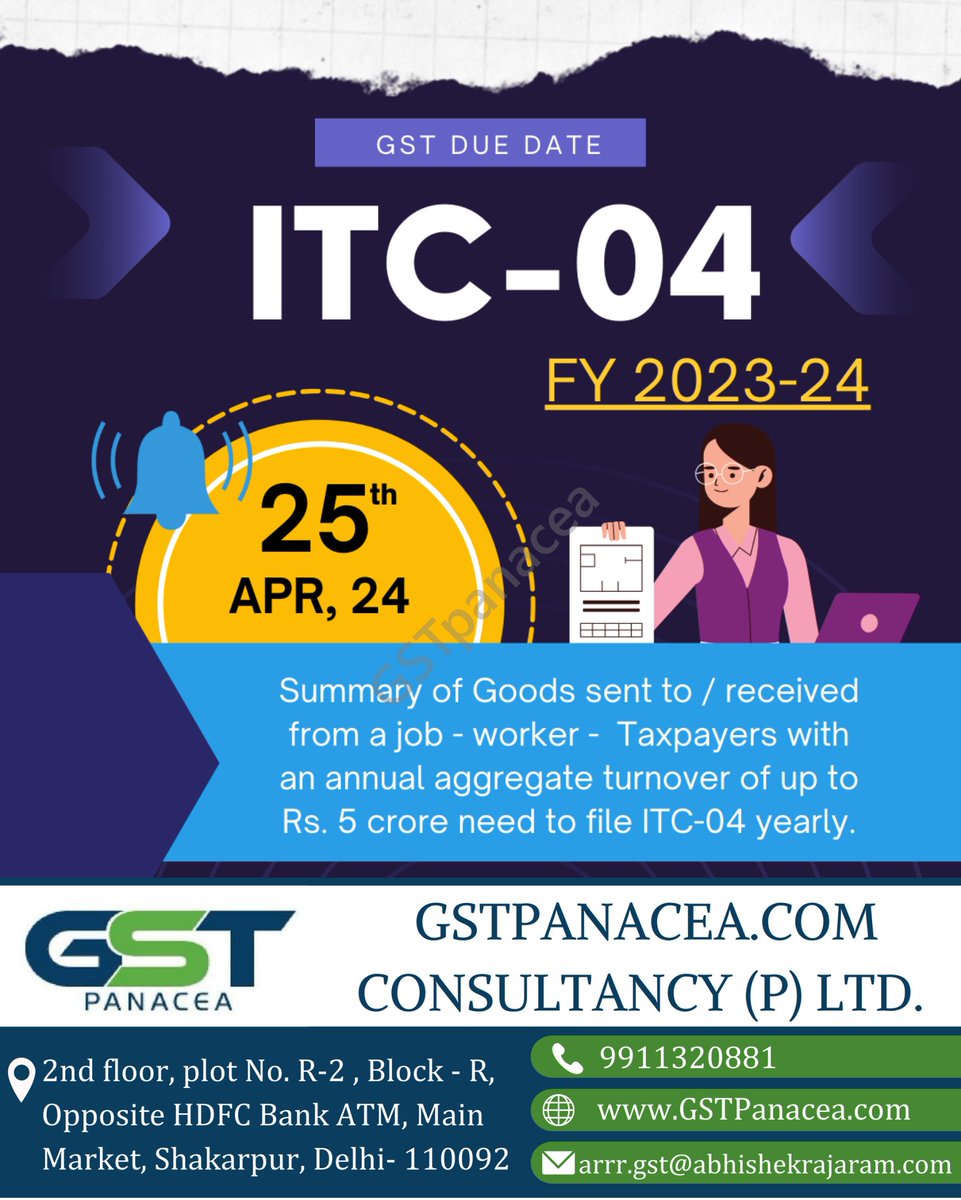

Taxpayers with turnover upto Rs. 5 crore, 25th April,2024 is the last date to file ITC-04 for FY 2023-24. Ensure timely filing to avoid Late Fees.

