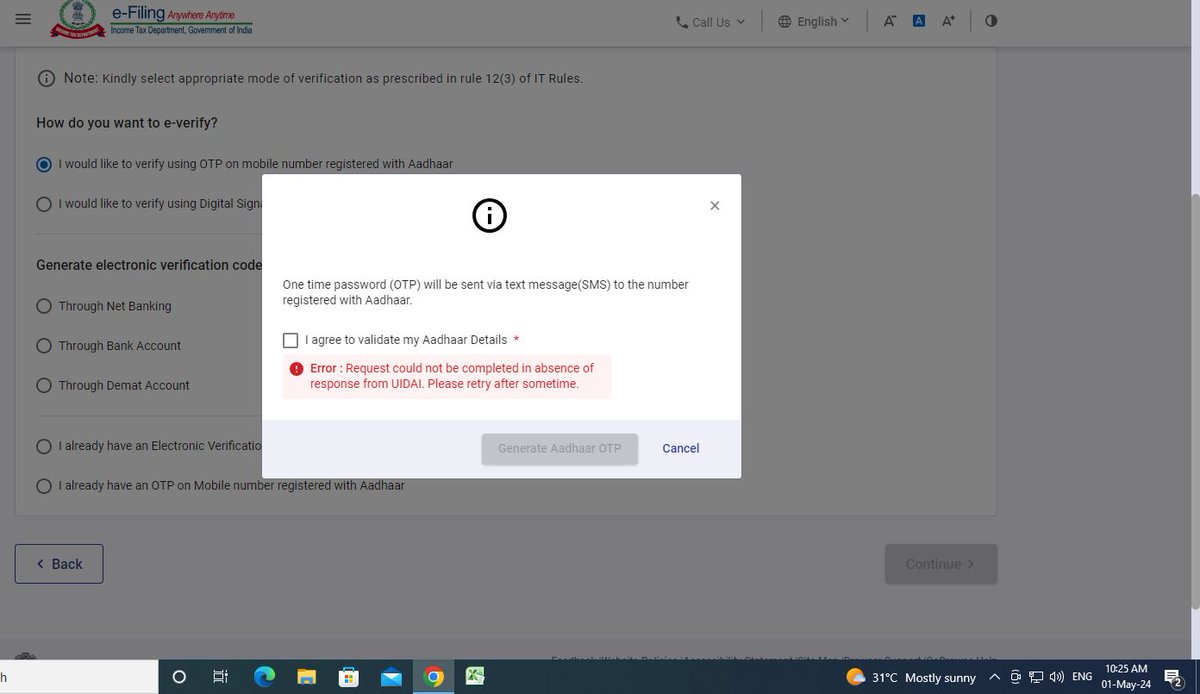

Payment successful होने के बाद भी income tax उसको payment failed दिखा रहा है ...... और आज दो दिन बाद भी ना तो refund आ रहा है ना challan update हो रहा हैं

Income Tax India @CBDT Income Tax Rajasthan Nirmala Sitharaman (Modi Ka Parivar)

पता नहीं कितने साल लगेंगे इन्कमटैक्स पोर्टल को ठीक होने में Narendra Modi Amit Shah (Modi Ka Parivar) Income Tax India Nirmala Sitharaman (Modi Ka Parivar) Nirmala Sitharaman (Modi Ka Parivar)offc PMO India cbdt Nitin Gadkari (मोदी का परिवार) Infosys

