Tax Calendar Decemeber2023 #duedates #biometric #registration #gstr9 #table8A #gstupdates #gstreturns #gstcompliance #taxcompliance #Ahmedabad

Did you know?

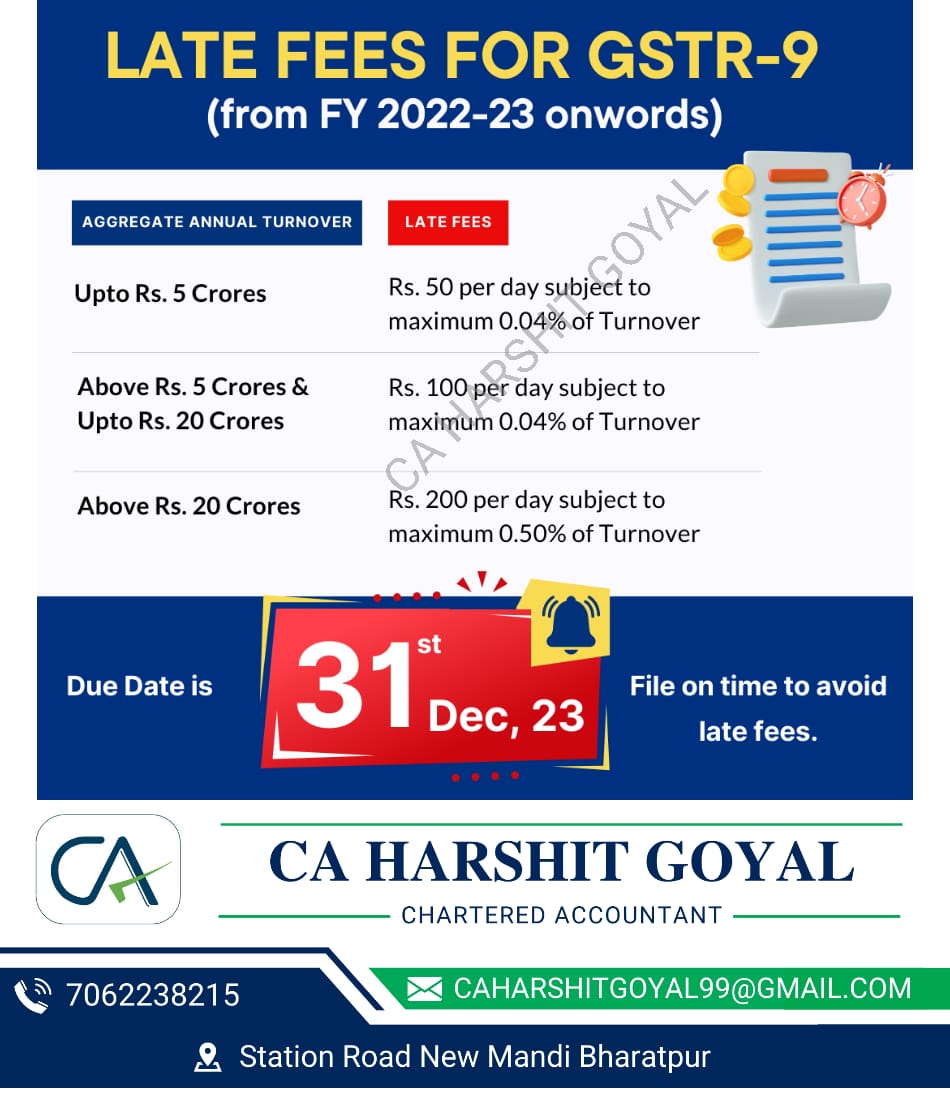

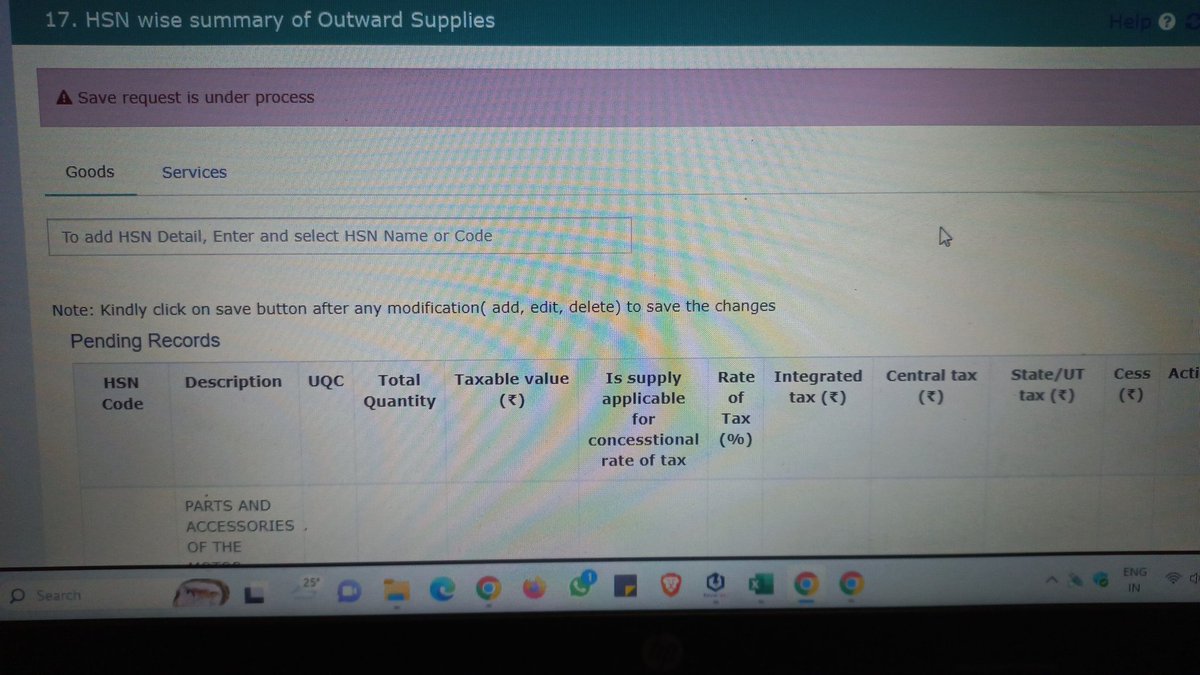

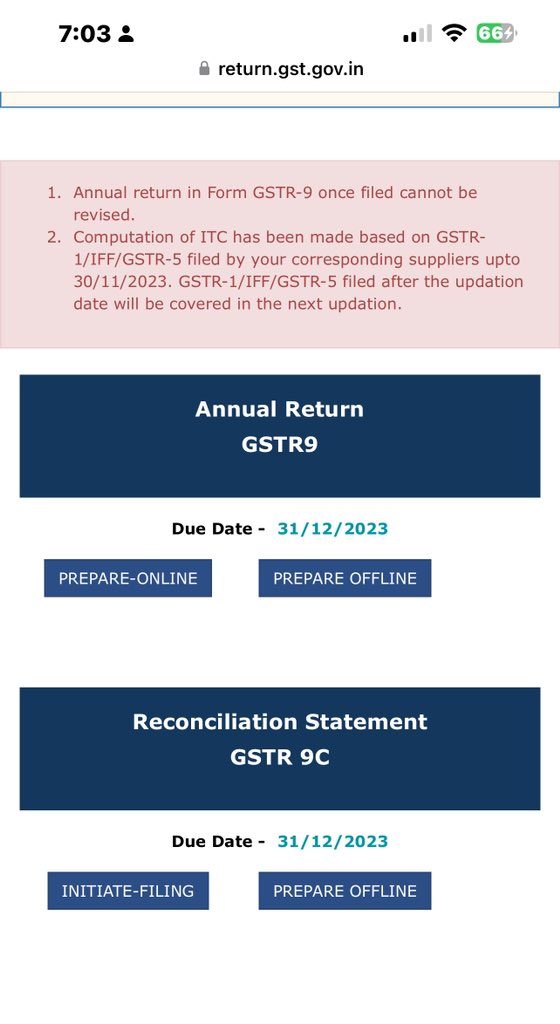

Under GST, businesses need to file regular GST returns, including: GSTR1, GSTR3B, GSTR9

#GST #GST Return #GST R1 #GST R3B #GST R9 #TaxFiling #Adani #TataGroup #Emile #Vedanta #HimachalFloods #Smaket #BillingSoftware #Trending #Odisha #automation #business