#ITC04 #InputTaxCredit #GSTCompliance #GSTFiling #GSTIndia #TaxCompliance #GSTReturns #InventoryManagement #TaxReconciliation

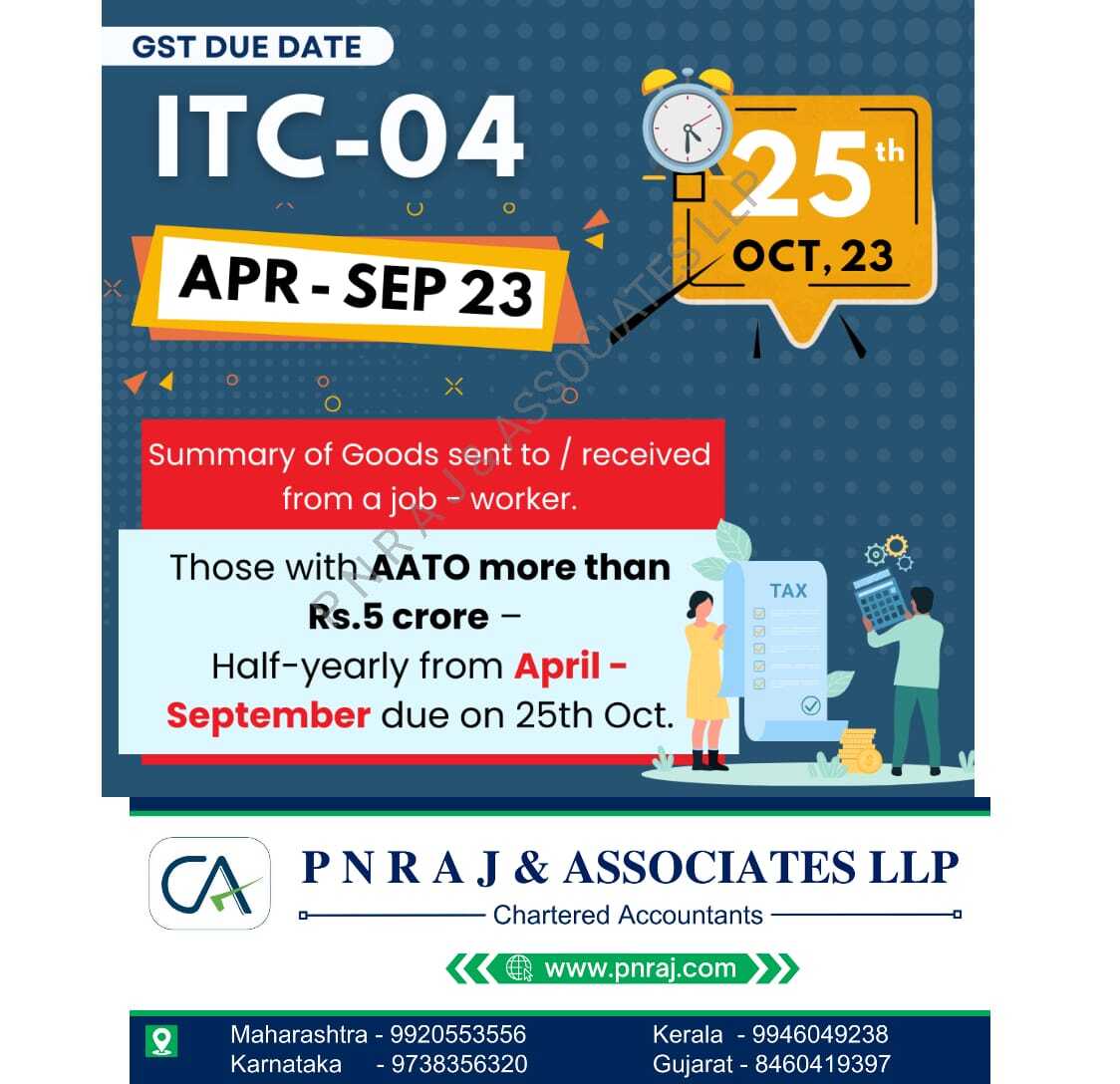

