steven blitz

@sblitz1

ID:321372866

21-06-2011 13:29:42

3,0K Tweets

973 Followers

360 Following

Follow People

The #recession crowd is about to have their moment after the April #employment number. Fact is the numbers of the past few months were over the top. 170,000 is what the economy normally produces at this point in the cycle. . . .

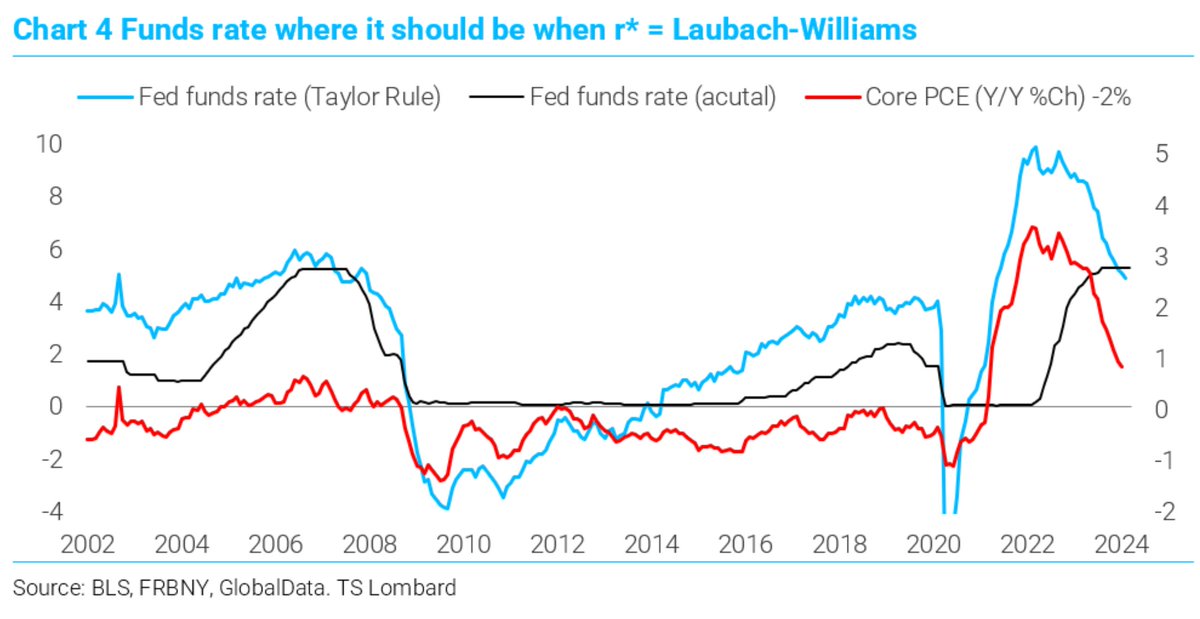

For equity markets, not a bad thing for the Fed not to cut because of strong growth and inflation stubbornly in the 3% to 4% range. It is a bad thing for the FOMC to ignore whether the real funds rate is high enough to generate the slow walk to 2% inflation. steven blitz

