I am extremely grateful to the FM Nirmala Sitharaman (Modi Ka Parivar) mam for considering my suggestions on #GST regarding #GST Amnesty scheme & #waiver /reduction of #latefee / #penalty in GSTR9/9C

#Extremelyhappy to share that suggestions in this video has been accepted in the 49th GST Council meeting.

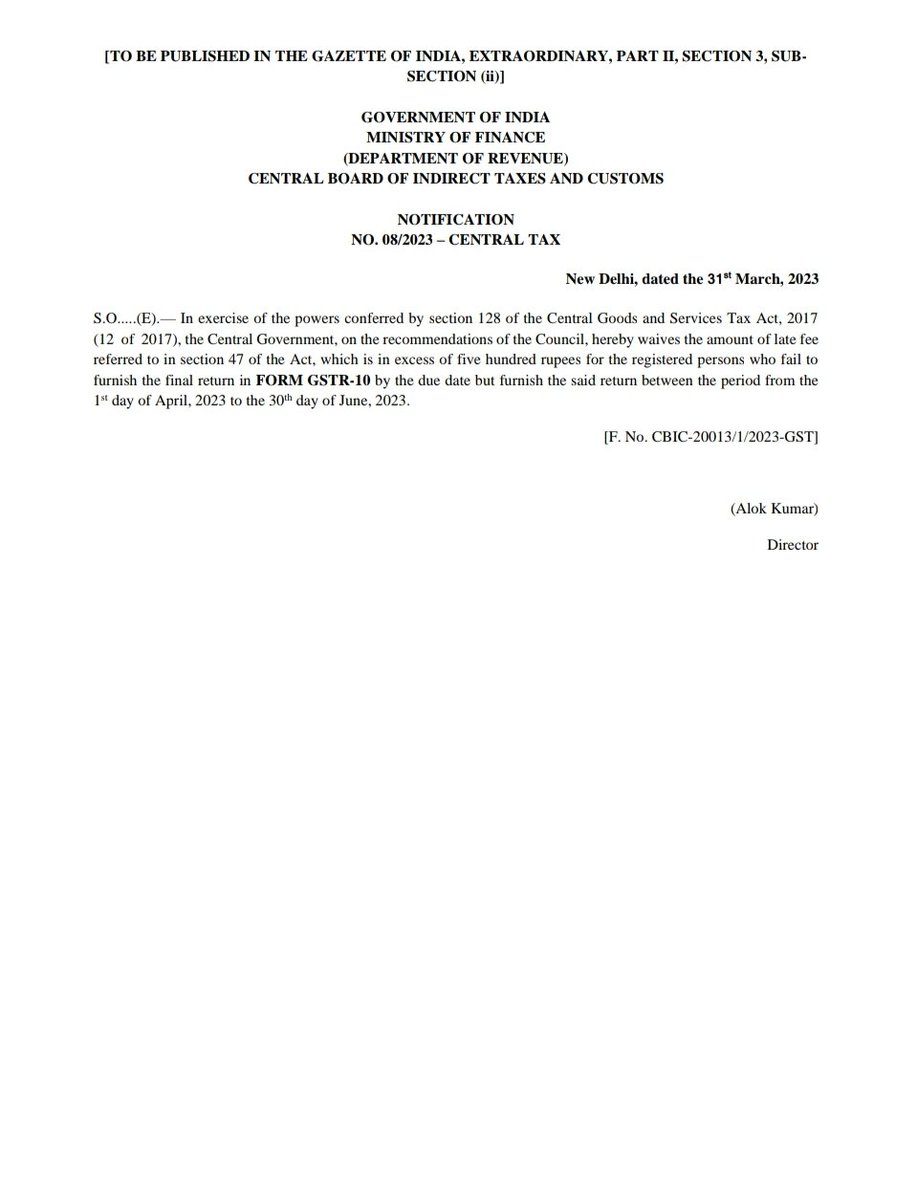

Notification No.08/2023 Central Tax dated 31.03.2023

Maximum late fee for filing final return in form GSTR-10 (if not filed in the past) is restricted to Rs.1,000/- if filed between 01/04/23 to 30/06/23 (instead of Rs.10,000/-)

#gstupdate #gstamnesty

Revocation of Cancellation!