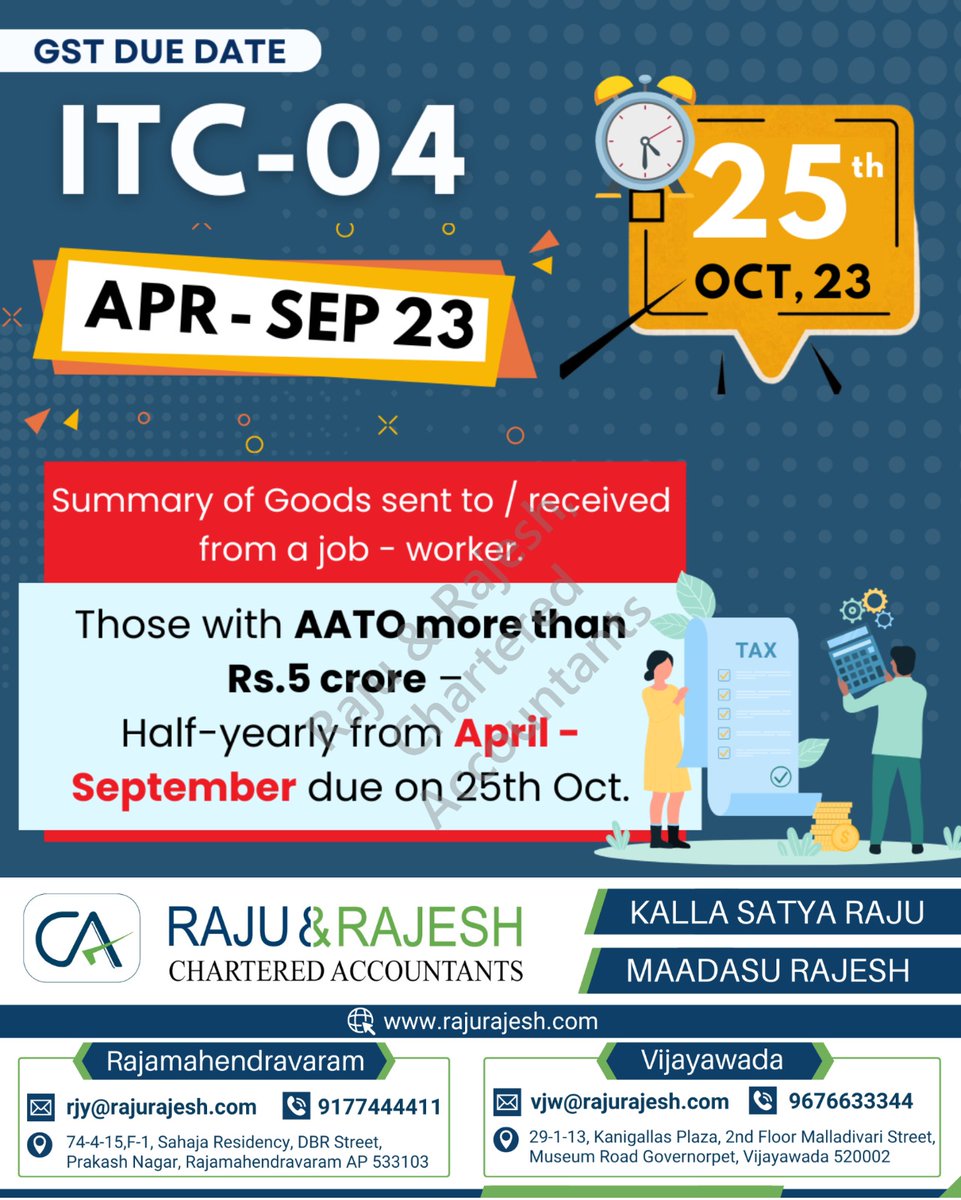

Summary of Goods sent to or received from a job- worker-Those with AATO more than Rs.5 crore - Half-yearly from Oct 23 - Mar, 24 due on 25th April, 24.