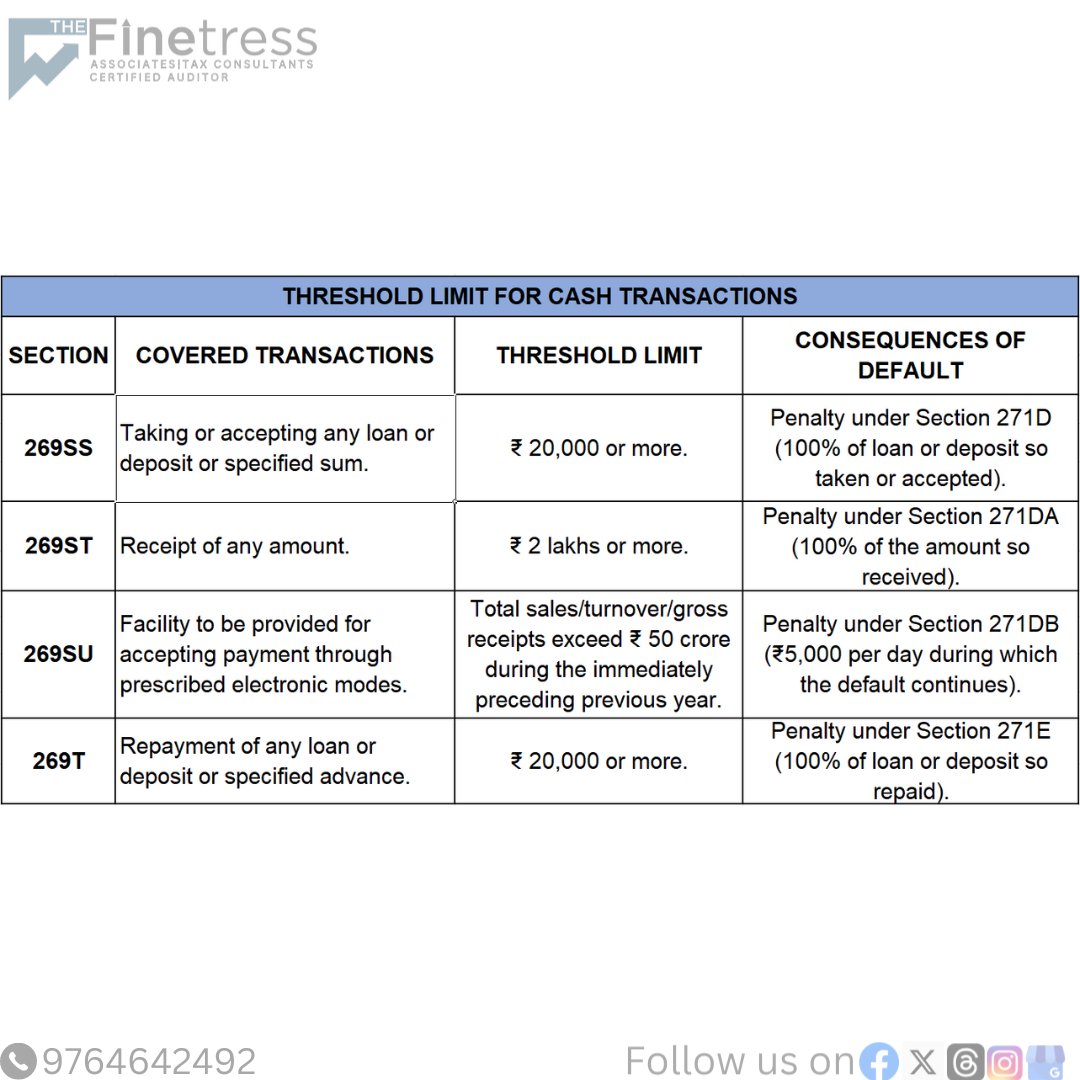

#incometax #tax #cbdt #indiatax #tax forms #indiantax #indianincometax #incometax act #duedate #itr #tax calendar #tax consultant #thefinetress #certifiedauditor