49th GST Meeting recommended to increase time limit for Revocation of Cancellation.

#GST #gstamnesty #gstcouncil #tax #GabbarSingh #tax #BNI #Mumbai #mahagst

🔔Dive into the latest on the GST Amnesty scheme and Appeal Filing nuances! 🚀 Swipe to explore our breakdown. Thoughts? #GST Amnesty #AppealFiling #TaxInsights #GST #GST Updates #taxupdates

For more details or inquiries, please DM me!

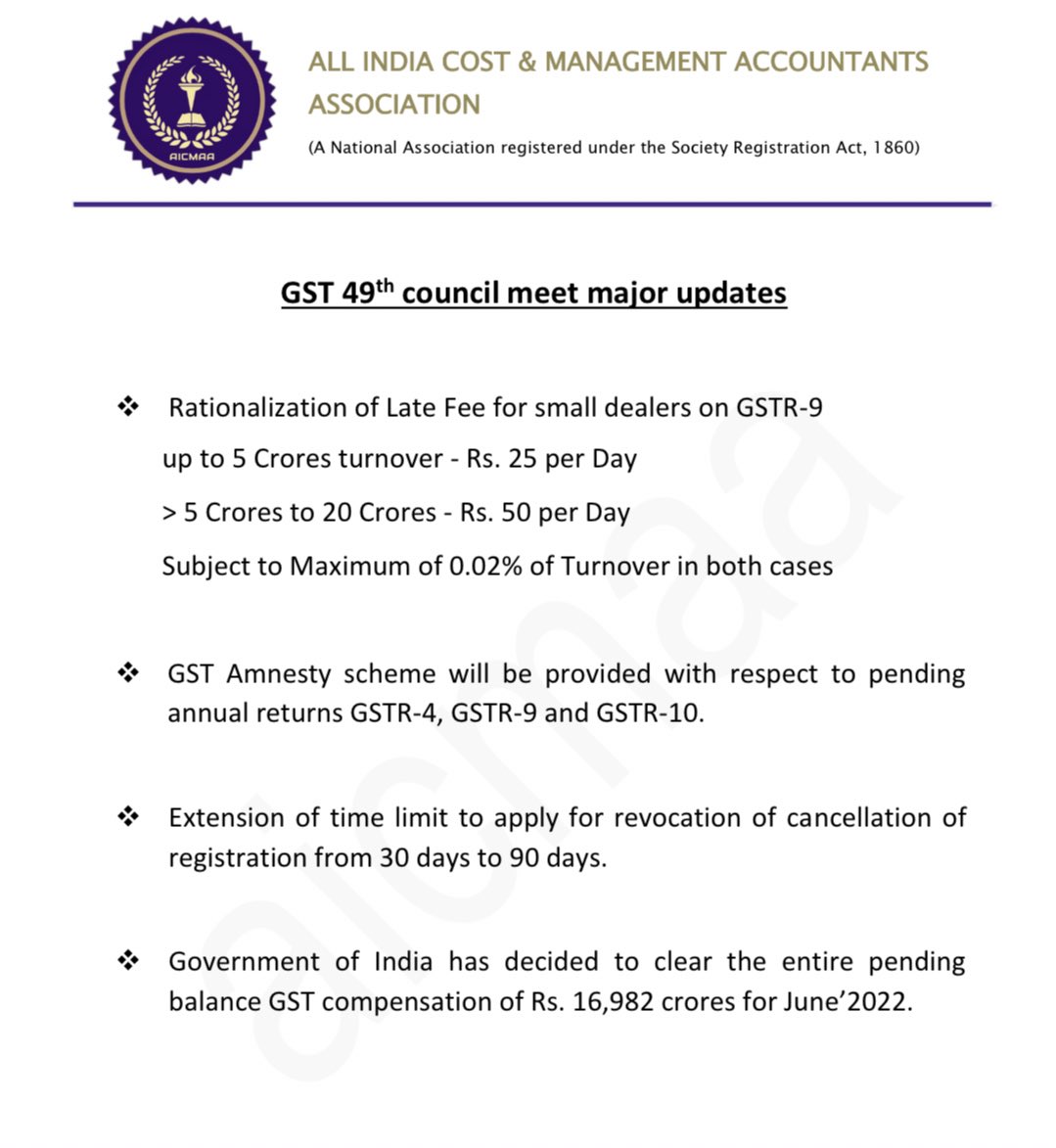

49th GST Council Meeting