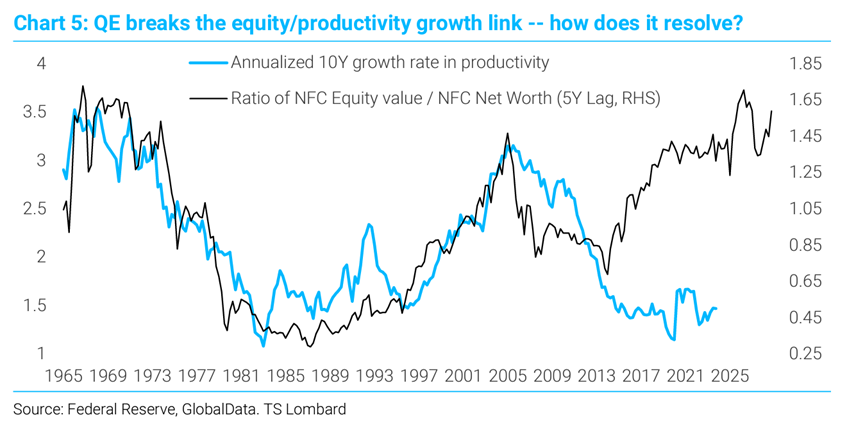

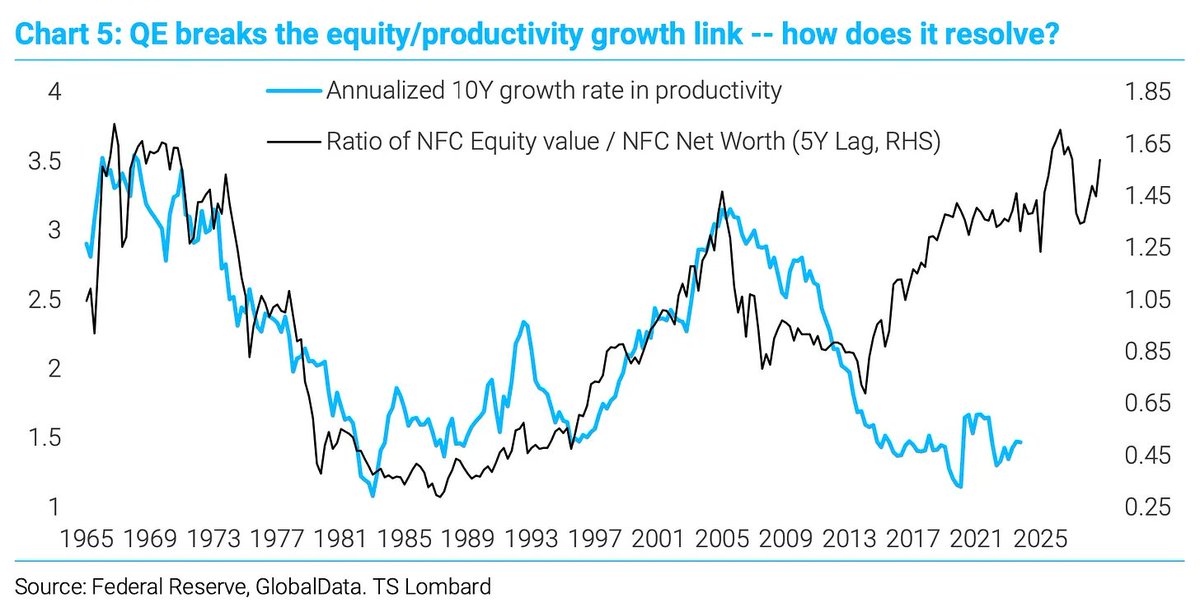

'Either productivity begins to accelerate (inclined to think it will) or the Fed will need to continue propping up the market.'

steven blitz

Marriage between the FOMC and disinflation is heading for a divorce “Participants generally noted their uncertainty about the persistence of high inflation and expressed the view that recent data had not increased their confidence that inflation was moving sustainably. steven blitz

