Collateral is King 👑

#WorstBankScenario #multipolarsystem #HQLAx #ECB #bankenfraude #repomarket

imf.org/external/pubs/… [2019]

![Hester Bais (@Wftproof) on Twitter photo 2023-06-16 05:58:51 Collateral is King 👑

#WorstBankScenario #multipolarsystem #HQLAx #ECB #bankenfraude #repomarket

imf.org/external/pubs/… [2019] Collateral is King 👑

#WorstBankScenario #multipolarsystem #HQLAx #ECB #bankenfraude #repomarket

imf.org/external/pubs/… [2019]](https://pbs.twimg.com/media/FyuO-9DWwAUrlpY.jpg)

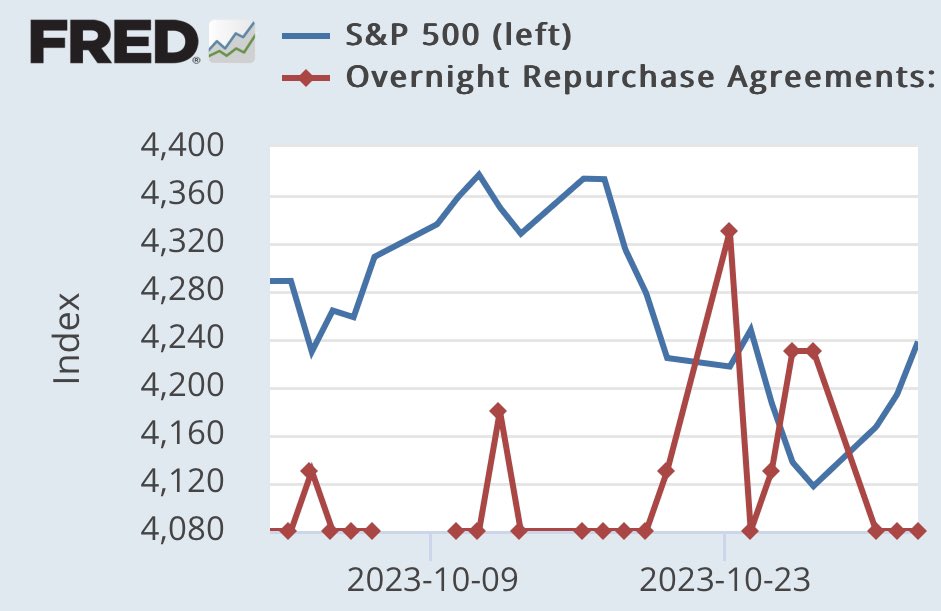

#Gold : Hit bottom as #FederalReserve 🖨️💵 Nov 14 in the #repomarket

🪙Gold now reigns, hovering around record highs in every world FIAT currency.

🪙Amidst prolonged inflation it's the standout asset, 🚀 13% since 2021

🪙Outshining Index’s:** Nasdaq (-9%) & SP (-2%) & 🏡

CIBC Capital Markets' Bipan Rai and Peter Maiorano discussed the Fed's RRP facility and what to make of the decline of funds parked there since mid-year.

Listen to the episode here: cibccm.com/en/insights/po…

#RepoMarket #InterestRates #FederalReserve

“The Netherlands Court of Audit revealed in 2013 that the total amount of guarantees and ownership stakes issued by the Netherlands to the European emergency funds under investigation had increased more than tenfold between 2008 and 2012 [..]”

#collateral #OTC #fraud #repomarket

![Hester Bais (@Wftproof) on Twitter photo 2023-12-30 10:09:19 “The Netherlands Court of Audit revealed in 2013 that the total amount of guarantees and ownership stakes issued by the Netherlands to the European emergency funds under investigation had increased more than tenfold between 2008 and 2012 [..]”

#collateral #OTC #fraud #repomarket “The Netherlands Court of Audit revealed in 2013 that the total amount of guarantees and ownership stakes issued by the Netherlands to the European emergency funds under investigation had increased more than tenfold between 2008 and 2012 [..]”

#collateral #OTC #fraud #repomarket](https://pbs.twimg.com/media/GClpgPDW0AAn3nc.jpg)

Travis Whitmore, senior quantitative researcher at State Street Associates and Cassandra Jones, head of financing solutions client management, State Street Global Markets EMEA, review the evolution of the #RepoMarket . Read more here: ms.spr.ly/6010ghuMk

Travis Whitmore, senior quantitative researcher at State Street Associates and Cassandra Jones, head of financing solutions client management, State Street Global Markets EMEA, review the evolution of the #RepoMarket . Read more here: ms.spr.ly/6017gCsvH

