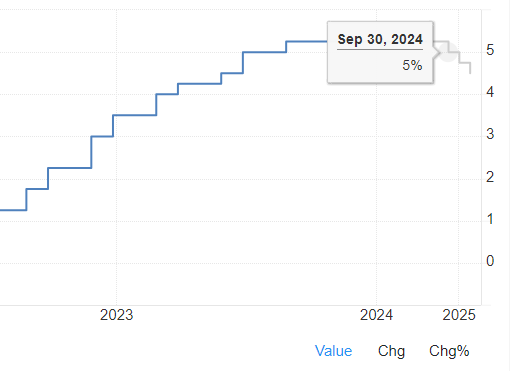

#Interestrate

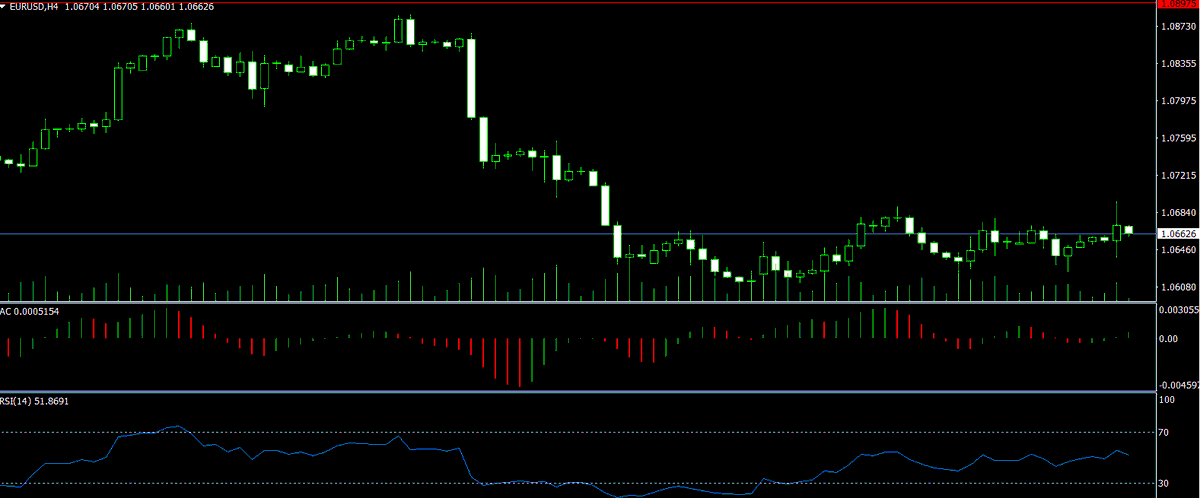

US Interest rate

Interest rate 5.75 may be possible. but after August 2027 may be fully raise.

Importance of stock selection:

#quantzaar #wealth #company #investor #portfolio #PEratio #startup #finance #CFA #fintech #MutualFunds #recession #bonds #corporate #RBI #interestrate #OptionsTrading #trading #investments #CryptoCommunity #Cryptos #NiftyBank

श्री हनुमान जयंती की हार्दिक शुभकामनाएं।

#hanumanjayanti #happyhanumanjayanti #hanumanjayanti 2024 #banking #cooperativebank #fixeddeposit #interestrate #loans #advances #adarshbank

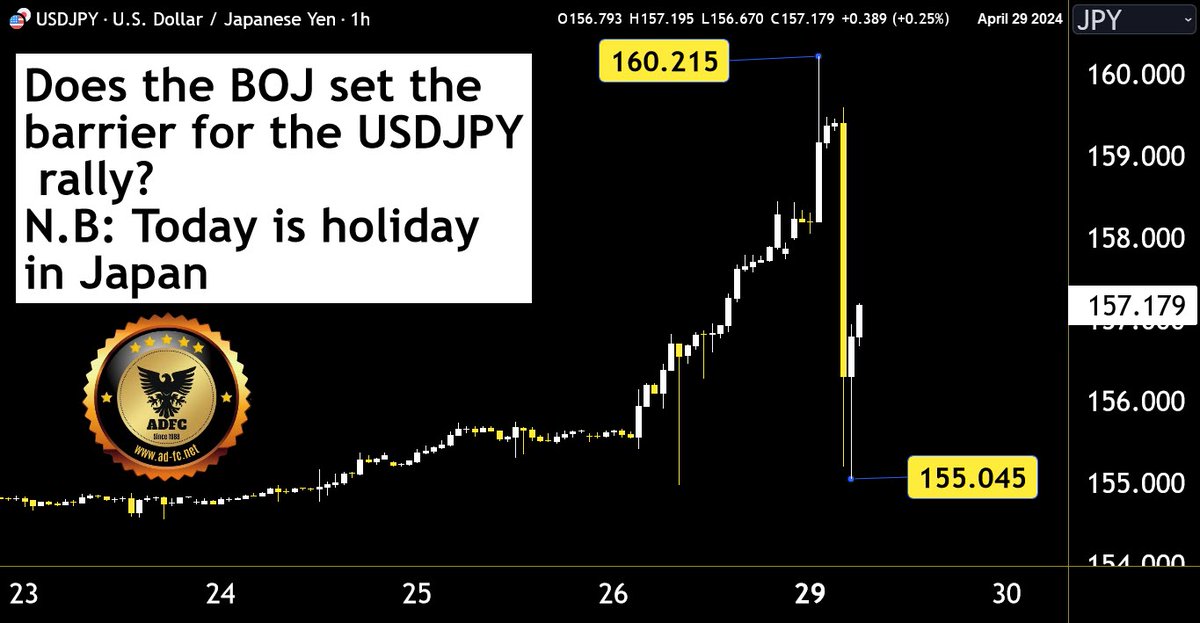

Mon 29 Apr, In the #CommoditiesMarket , #XAU down $1.83 (-0.08%) to 2335.89. $GLD prices up on Mon, helped by a #WeakerDollar , as focus turns to the #FederalReserve ’s #PolicyMeeting & #US #NonFarmPayrolls data due this week for cues on the #CentralBank ’s #InterestRate trajectory.

