Fantastic question..

Unfortunately lame response from FM. She is clueless.

#IncomeTax #STT #GST #CBDT #FinanceMinistry #TaxTerrorism #ICAI #CAStudents

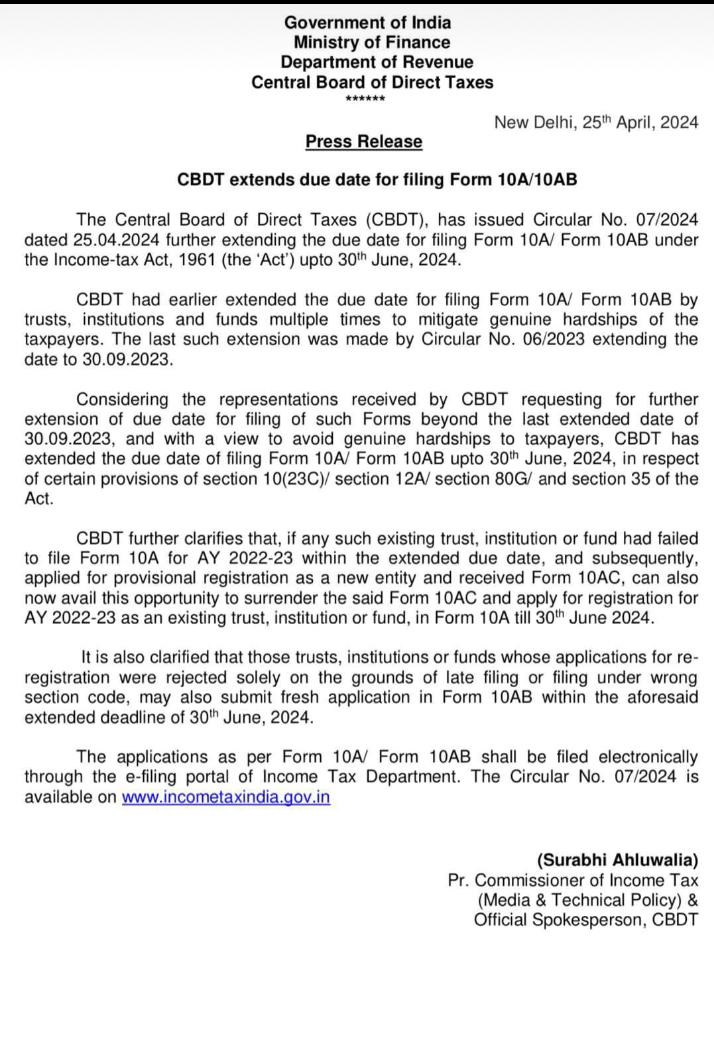

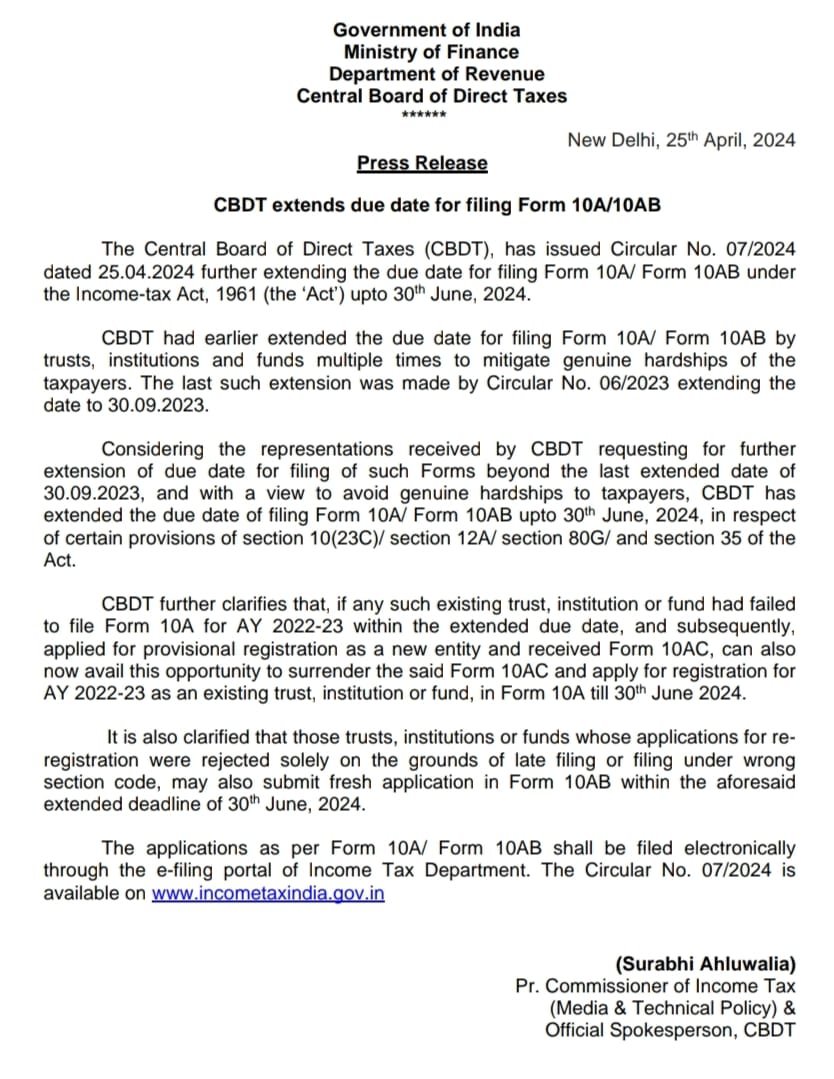