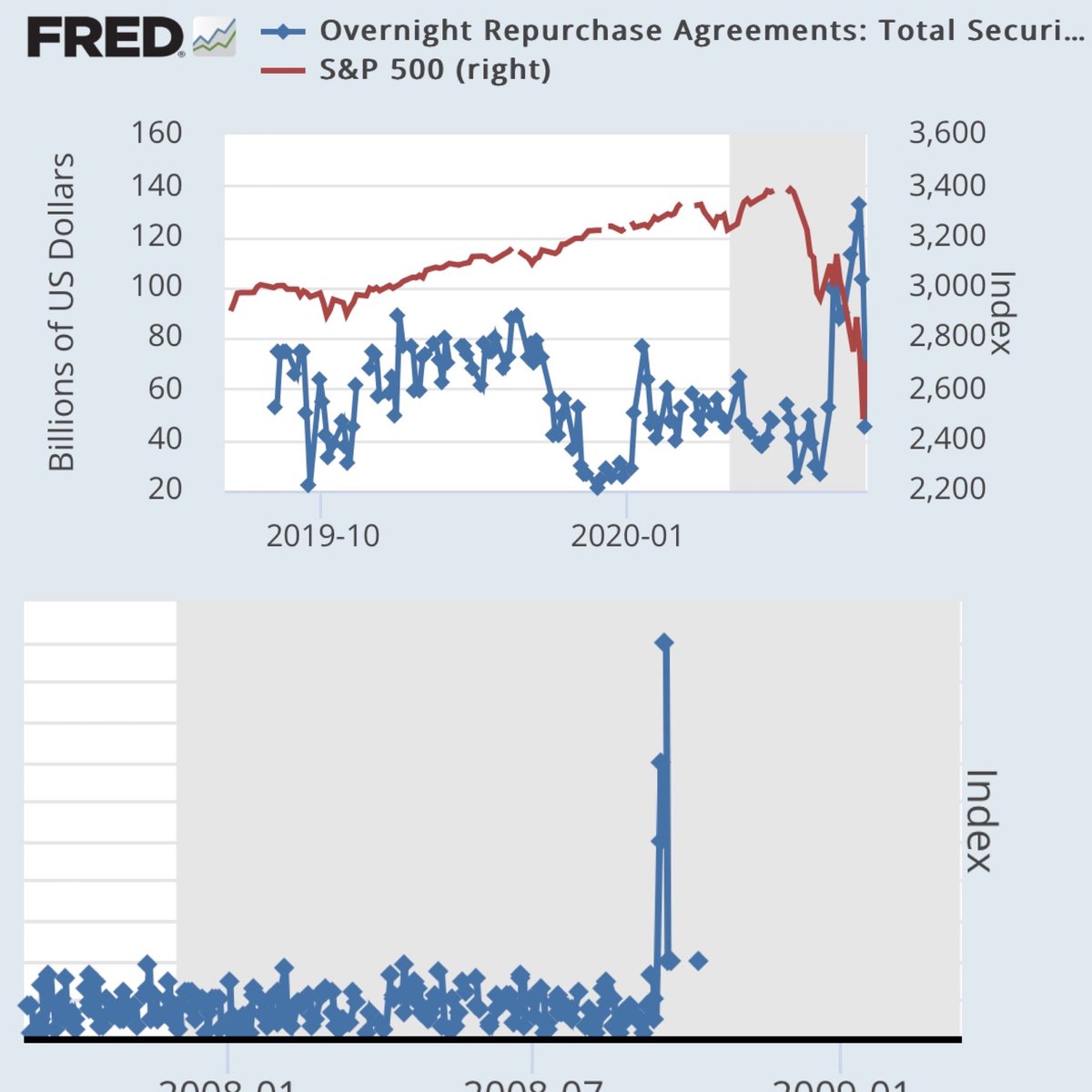

🔸 The Secured Overnight Financing Rate, a benchmark connected to overnight repo transactions, rose to a new all-time high of 5.40% as of Dec. 28, according to New York Fed data published Friday.

2/3

#repomarket $USD

Peter St Onge, Ph.D. Collateral (gold, (state)debts and carbon included) is King. 👑

#multipolarDLTsystem #CBDC #TransatlanticPlan #centralbanks #investmentbanks #assetmanagers #BrettonWoods #centralizationassets #upgradingassets #repomarket #liquidity #collusion #fraud

amazon.co.uk/dp/B0CNQYK2LS/…

Larry La Tache Nice picks! I’m keen to try Theo Dancer. Got these ones yesterday passing through France otw to Spain. 1/2 suitcase full of wine

📝How does QE impact bond and money markets? More in SAFE Working Paper No. 395 'Quantitative Easing, the Repo Market, and the Term Structure of Interest Rates' by Ruggero Jappelli, Loriana Pelizzon, and Marti Subrahmanyam.

👉papers.ssrn.com/sol3/papers.cf… #RepoMarket