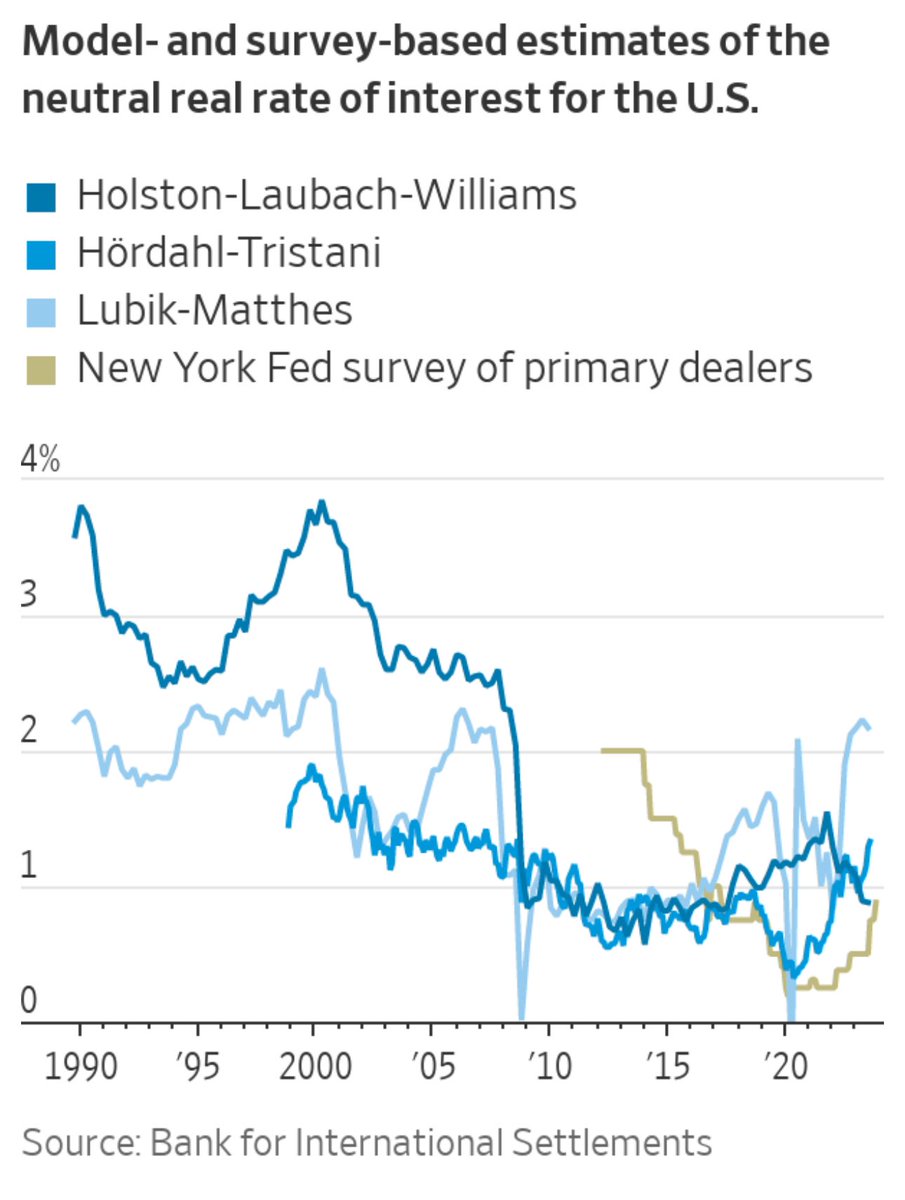

Even If the Fed Cuts, the Days of Ultralow Rates Are Over

Soaring budget deficits and investment needs mean the ‘neutral’ interest rate may be higher

wsj.com/economy/centra… #interestrate #Fed #QE #economy #centralbanks #Fed eralReserve #

#CLO issuance has blossomed in the first quarter of 2024 despite a higher for longer #interestrate environment. Leveraged loan volume and refinancing activity is up significantly year-over-year, and #structuredcredit transactions, including broadly syndicated loan and

Well the data indicates in next 5-6 months market can fall. Time to buy Put ?

What do you think?

#inflation #us #america #fed #interestrate

NAR Predicts Rent Decline in 2024, Interest Rates to Follow

roomvu.com/agent/travis-b…

#mortgage rate #interestrate #VAloan #Homeloan #mortgage #realestate #homebuyers #realestate agent #realestate investing

MARKET UPDATE: The Monetary Policy Committee has decided to keep the policy rate UNCHANGED at 22%.

#KTradeSecurities #KTradeisBullishonPakistan #InterestRate #Marketupdate