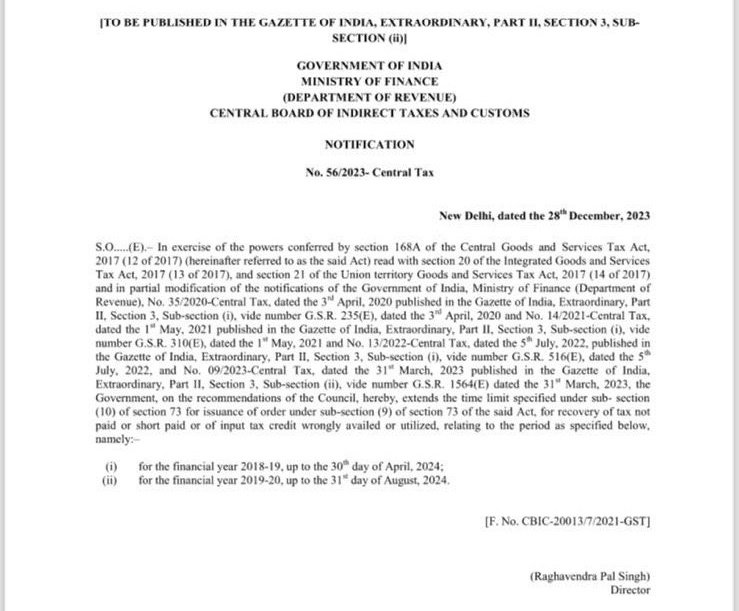

Indeed a Good News for Tax Payers by seeing a humane gesture from CBIC. We can therefore expect below in order :-

1. GSTR3B & R1 Rev. till date

2. GST9 Rev. till FY 2021-22

3. Extension of GSTR9 of FY 2022-23 till date of such Rev.

4. #EnableGSTR2 & R3

... for an ideal GST !!

🚨 New Course Alert!

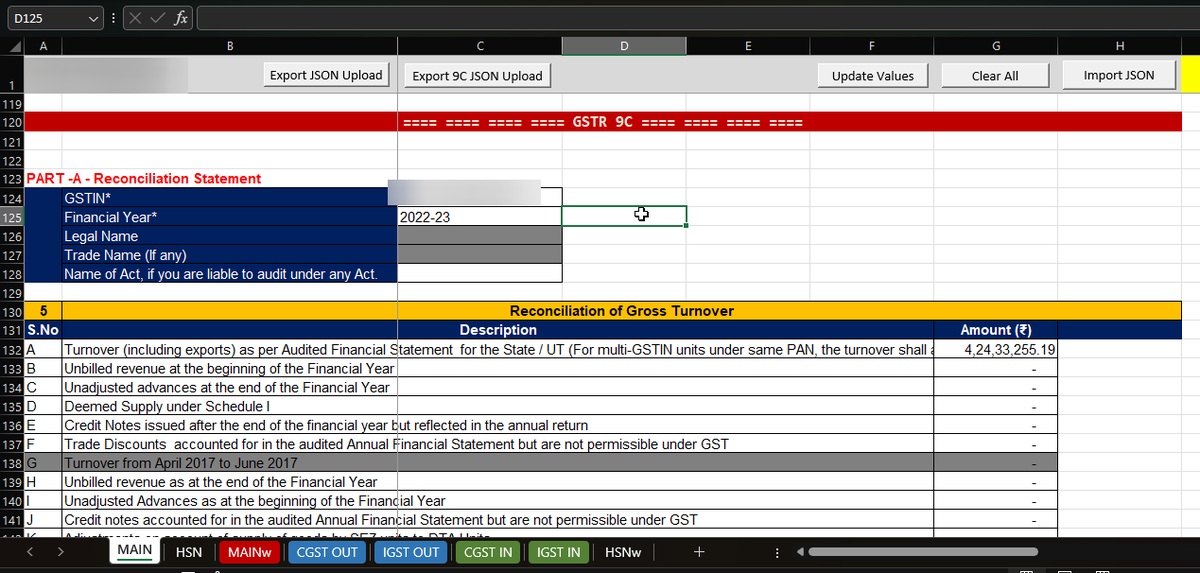

🟥Practical case studies, legal provisions and Graphical approach to #GSTR9 and 9C

Faculty - CA Aanchal Kapoor

Click Here To Know More

bit.ly/3sb1X3J

For Queries - 7560 932 109,[email protected]

#GSTR9 C #GSTUpdates #taxscan academy #taxscan