2% inflation. steven blitz

Index concentration: not just a US problem. Extremes of concentration – not just in the US but also in the Euro Area, leave the market vulnerable to poor results from the giants, especially Nvidia. Freya Beamish

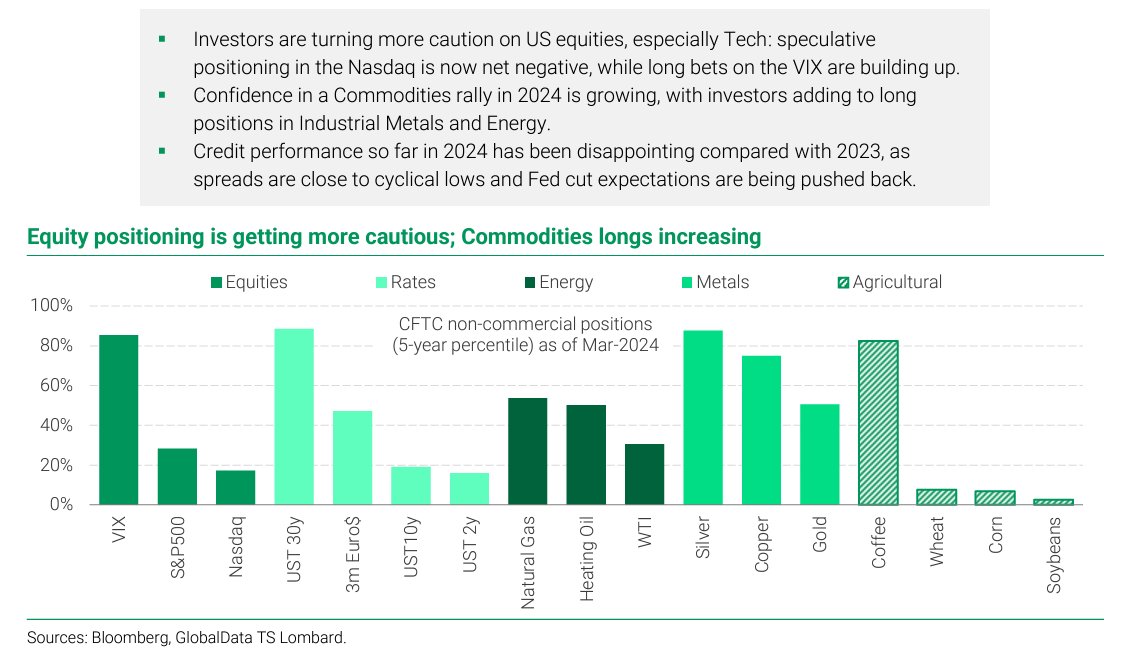

Investors are turning more cautious on US equities, especially Tech: speculative positioning in the Nasdaq is now net negative, while long bets on the VIX are building up. Andrea Cicione and Skylar Daithi Montgomery Koning

US equities have marginally lagged other markets so far this year. This is especially true in the Tech sectors, with IT-heavy country indices outperforming the Nasdaq. Andrea Cicione and Skylar Daithi Montgomery Koning

“.. IS THE EXPANSION JUST GETTING STARTED? .. Equity market reflects earnings, earnings lead to hiring .. Nothing unusual here, typical start-of-cycle dynamics.” 🇺🇸

- GlobalData.TSLombard

GlobalData.TSLombard P.S. all is not lost. At least someone at the ECB is paying attention:

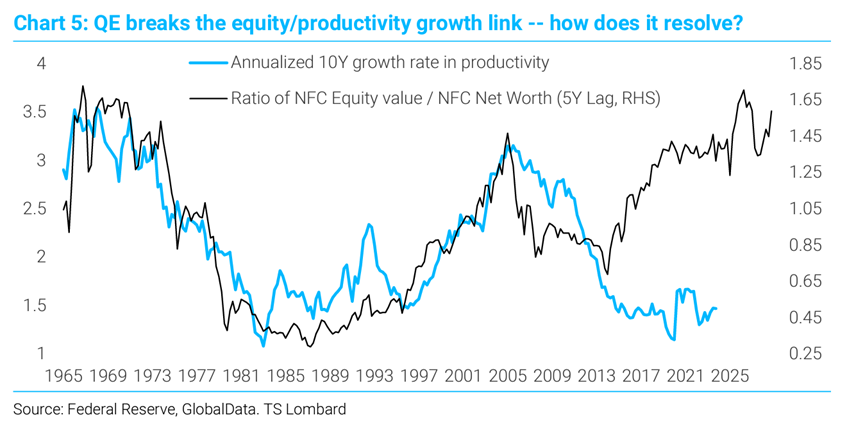

”If we hold them [high interest rates] for too long, we might put the recovery at risk and delay the associated cyclical rebound in productivity growth” (Piero Cipollone, 27 March)

ecb.europa.eu/press/key/date…

EA productivity rebound but will policymakers spoil it? Very important thread by Davide Oneglia

US equities have marginally lagged other markets so far this year. This is especially true in the Tech sectors, with IT-heavy country indices outperforming the Nasdaq. Andrea Cicione and Skylar Daithi Montgomery Koning