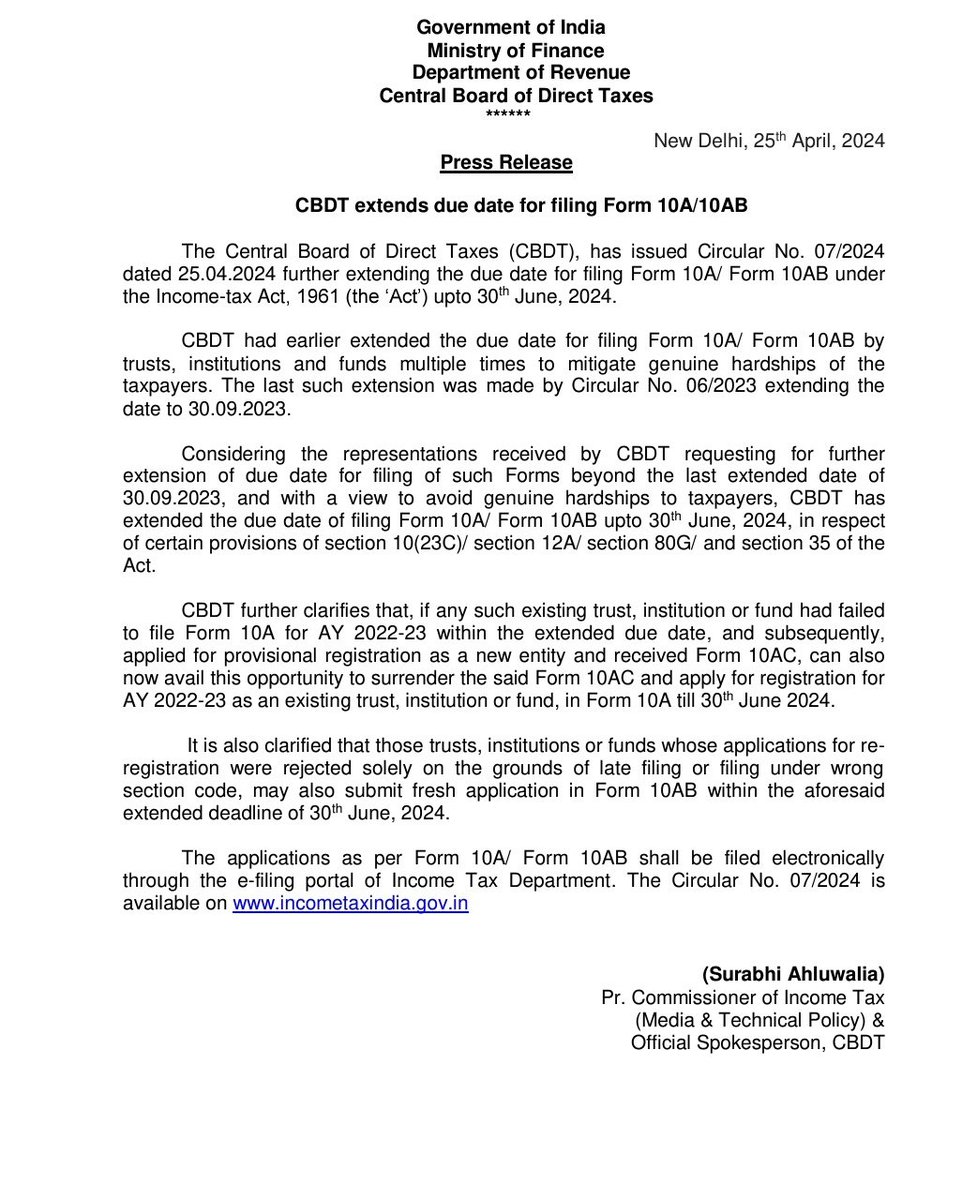

CBDT further extends time limit to 30th June 2024 for filling Form 10A/10AB beyond extended time limit of 30th Sept 2023

#IncomeTax

Why it is important to file an #ITR ?