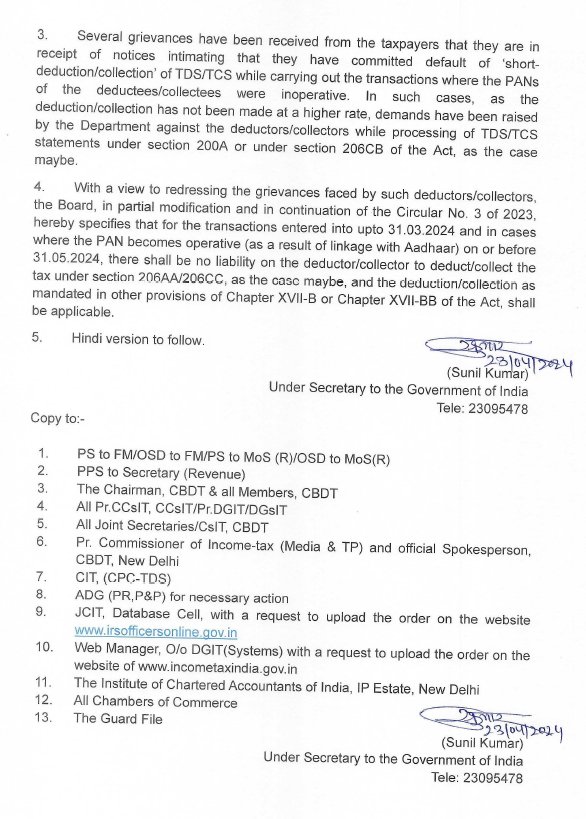

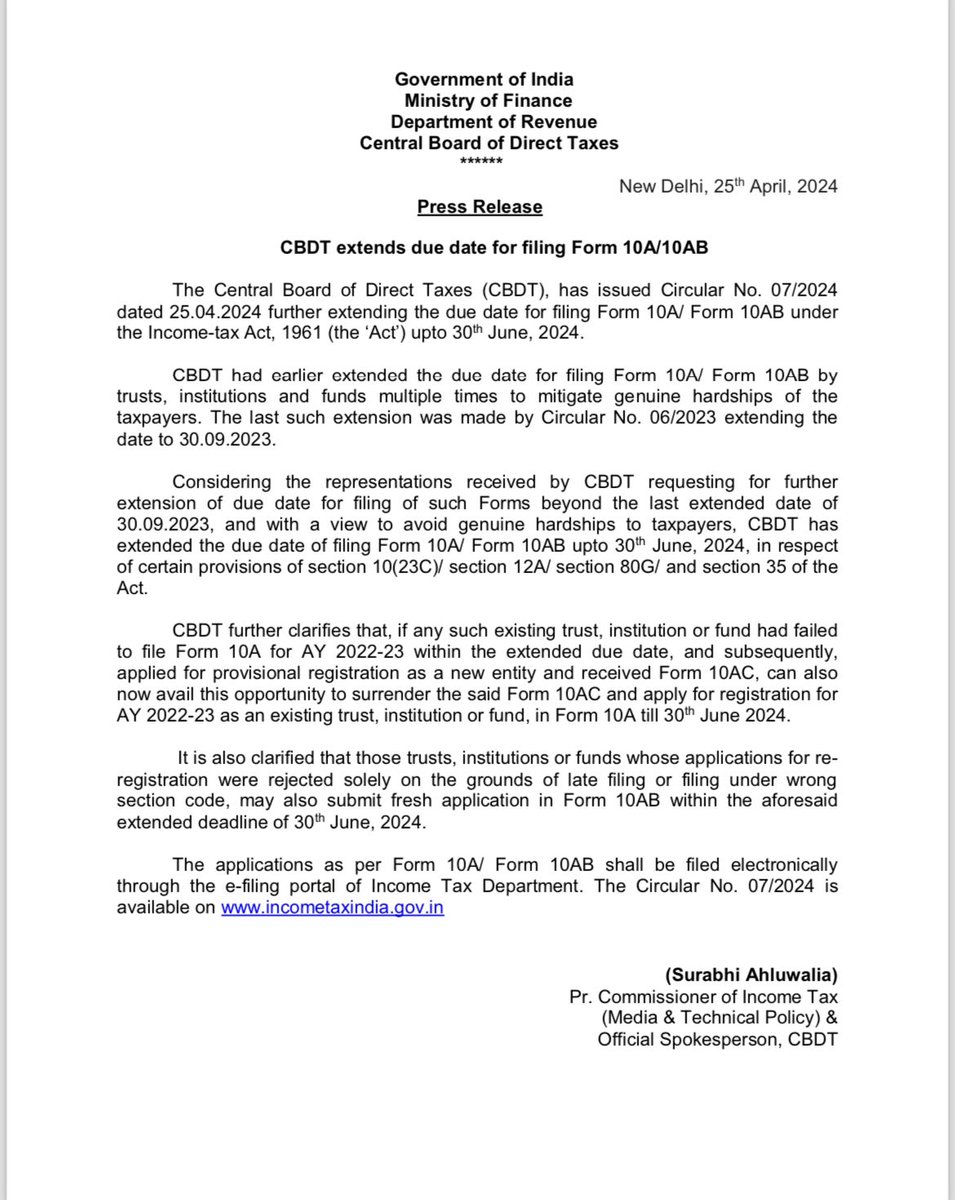

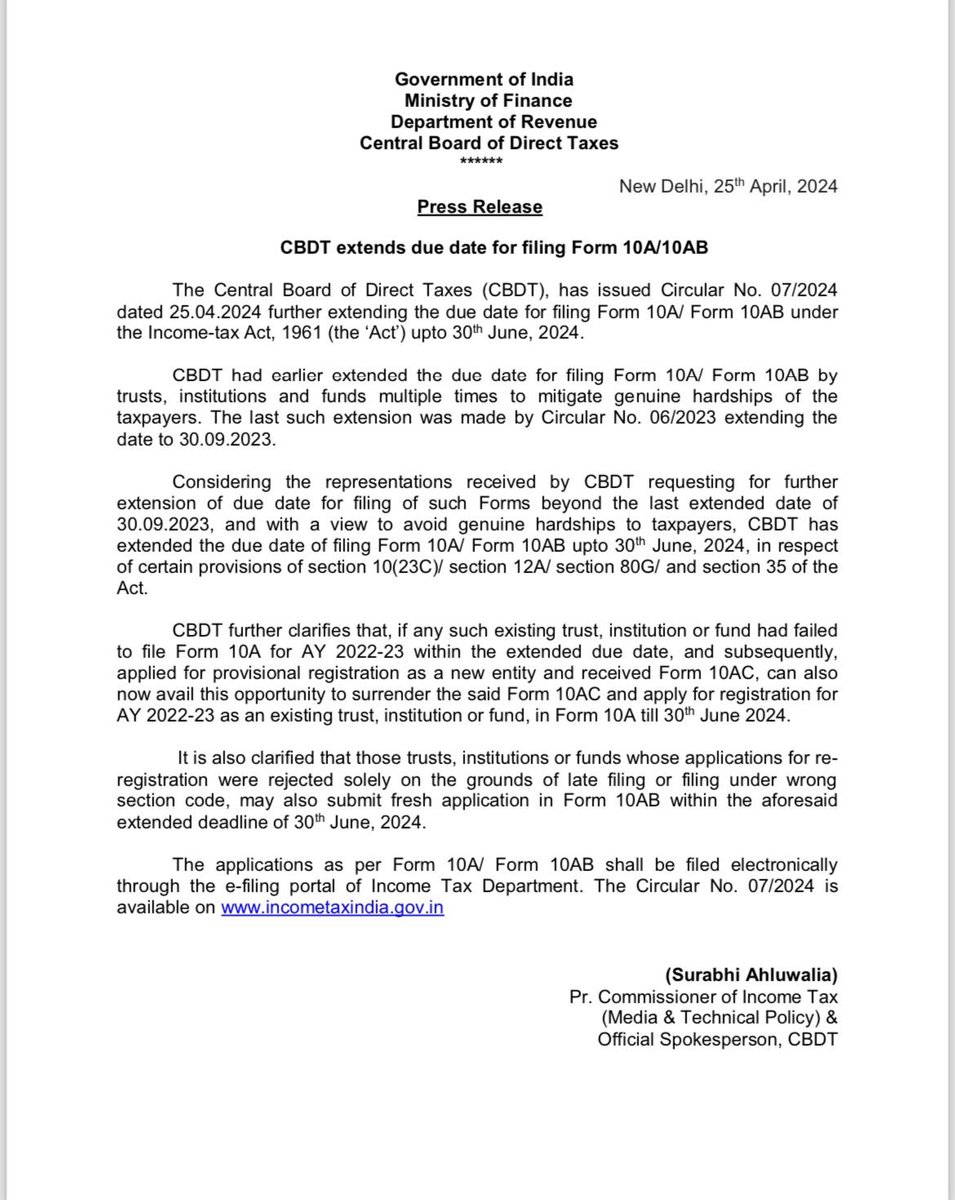