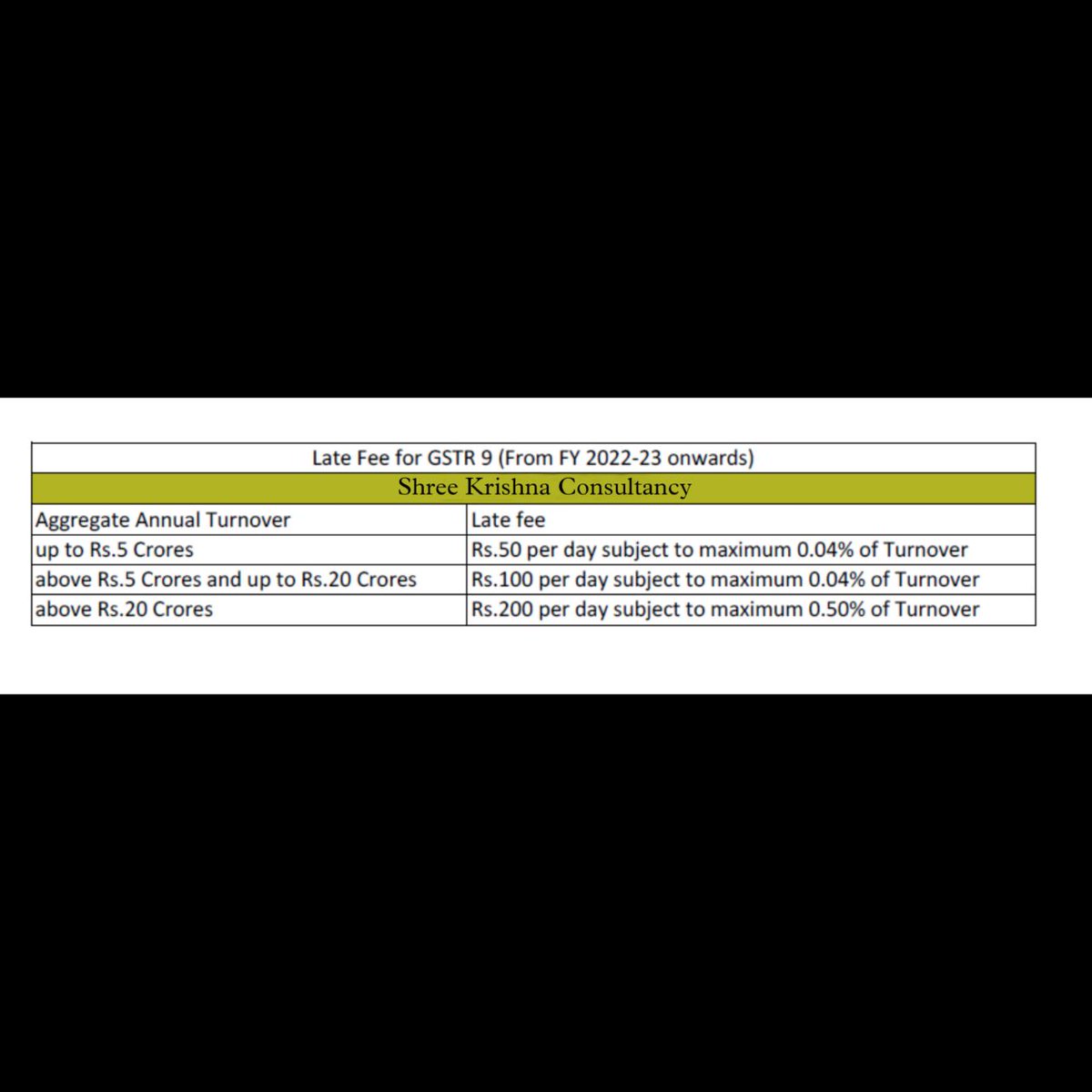

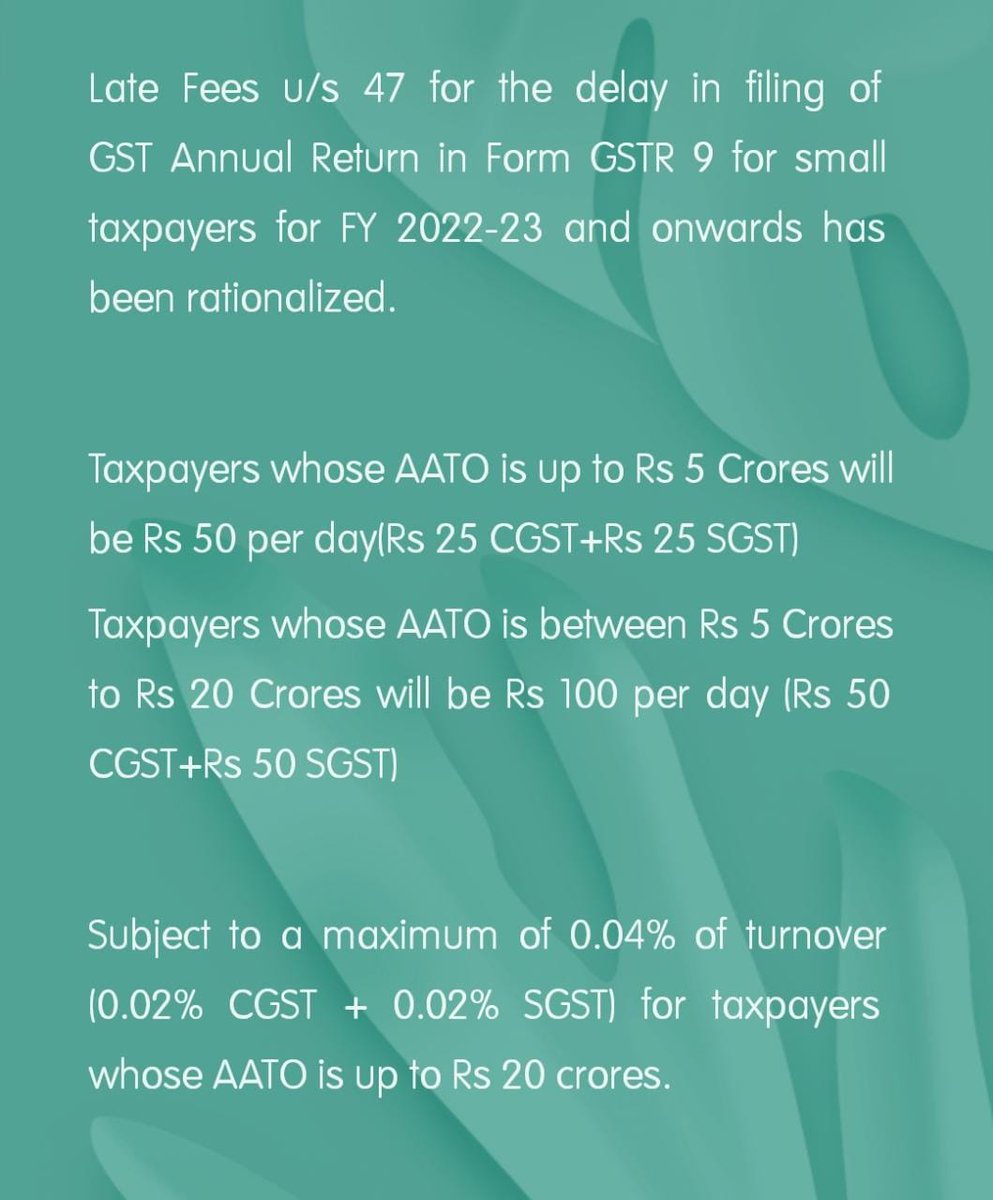

Late Fees u/s 47 for the delay in filing of GST Annual Return in Form GSTR 9 for small taxpayers for FY 2022-23 and onwards has been rationalized.