#Incometaxreturn #incometax #cbdt #salary #refund #loan #visa #education #vcjco #firozabad #agra #shikohabad #itr #incometax return #refund #gst #gst r #gst registration #tax #tax ation

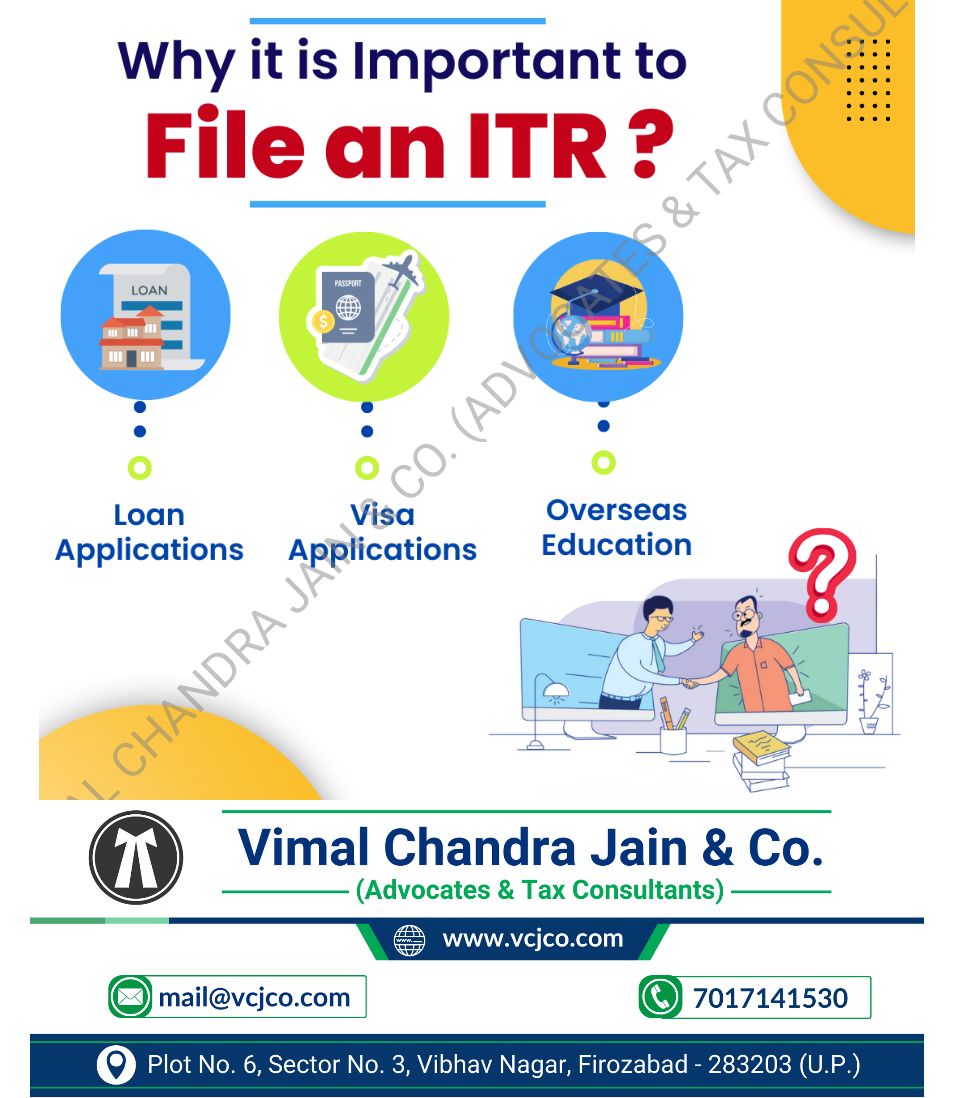

![Indian Tax Payer (@indtxpyr) on Twitter photo 2024-05-19 06:08:04 Latest data released by CBDT [23-Jan-2024]

FY 2022-23 :

- ITRs by Individuals : 6.97 crore

[ Merely 4.98% of population ]

- ITRs by Firms : 15.1 lakh

- ITRs by Companies : 10.27 lakh

Note : Report doesn't mention how many ITRs had 'Zero Tax Liability'. Latest data released by CBDT [23-Jan-2024]

FY 2022-23 :

- ITRs by Individuals : 6.97 crore

[ Merely 4.98% of population ]

- ITRs by Firms : 15.1 lakh

- ITRs by Companies : 10.27 lakh

Note : Report doesn't mention how many ITRs had 'Zero Tax Liability'.](https://pbs.twimg.com/media/GN66ZDhXsAAUJaK.png)