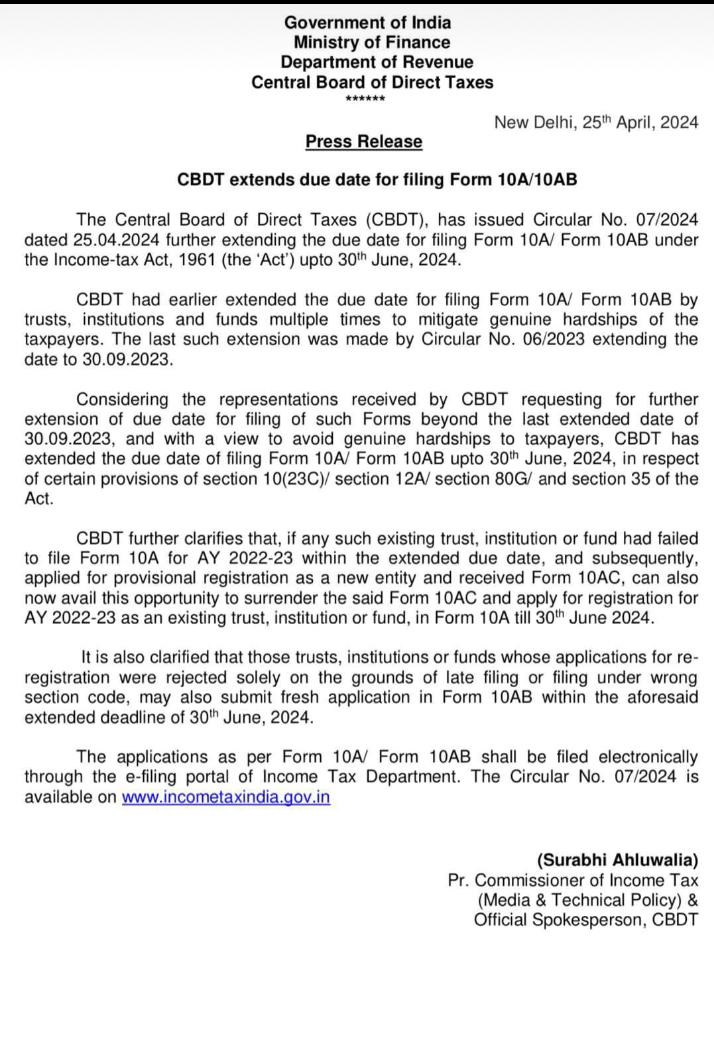

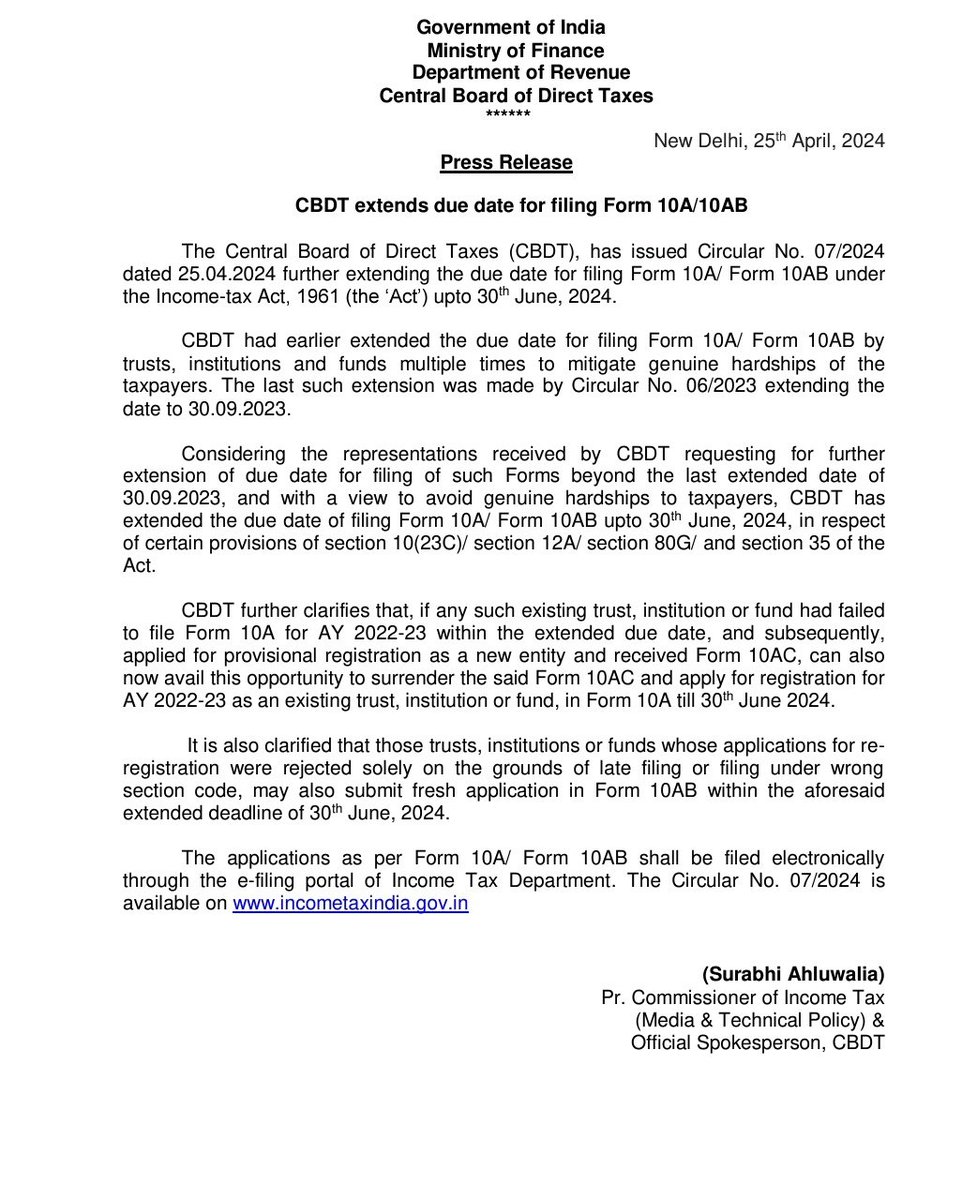