CA Ajay Laxkar

Mumbai

#gst #GSTCouncil #GSTCouncil meeting #GstAmnesty #GSTC2023

🟥How to Solve your GST Issues using Amnesty Scheme

Faculty - CA Abhishek Raja Ram

Know More

bit.ly/3FJIKJz

#CourseonGSTAmnesty #GST Amnesty #GST #Amnesty #Practice #Pleading #PracticallyHowtohandleGSTNotices #GST Notices #HowtohandleGSTNotices #GST NoticesonAssessment

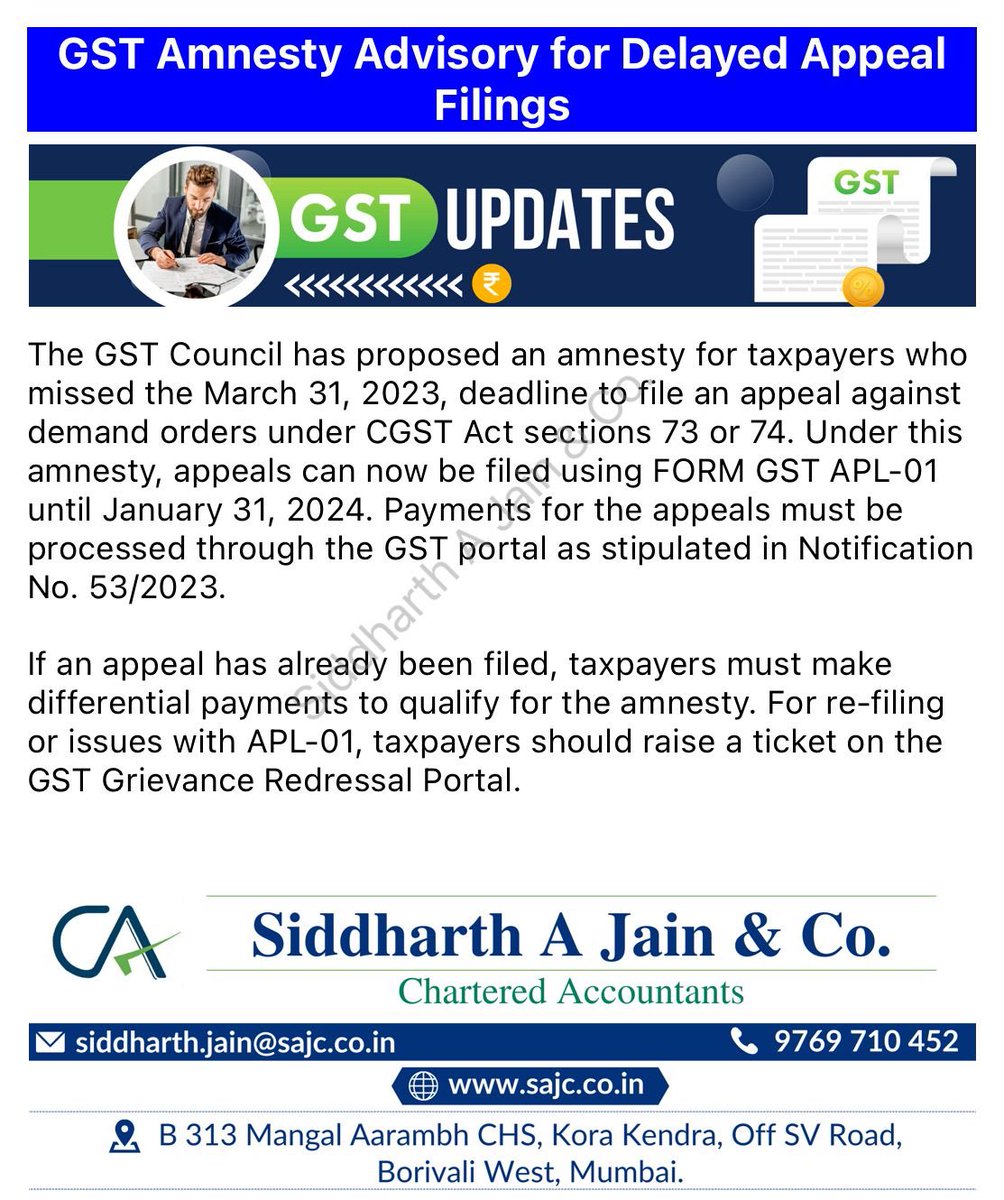

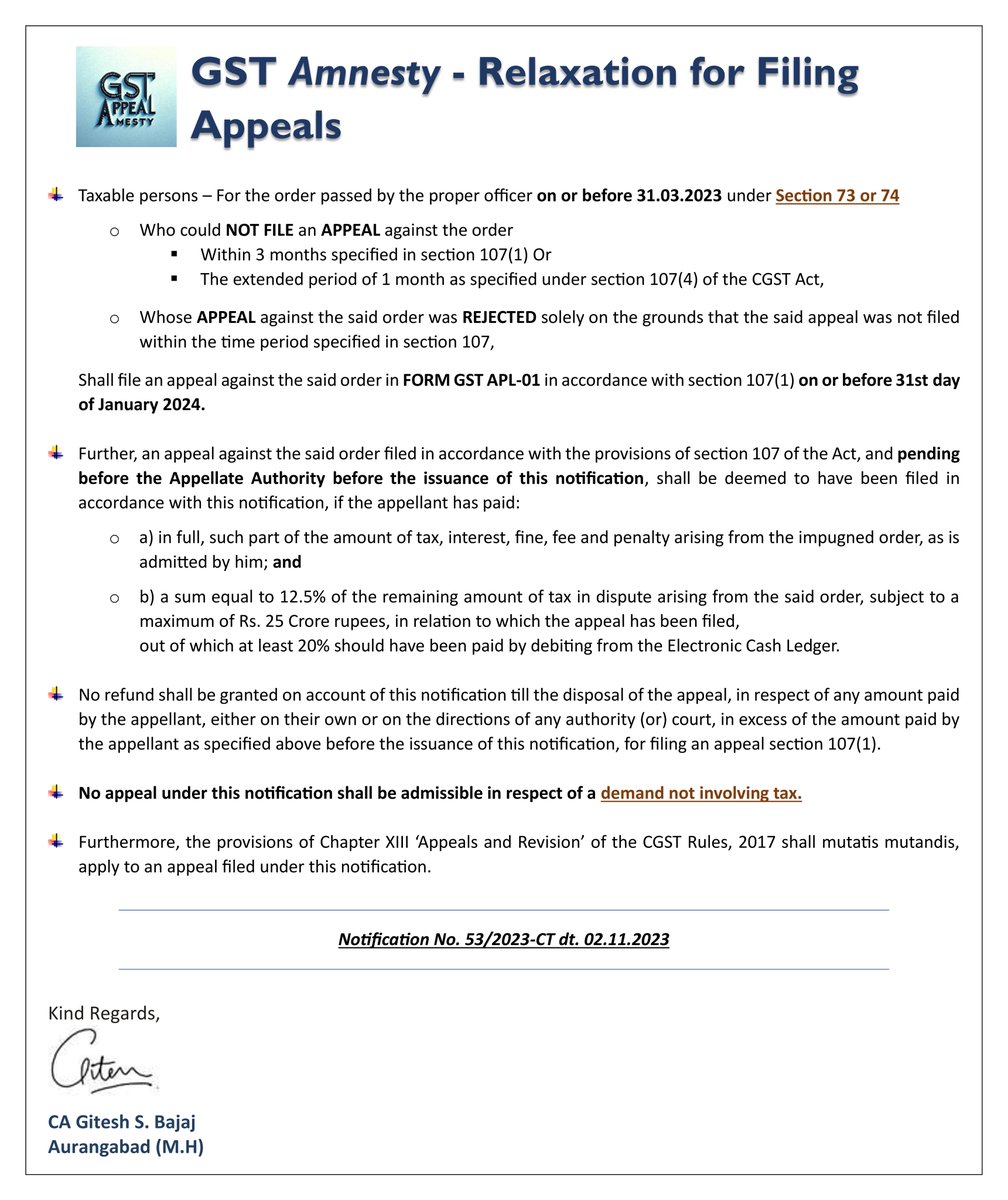

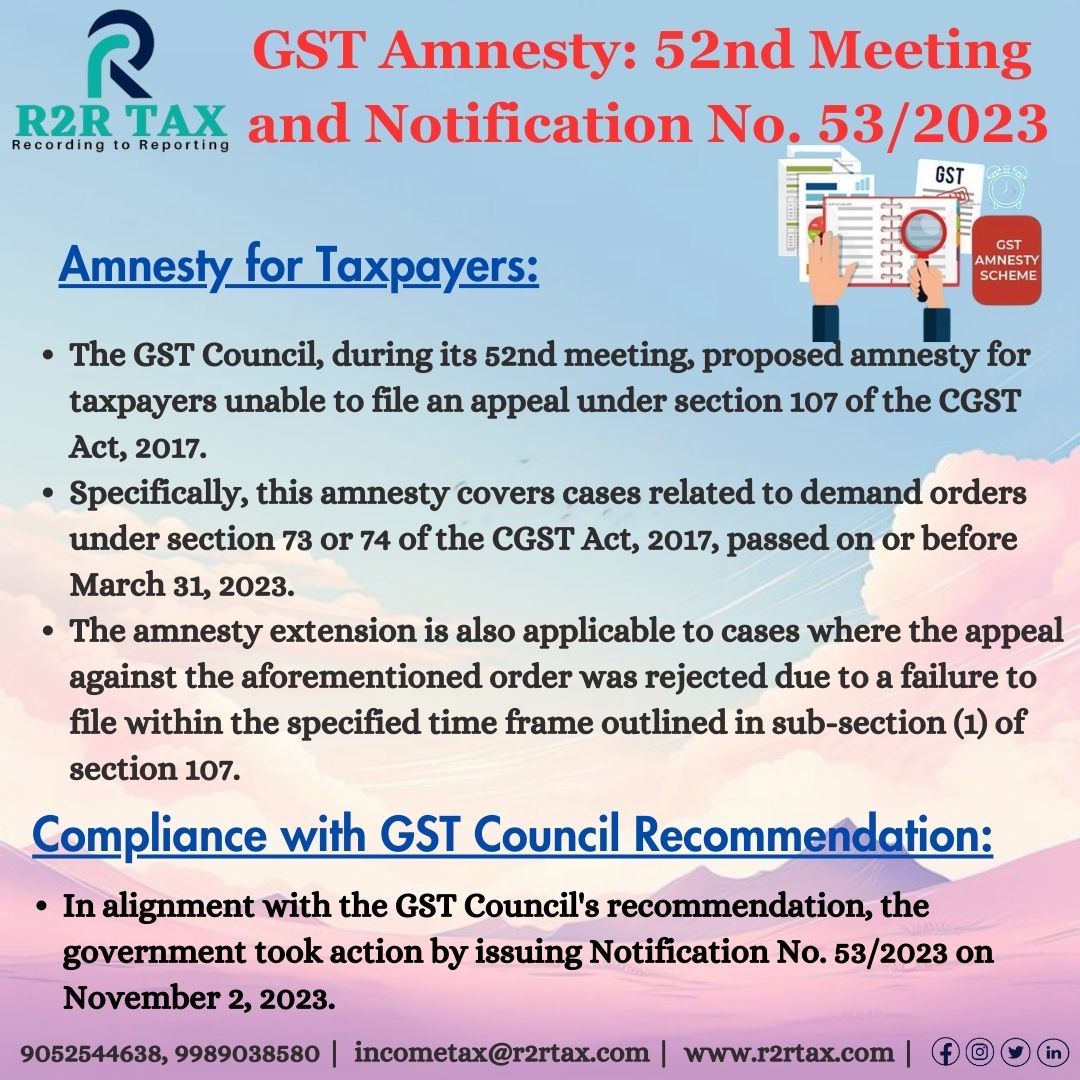

GST Amnesty: 52nd Meeting and Notification No. 53/2023 Summary.