#ITC04 #InputTaxCredit #GSTCompliance #GSTFiling #GSTIndia #TaxCompliance #GSTReturns #InventoryManagement #TaxReconciliation

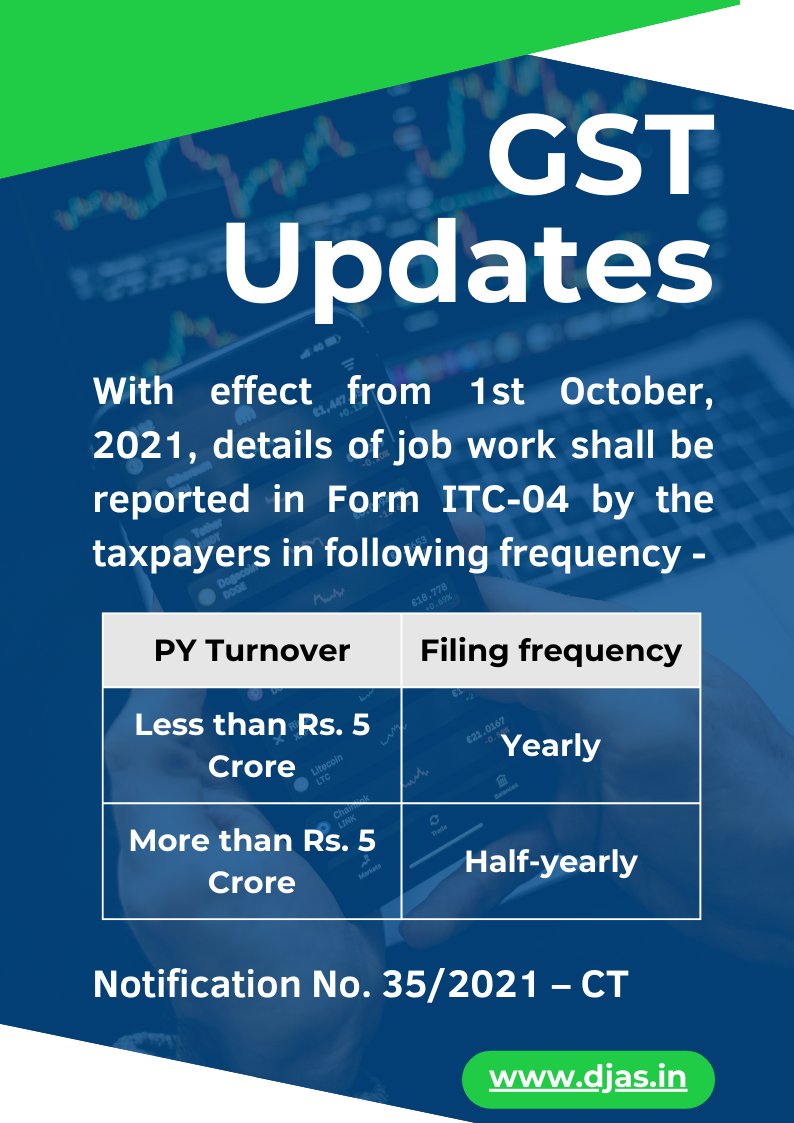

📦 Attention taxpayers! 📊 File your ITC-04 for the summary of goods sent to or received from a job-worker. Taxpayers with an annual turnover of up to Rs. 5 crore need to file ITC-04 yearly.💼📝 #ITC04 #JobWorker #TaxCompliance #JainTaxTech #AccountingServices #CAConsultancy

Summary of Goods sent to or received from a job - worker - Taxpayers with an annual aggregate turnover of up to Rs. 5 crore need to file ITC-04 yearly.