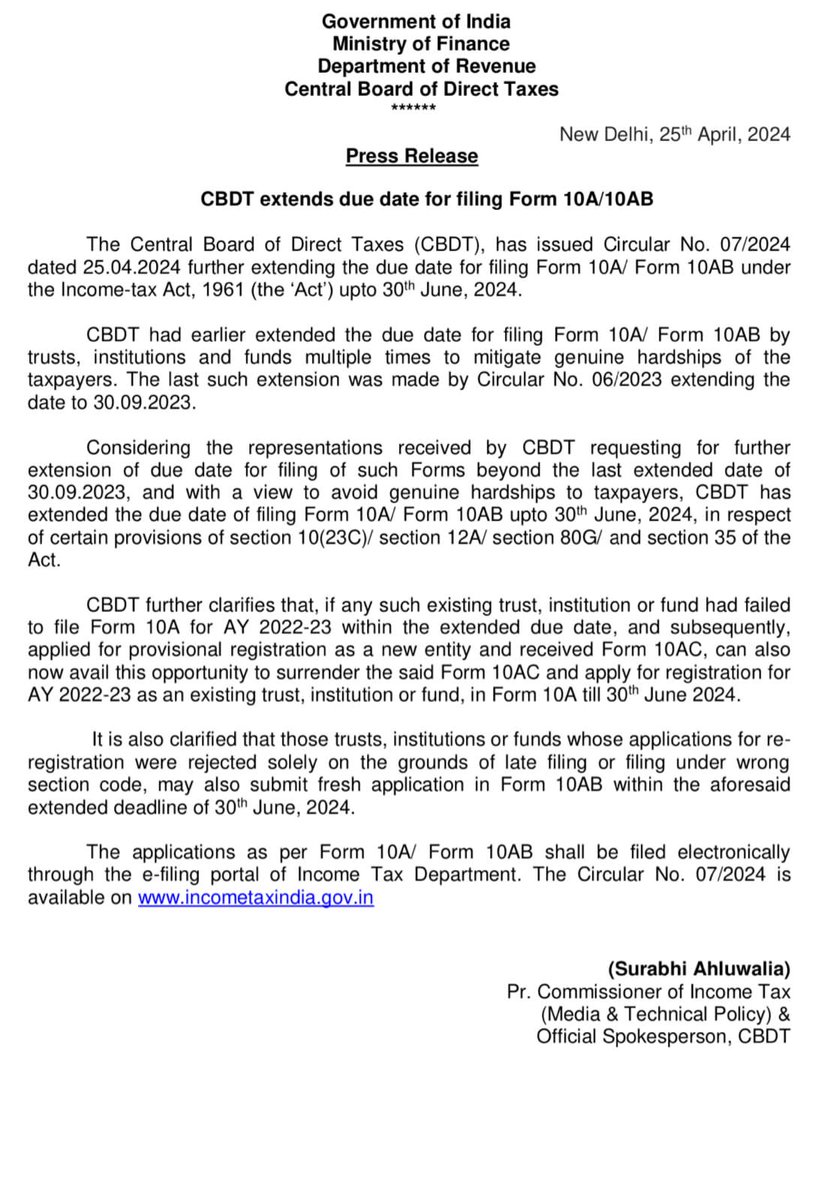

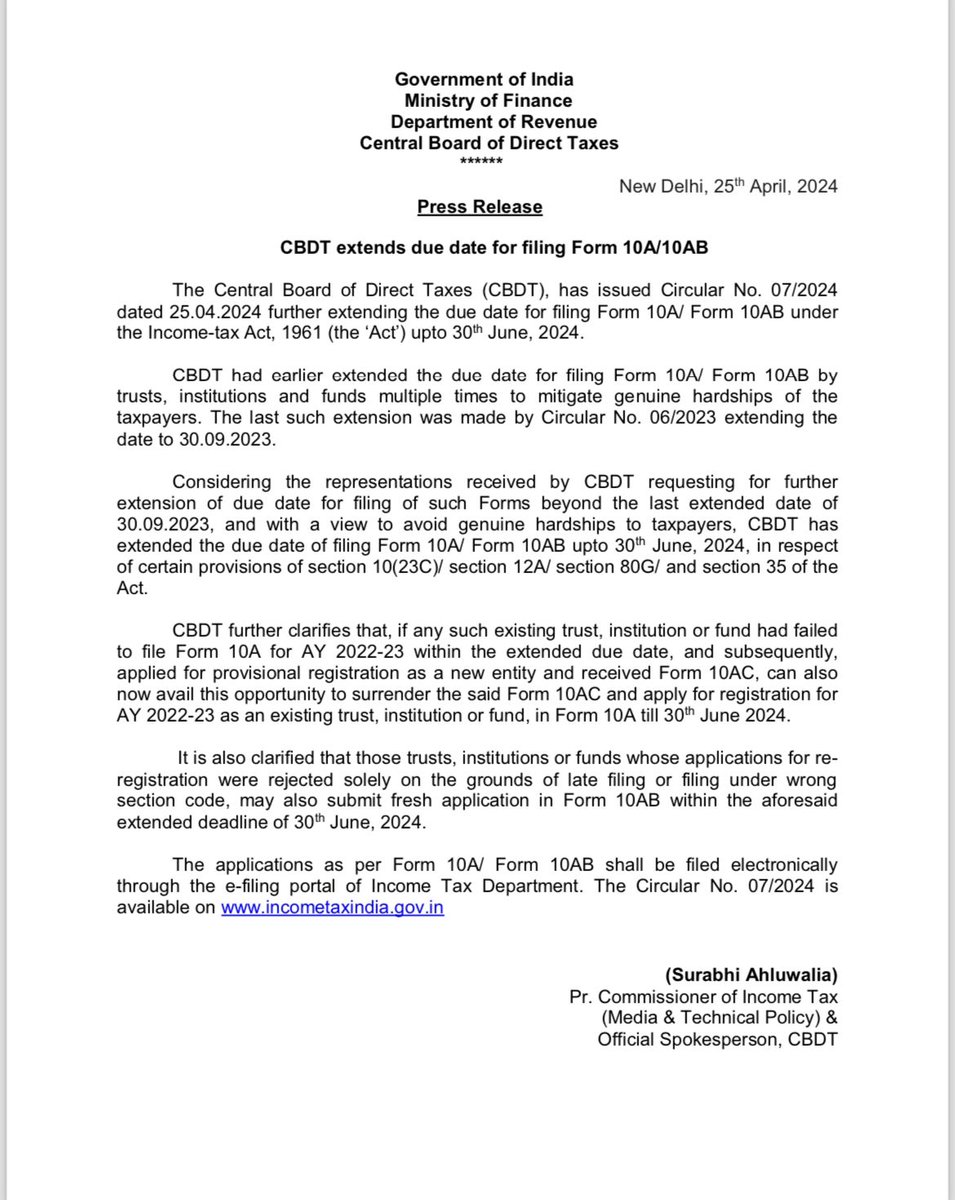

CBDT ने बढ़ाई #Charitable Trusts register करने की तारीख अब 30 Jun 24 तक कर सकेंगे apply.. register करने के लिए संपर्क करें

CBDT further extends time limit to 30th June 2024 for filling Form 10A/10AB beyond extended time limit of 30th Sept 2023