Follow @r2rtax for more updates and be a part of @r2rtax

#GSTAmnesty #TaxpayersRelief #CGSTAct2017 #52ndGSTCouncilMeeting #Notification53_2023 #TaxCompliance #instagram #facebook #linkedin #twitter #r2rtax

Please #Extend_Due_Dates_Immediately #GSTAmnesty #gstr4 #gstr9 #gstr1 #GSTR3B #GSTLateFees500 #savegst PMO India Narendra Modi Narendra Modi_in Ministry of Finance #ResignNirmalaSitaraman #ResignFm Nirmala Sitharaman (Modi Ka Parivar) Anurag Thakur (मोदी का परिवार) GST Council Sushil Kumar Modi (मोदी का परिवार ) CBIC

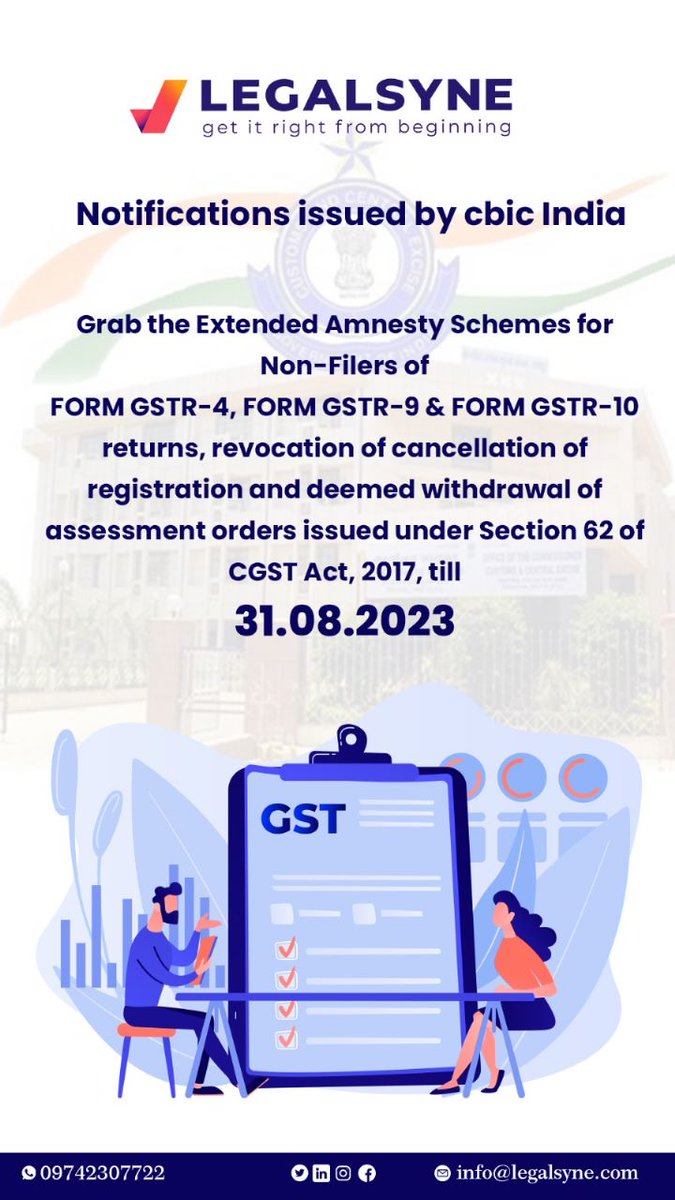

Extended amnesty schemes for non-filers of GSTR-4, GSTR-9 & GSTR-10 returns, registration cancellation revocation, and assessment order withdrawal till 31.08.2023. CBIC

#ExtendedAmnesty #GSTAmnesty #GSTR4 #GSTR9 #GSTR10 #CBIC #TaxCompliance #BusinessNews #DeadlineExtended

ரத்து செய்யப்பட்ட GST பதிவை திரும்பப்பெறுதல் மற்றும் GSTR -4 தாக்கல் செய்யாதவர்களுக்கான பொது மன்னிப்பு திட்டம்.

#gstamnesty #GST Registration #gstupdates #gstreturns #gstamnesty scheme #gstindia #GST