easitax.in

#EasiTax

#ITC04

#InputTaxCredit

#GSTCompliance

#GSTFiling

#GSTIndia

#TaxCompliance

#GSTReturns

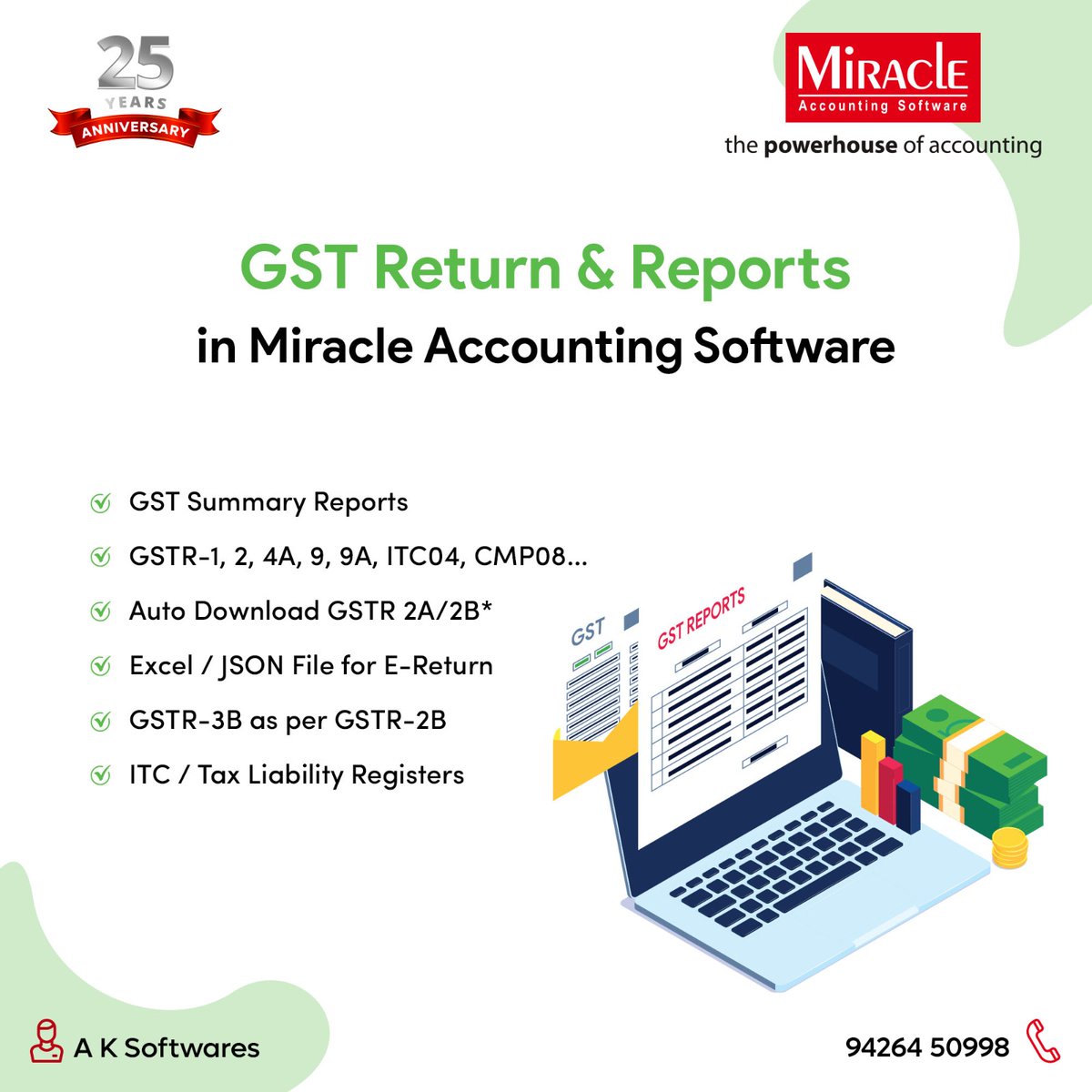

Explore the comprehensive suite of GST Return & Reports in #Miracleaccountingsoftware . From GST Summary to GSTR-1, 2, 4A, 9, 9A, ITC04, CMP08, and more.

Call: 94264 50998 | Visit:aksoftwares.in

#gujarat #ahmedabad #gstupdates #GST

Attention GST Taxpayers!

GST ALERT ITEC-04

Connect with us: - +91-7229903363

Mail us: - [email protected]

Website: - gstnitbuddies.com

#GST #Taxpayers #Form #ITC04 #Quarterly #Filing #Online #JobWorker #cbicindia #gstalert #business #goods #gstnitbuddies #msme