#IncomeTax

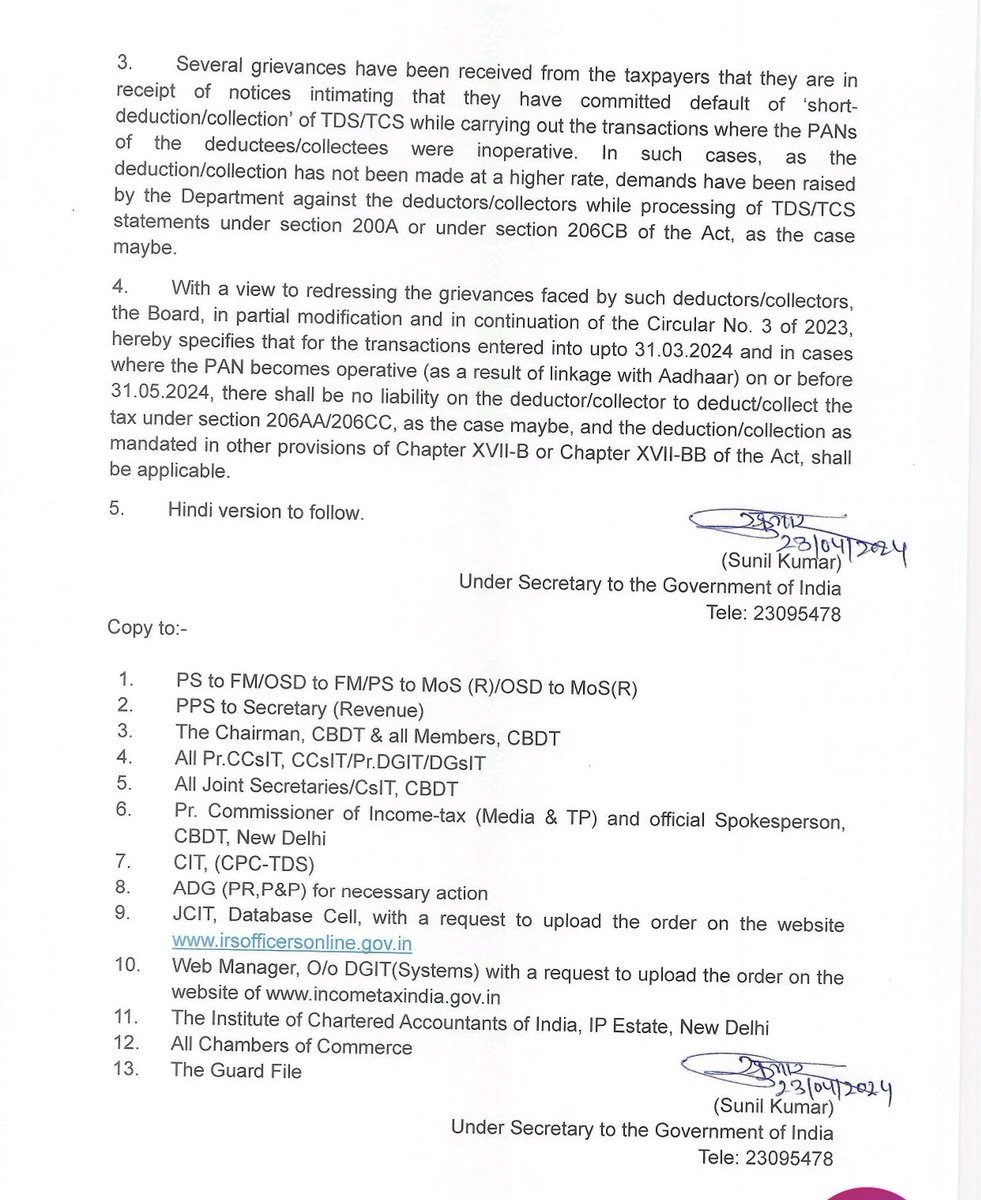

![Indian Tax Payer (@indtxpyr) on Twitter photo 2024-04-26 17:53:26 📈Tax Collections from FY 2000-01 to FY 2022-23 [ Data Table ]

Source : CBDT (incometaxindia.gov.in) 📈Tax Collections from FY 2000-01 to FY 2022-23 [ Data Table ]

Source : CBDT (incometaxindia.gov.in)](https://pbs.twimg.com/media/GMG_QEAW0AEgn_Q.png)