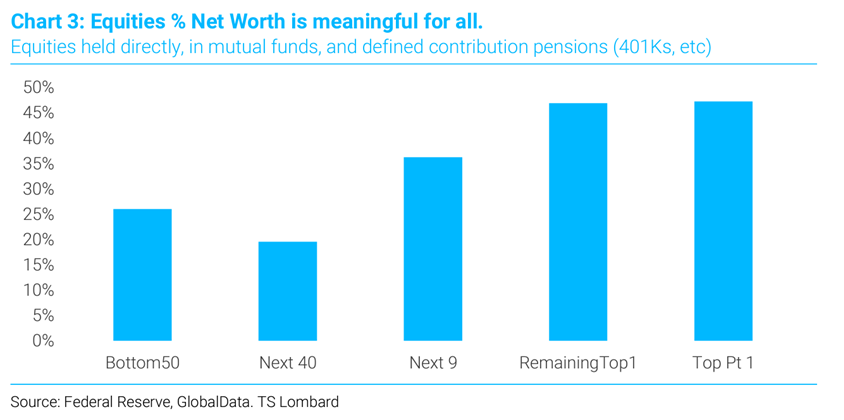

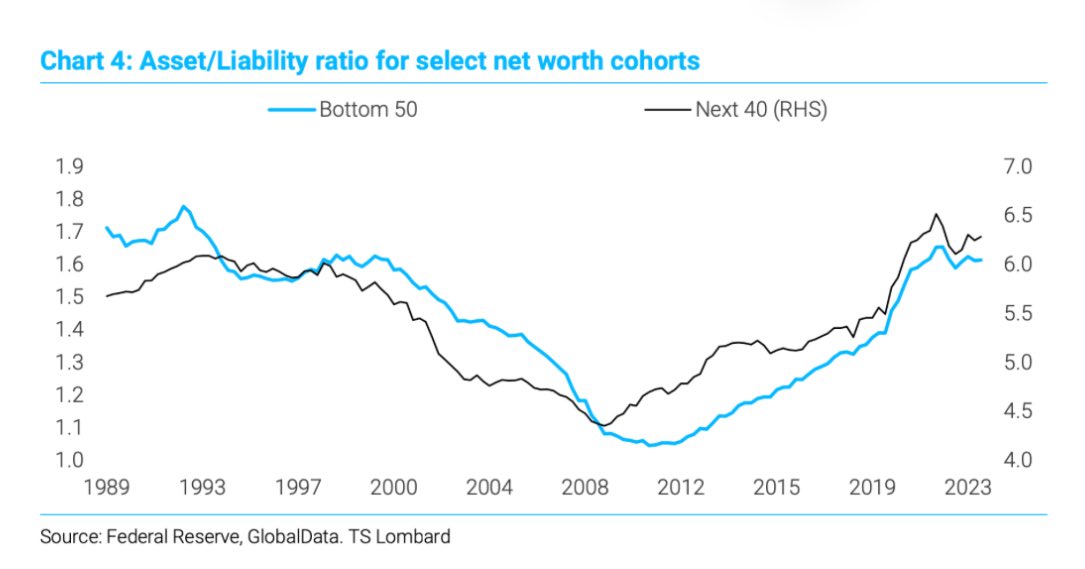

“.. Largely because of the rise in equities .. and the deleveraging of household balance sheets in the past decade, asset/liability ratios have not been this high since the late 1990s.' 🇺🇸

- GlobalData.TSLombard steven blitz Daily Chartbook

EA productivity rebound but will policymakers spoil it? Very important thread by Davide Oneglia

GlobalData.TSLombard P.S. all is not lost. At least someone at the ECB is paying attention:

”If we hold them [high interest rates] for too long, we might put the recovery at risk and delay the associated cyclical rebound in productivity growth” (Piero Cipollone, 27 March)

ecb.europa.eu/press/key/date…

“.. IS THE EXPANSION JUST GETTING STARTED? .. Equity market reflects earnings, earnings lead to hiring .. Nothing unusual here, typical start-of-cycle dynamics.” 🇺🇸

- GlobalData.TSLombard

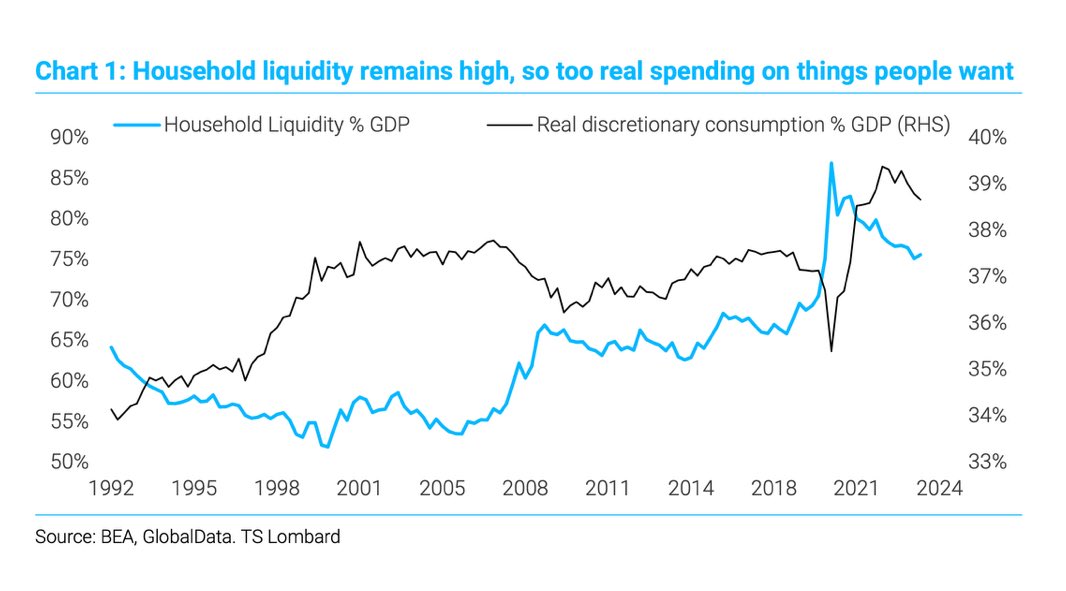

“.. Consumers remain liquid, and underleveraged, and this will keep real discretionary spending running high.” 🇺🇸

steven blitz GlobalData.TSLombard Daily Chartbook

'Plugging the Laubach-Williams r* into the Taylor Rule, using the CBO’s historic estimates for NAIRU and a 2% inflation target, the funds rate is where it should be.'

steven blitz GlobalData.TSLombard